In the din of brewers’ corporate Newspeak, one voice has always stood out: Graham Mackay’s. While his colleagues preferred to drone on in a language that could have been some obscure Mongolian dialect for all we knew, the outgoing Executive Chairman and former CEO of SABMiller could be trusted to talk about issues that really mattered in plain English that even a dumb blonde understood – had she been interested in the consolidation of the brewing industry.

Media support is rallying behind the U.S. government to prevent AB-InBev’s pending transaction to acquire the remaining shares in Mexico's brewer Modelo that it does not already own.

The future of beer importer Crown Imports, which ranks third in U.S. beer sales volume behind Anheuser-Busch and MillerCoors, looks decidedly uncertain after the U.S. government announced it will sue to block the attempted merger of AB-InBev and Mexico’s Grupo Modelo on 31 January 2013.

In 2006 ProLeiT founded, together with the Brazilian plant manufacturer Dedini, the joint venture called „DAP – Dedini Automação de Processos“. Primarily DAP is responsible for the automation of Dedini plants and other projects in the Brazilian market.

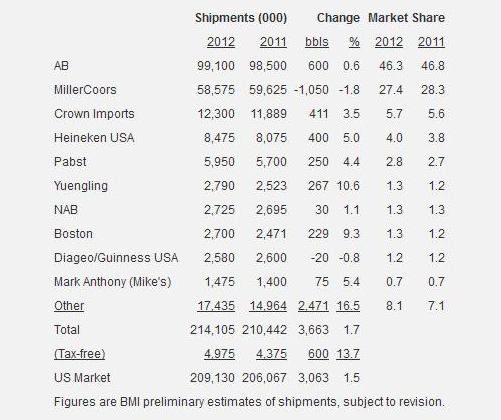

While most of us were partying through the holiday season, the experts at beerinsights.com worked overtime to put together their preliminary data on the performance of the major U.S. brewers and importers in 2012. They were released on 14 January 2013 and make fascinating reading.

Looks like AB-InBev were highly optimistic when they announced in June 2012 they expected their Modelo deal to close in the first quarter of 2013. That was provided the lawyers at the U.S. Justice Department did not drag their feet. But seven months later, the anti-trust regulators still seem to be in no rush to issue their verdict.

The US company of the Krones Group, Krones Inc. in Franklin/Wisconsin (USA), and Krones AG, Neutraubling (Germany), have now settled the legal disputes that have been ongoing in the US since October 2008. Only one claim for legal fees remains pending. The proceedings concerned relate to claims for damages asserted by several American financial service providers, a group of hedge funds and a liquidator, and most recently investigations by the district attorney in Pennsylvania. The settlement agreed with the liquidator is still subject to formal approval by the insolvency court. The proceedings related to the financial scandal involving the bankruptcy of the US company Le-Nature’s.

AB-InBev's investor Jorge Paulo Lemann is Brazil's richest man, according to Bloomberg's recent billionaires index. Bloomberg ranks Mr Lemann as the world's 37th most wealthy person based on Bloomberg's 30 November 2012 estimates, which put Mr Lemann's fortune at USD 18.7 billion.

No doubt, big brewers face a consumer-led backlash in favour of niche craft beers. But instead of hiding behind a napkin with embarrassment, they have stepped up their marketing efforts to lure consumers back to long-established brands with the help of crafty looking brand extensions. According to U.S. sources, global brewer AB-InBev is preparing to release a new addition to its Budweiser line in 2013. Though called Budweiser Black Crown, the beer will be a golden amber lager, i.e. darker in colour than regular Budweiser, and packaged in special bow tie-shaped cans, it transpired in early November 2012.

Reports are popping up in Bahamian newspapers about a growing feud between the privately-owned Bahamian Brewery and Beverage Company (BBB), based in Freeport on Grand Bahama island, and its big rival Commonwealth Brewery, which is located in Nassau on New Providence island.