That’s how SABMiller interpreted the ruling by Mexico’s anti-monopoly agency on 12 July 2013, which basically upholds exclusivity contracts. SABMiller had lodged a complaint with the Mexican antitrust authority in 2010, alleging that the two big brewers – Modelo and FEMSA – lock up much of the market with exclusive contracts. Exclusivity contracts, either verbal or in writing, are where a customer agrees just to sell one brewer’s beer in exchange for financial commitments. Commenting on the resolution, SABMiller said that it did not go far enough to materially change conditions for access and really stoke competition.

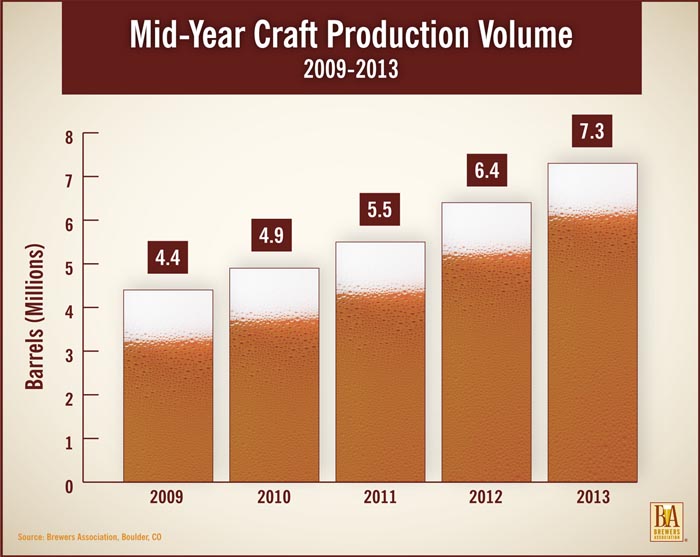

The steady and sustained growth of American craft brewing continued during the first half of 2013, according to mid-year data released by the Brewers Association (BA). The not-for-profit trade association, which represents the majority of U.S. breweries, announced that during the first six months of 2013, American craft beer dollar sales and volume were up 15 percent and 13 percent, respectively. Over the same period last year, dollar sales jumped 14 percent and volume increased 12 percent.

They may be partners with Coors in the U.S., but this did not prevent SABMiller from terminating a licensing agreement with Molson Coors in Canada, to which Molson Coors responded by dragging SABMiller to court.

Profit margins in the burgeoning cider segment must be significant or big brewers would not be clamouring to enter this segment. According to media reports in June 2013, Molson, the Canadian arm of brewer Molson Coors, has launched Molson Canadian Cider, following a number of new entrants in Canada, including Labatt’s Alexander Keith’s Original Cider; Brick Brewing’s Seagram Cider; and Carlsberg Canada’s imported Somersby Apple Cider, all of which have already hit stores in 2012.

A lawsuit opposing AB-InBev's USD 20.1 billion acquisition of Grupo Modelo by nine consumer groups lost its bid for a court order blocking the deal, U.S. media reported on 5 June 2013.

The global wine glut may be ending but now there is an orange glut building up.

Only years ago, any craft brewer wanting to supply beer in cans would have risked the Fall from Grace. Cans were considered, oh so mass-market and not in keeping with craft beer’s superior appeal. But now that even Boston Beer, the maker of Samuel Adams beer, has introduced the “Sam can”, something must have happened to cans’ erstwhile boo-boo image.

Oh, oh, more ammunition for the obesity police. At the end of May 2013 Coca-Cola FEMSA, the largest Coca-Cola franchise bottler in the world, completed its merger with Grupo Yoli, a family-owned Coca-Cola bottler and soft drink manufacturer, best known for its lime-flavoured soft drink Yoli, popular in its home base of Acapulco.

Everybody I asked seemed to agree that AB-Inbev plans to produce Corona Extra, Modelo’s best-selling beer, in Brazil. But when will it be? It took AB-InBev three years after they purchased Anheuser-Busch to start production of Budweiser in Latin America’s major beer market.

On 17 May 2013 AB-InBev snapped up another beer distributor. It bought C&G Distributing Company in Lima, Ohio, for an undisclosed sum, merely weeks before a new law comes into effect that prevents brewers in the state of Ohio from acquiring beer distributors.