Cocktail hour for Diageo

So will all of us be slurping Caipirinhas from now on? British drinks group Diageo announced at the end of May 2012 that it is buying a maker of Brazil’s most popular spirit, cachaça, for USD 470 million, thus boosting its expansion in fast-growing emerging markets while biding its time on a tequila deal.

The maker of Johnnie Walker whisky and Smirnoff vodka, which is aiming to get half of its sales from emerging markets by 2015, said it had agreed to buy Brazil’s Ypióca from its family owners. Ypióca is the third-biggest player in the market for cachaça, a spirit made from fermented sugar cane also known as Brazilian rum, and leader in the rapidly-expanding premium segment of the market.

The British group did not give any profit figures for the Brazilian business. "Brazil is an attractive, fast growing market for Diageo with favourable demographics and increasing disposable incomes. The acquisition of Ypióca gives us the leading premium brand in the largest local spirits category," Diageo’s Chief Executive Paul Walsh said in a statement.

Analysts suspect that the brand did not come cheap: UBS analyst Melissa Earlam estimated that Diageo paid a multiple of around 19 times earnings before interest, tax, depreciation and amortisation (EBITDA) for the business. Her guesstimate is that it generates a 25 percent EBITDA margin on its GBP 60 million (USD 90 million) of annual sales.

Diageo is not the first drinks company to set its eyes on a cachaça brand. In August 2011 Italy’s Gruppo Campari acquired the Brazilian cachaça brand, Sagatiba, for USD 26 million from the entrepreneur Marcos de Moraes.

Cachaça accounts for about 80 percent of the volume of the Brazilian spirits industry and, when mixed with ice, sugar and lime, it makes the Brazilian cocktail Caipirinha. While in Brazil it’s mostly drunk straight without mixers, the rest of the world prefers it as a cocktail.

Brazil produces about 1.9 billion litres of the rum, which equals roughly 1.5 percent of national sugar production, it was reported. However, despite the growing interest in cachaça, the industry still remains one of the country’s most traditional. About 99 percent of Brazil’s 40,000 cachaça producers are considered “micro-distillers” – usually farmers who make some extra money by selling small amounts of milk, coffee or grains, according to Brazil’s national cachaça association IBRAC.

Diageo, like other international drinks groups, is looking to build its presence in emerging markets in order to offset sluggish demand in austerity-hit Europe.

The group has also been in discussions with the family owners of Jose Cuervo tequila about taking a stake in the USD 3 billion-plus valued number one tequila brand, with some sources claiming that talks have hit a wall because the two parties cannot agree on who will have the ultimate control of the brand. Diageo has also recently invested in businesses such as Mey Icki in Turkey and ShuiJingfang in China to push up its sales from emerging markets which currently account for nearly 40 percent of its global total.

In a recent report Euromonitor says that spirits in Brazil registered a decline of 2 percent in total volume terms in 2011. This was mostly due to decreased sales of cachaça as consumers had traded up from popular alcoholic drinks to premium spirits and even beer. Market research firm Mintel forecasts that Brazil’s spirits market will increase between 4 percent and 5 percent in value annually over the next four years, above projected national GDP growth and in contrast to an expected decline in volume sales. The challenge will be to prevent consumers from trading up to a beer, which increasing numbers of locals would rather buy than a premium cachaça.

Although Cia Müller de Bebidas remains the leading player in spirits, accounting for 18 percent of total volume sales, Diageo will compete head on with France’s Pernod Ricard group. A combined Diageo and Ypióca will overtake Pernod Ricard in terms of volume share in Brazil’s spirits sector. Research group Mintel puts Pernod’s volume share of spirits retail sales at 7 percent, with Diageo at 6.5 percent and Ypióca at 6.8 percent, based on 2010 estimates.

In terms of value sales share, however, it’s a different picture: Pernod Ricard controls one third of Brazil’s retail sales, while Diageo has 21 percent and Ypióca 3 percent, according to Mintel.

Nevertheless, what Ypióca offers to Diageo is a strong distribution platform in Brazil’s northeastern region. Although Ypióca itself may also benefit from Diageo’s existing relationship with Brazilian retailers, this looks to be another example of Diageo laying long-term foundations for the sales of its other international premium brands, especially Scotch, in a key emerging market.

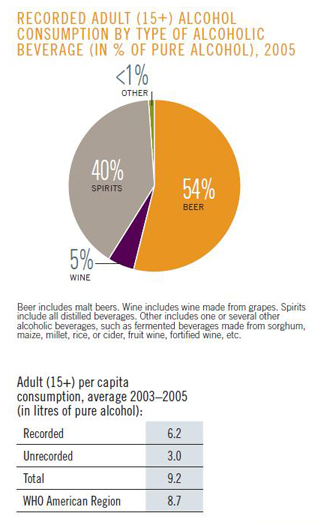

According to Datagro, Brazil’s biggest sugar consultancy, about 10 litres of cachaça are consumed per person in the country every year. Given that this figure includes children, the real number for drinkers is likely to be closer to 12 litres per year. Data: World Health Organisation