“We believe this transaction brings no change to the U.S. market,” AB-InBev’s CEO Carlos Brito told analysts when the deal was announced on 29 June 2012. Mark his words.

Why would any sane brewer want to use open wooden fermenters? Why indeed. The answer is: because he wants to. When I visited Bell’s new brewhouse in Kalamazoo, Michigan, in June, I was shown a hall where they had fanned out the parts of four 100 year old cypress-wood fermenters. These fermenters were used at Stroh’s Brewery until the late 1950s or early 1960s and have been sitting in a warehouse in the Detroit area for more than 50 years. They are 12 feet in diameter and will stand about 8 feet tall. Stroh’s was one of the largest breweries in the country until it closed in 1985, the same year Bell’s sold its first beer.

You win some, you lose some. AB-InBev may have been successful in acquiring the rest of Grupo Modelo it did not yet own, but in the U.S. it has been prevented from buying the remaining shares in a Chicago beer distributor. In its long-standing dispute with the Illinois regulators over the future of its stake in Chicago’s distributor City Beverage, Anheuser-Busch (A-B) has been given until 1 October 2012 to review its case. The request was granted on 20 June 2012.

As we reported on 2 July 2012, U.S. wine company Constellation Brands is one to benefit big time from the AB-InBev-Modelo deal. In a side deal meant to allay antitrust concerns over the Modelo purchase, Constellation Brands has entered into an agreement with AB-InBev to acquire the remaining 50 percent stake of Crown Imports, the Corona importer in the United States.

The state-owned Czech brewery Budejovicky Budvar (Budweiser Budvar) on 3 July 2012 terminated its U.S. distribution deal with AB-InBev and transferred the rights to distributor United State Beverages based in Stamford, Connecticut.

You would have thought that all Americans are overweight hulks, straddled with so much fat that they cannot see their own toes - that's the impression one gets from following the news. Recent studies have shown that almost two thirds of the country's population are overweight or obese. Availability and advertising seem to contribute to this problem. Limiting both appears to be the answer. In New York City, the mayor Michael Bloomberg wants to prohibit licensed food service outlets from selling containers bigger than 16 ounces, roughly half a litre, of high-calorie drinks like cola, lemonade and punch. This is part of the mayor's plan to fight obesity announced in late May 2012.

At long last. AB-InBev said on 29 June 2012 that it had reached agreement with Grupo Modelo's closely-tied family shareholders which allows it to swallow the half of the leading Mexican brewer it does not already own for USD 20.1 billion or 12.9 times EBITDA before disposals.

So will all of us be slurping Caipirinhas from now on? British drinks group Diageo announced at the end of May 2012 that it is buying a maker of Brazil’s most popular spirit, cachaça, for USD 470 million, thus boosting its expansion in fast-growing emerging markets while biding its time on a tequila deal.

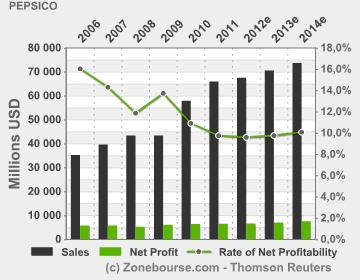

Is this the writing on the wall? In mid May 2012 the activist investor Ralph Whitworth disclosed that his hedge fund Relational Investors has bought a USD 600 million position in PepsiCo Inc, amid talk that the company should separate its beverage business from its faster-growing snacks assets.

Altria, Diageo, Mondelez – seems like companies these days are given weird, strange, suggestive or just plain bad names. In preparation for the eventual split, scheduled some time later this year, the shareholders of Kraft Foods on 23 May 2012 voted to change the name of the company to Mondelez International.