India | Kirin is in talks with Ankur Jain, founder of Indian beer company B9, to exit its investment in the firm, media reported on 26 November. The well-known craft brewer faces deepening financial distress: its net loss for FY2024 has soared to approximately USD 84 million on revenues of approximately USD 72 million.

Japan | Asahi Group aims to normalise logistical operations by February after a cyberattack on 29 September forced widespread suspension, though not all products will be available to ship by that time. The beverage firm also admitted on 28 November that the personal details of more than 1.5 million customers may have been leaked. The Russia-based ransomware group Qilin has claimed responsibility. Asahi insisted it did not pay any ransom.

Japan | Japanese brewer Asahi revealed on 27 November that in a massive cyber-attack on its system on 29 September the personal information of more than 1.5 million customers - specifically their names, gender, addresses and contact information - could have been leaked. Data belonging to about 107,000 current and former employees and 168,000 family members of staff were also potentially leaked. Those affected would be notified soon.

Australia | Many will have wondered how the family-owned Coopers brewery in Adelaide could spend AUD 70 million (USD 46 million) on a visitor centre - or what is nowadays called a “brand home”. That is a lot of money even when considering Australia’s high construction costs. But the figure becomes less extravagant if you bear in mind that the visitor centre also features a sizeable copper distillery and an underground temperature-controlled stillage capable of holding up to 5,000 casks of 200 litres each.

Australia | Privately-owned Coopers Brewery has bucked the overall beer market contraction trend, selling 806,000 hl beer in 2024-25, up2.4 percent from 2023-24. The figure excludes the sales of non-alcoholic beers and Coopers’ contract manufacture beer, and is a sharp contrast to the 0.9 percent total contraction of the national beer market (including keg sales) over the corresponding period.

Thailand | Travelling to Thailand soon? Visitors should be aware that the country's strict rules on afternoon drinking are being reconsidered. Since 8 November, anyone caught drinking alcohol between 2 pm and 5 pm would have been fined up to THB 10,000 (USD 308). Then came a swift backlash from the tourism and hospitality sectors. They argued that the rule hampered the usual service patterns at restaurants and bars and created confusion for tourists.

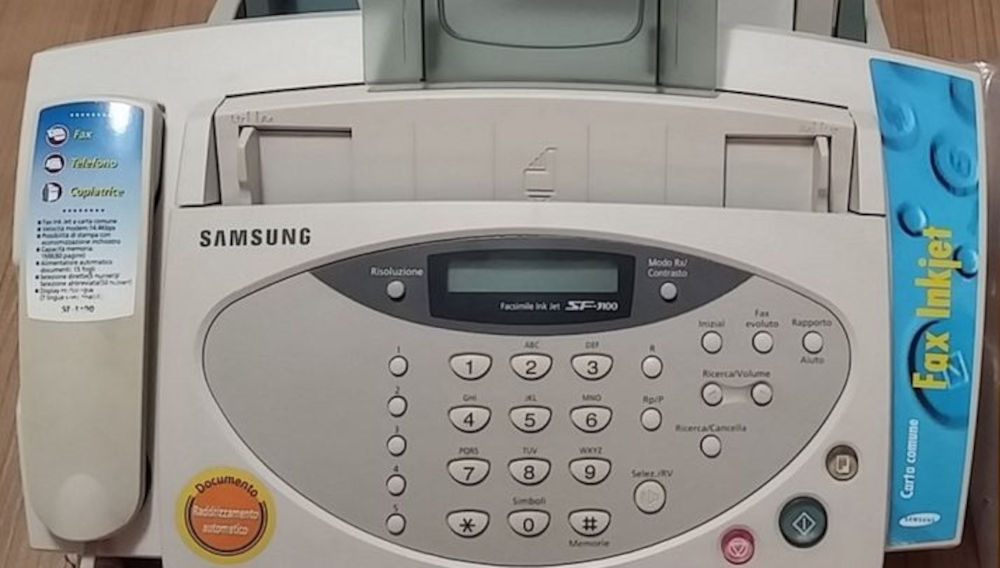

Japan | Luckily, they still have fax machines. Asahi, the maker of Japan's best-selling beer, was forced to halt production at most of its 30 factories in the country at the end of September after a cyber-attack. While all of its facilities in Japan – including six breweries – have partially reopened, its computer systems were still down two weeks later, the BBC reported. That means Asahi has to process orders and shipments manually, either by phone or by fax machines, resulting in much fewer shipments than before the attack.

India | The rumour is exciting cricket-mad India. Diageo is reportedly considering the sale of its Indian Premier League (IPL) team, Royal Challengers Bangalore, in a deal that could fetch up to USD 2 billion. The move comes as the world’s major drinks group looks to strengthen its balance sheet by divesting non-core assets.

Japan | Asahi has partially restarted production at all six of its domestic breweries on 6 October, after it was forced to close them down following a cyber-attack that crippled its systems on 29 September. The incident brought production of iconic products, such as Asahi Super Dry beer, Nikka whisky, and Mitsuya cider, to a standstill. The suspended operations included order processing, shipping, and call centre services. Asahi operates 30 beer, beverage, and food production plants in Japan.

Australia | A two-speed booze tax kicked in on 4 August: beer taxes are frozen while spirits are hit by the twice-a-year price hike. Prime Minister Anthony Albanese, in February, had made a two-year beer tax freeze an election promise and has paused the twice-yearly tax increases on draught beer until August 2027.