Ah, the sheer power of a global brand. North American brewers will be eating out their heart: while they watch beer volumes decline, Coca-Cola, the world’s largest soft-drink maker, reports volume increases and price hikes.

For diligent citizens watching the seemingly endless series of Republican Presidential candidate debates, the Washington Times Newspaper on 16 January 2012 devised a beer drinking game which tells viewers which craft beer to down as candidates deliver a painful litany of clichés.

Silly me: I had thought that the Super Bowl – 5 February 2012 – was the undisputed biggest moment of the year for America’s Ad Men. OK, it is also one of the highlights of the sporting calendar, if you are a fan of football.

The beer wasn’t even on sale nationwide yet, and already the blogosphere worried about how to recycle its cobalt blue bottle. Beer in blue bottles isn’t exactly the dernier cri in beer packaging as several brewers have done it before. Still, AB-InBev chose to launch its much hyped Bud Light Platinum in Texas on 24 January 2012. …one week before the rest of the country.

Emotions were flying high in the blogosphere when on 24 January 2012 the St Louis Today newspaper reported that Anheuser-Busch President Dave Peacock had resigned and would be replaced by Luiz Edmond, the Brazilian-born North America Zone President of AB-InBev.

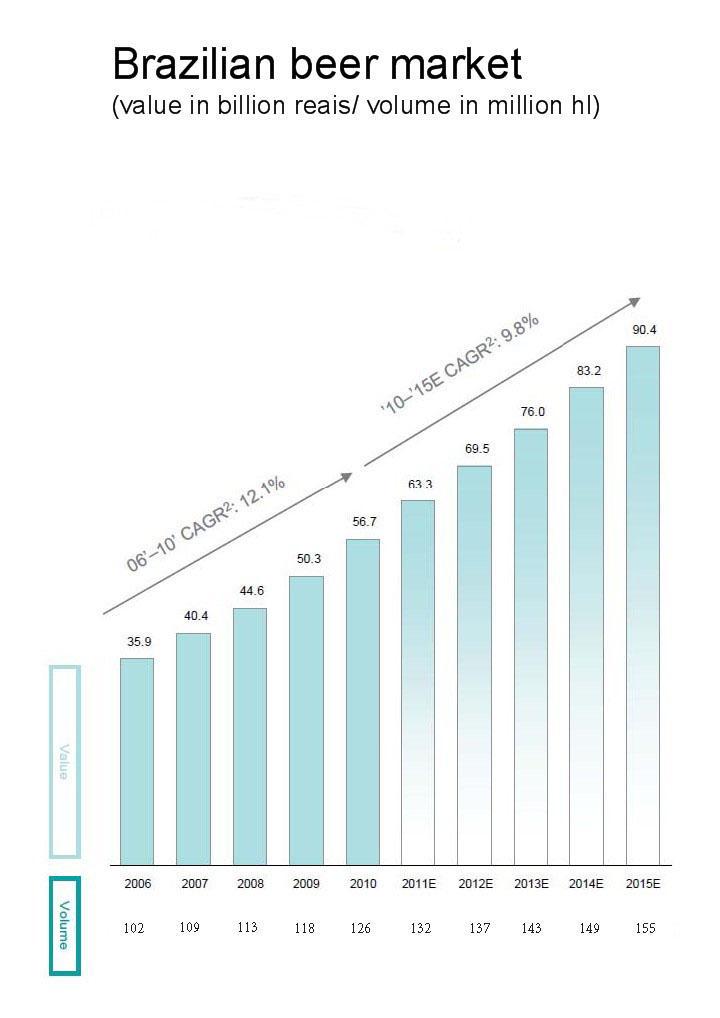

Gino Di Domenico, the new President of Schincariol, has his work cut out for him. Not only will he have to calm things down at Brazil’s third ranking brewer following the bumpy takeover by Japan’s Kirin last year. He will also have to implement a succinct strategy to fight back Petropolis’ advances on to Schincariol’s home turf in the northeast of Brazil.

After two years of having gotten written up as a takeover target, every fund manager and his dog seem to have finally woken up to the idea that buying SABMiller’s shares will land them a nice windfall profit in a few years’ time when the world’s number two brewer could be taken over.

In Golden, Colorado, they will have celebrated this news with a cold one. In 2011 Coors Light surpassed Budweiser as the number two beer brand by shipments in the U.S., including Puerto Rico, and exports, the trade publication Beer Marketer’s Insights reported in early January 2012.

Billy Busch, half brother to August Busch III, has finally started serving his Kräftig beer in St Louis bars – only to get served a USD 600,000 suit by consultancy Rio Creative in a breach of contract. Rio filed a suit on 21 November 2011 against the William K. Busch Brewing Company and company founder William K. “Billy” Busch, St Louis media reported.

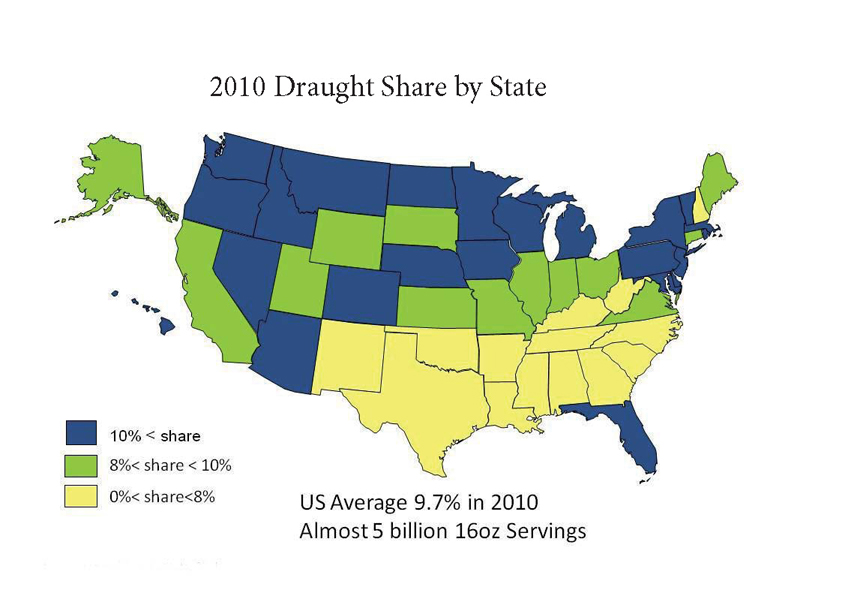

When it comes to on-premise beer, the U.S. has always sported strange customs. Go to any bar and, more likely than not, you will be served a beer in a bottle rather than a draught beer. Thankfully, things are changing. And it’s because of craft beer.