Corona, Modelo, Tecate, Dos Equis …: nearly 55 percent of all imported lagers in the U.S. are from Mexico. Not wanting to let this opportunity pass, AB-InBev’s U.S. unit Anheuser-Busch (A-B) will import its Mexican brand Montejo to Southwestern U.S. as of September this year, media reported in early August.

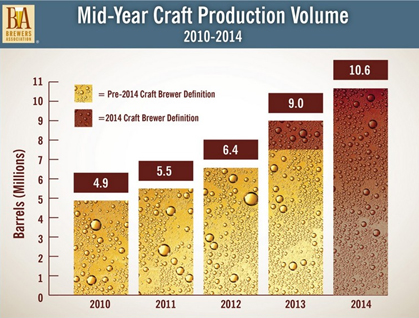

This news will make some chew their hankies. Small and independent craft brewers enjoyed continued growth in the first half of 2014, according to new mid-year data released by the Brewers Association (BA). U.S. craft beer production volume increased 18 percent during the first half of the year, while overall beer sales are estimated to have declined 0.5 percent.

You have to give it to the Americans: they were the first to have moved the regulars’ table with its low-hitting talk from the pub to the internet. Or how else to explain the recent electronic squabbling over Stone Brewery’s crowdfunding initiative?

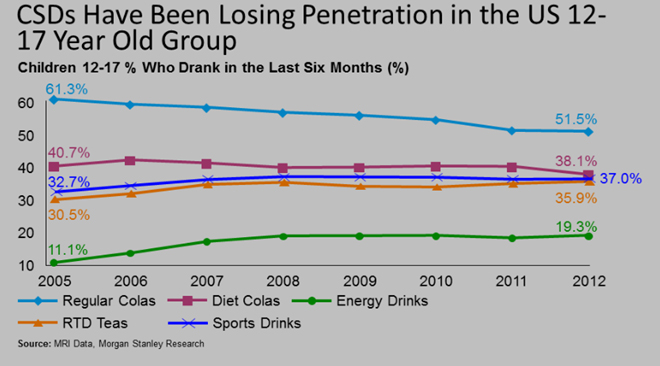

Anti-sugar campaigners watch out: with 70 percent of adults and 30 percent of children believed to be obese or overweight, the Mexican government has taken the extraordinary step to restrict television advertising hours for high-calorie food and soft drinks.

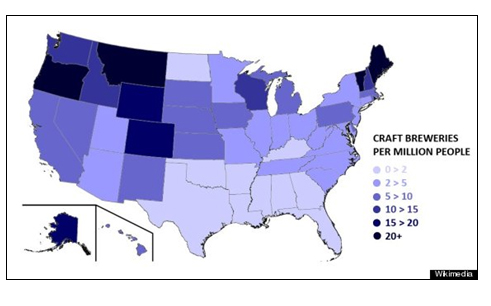

Statistically, beer-loving Americans never had it so good. This June marked a milestone in the U.S. brewing industry as the number of breweries operating in the country passed 3000, according to the Brewers Association.

Who would have thought that Ms Katz would file for a new trial? Only in May 2014, after three weeks of testimony and ten hours of deliberation, the majority of jurors had sided with Anheuser-Busch, thus throwing out Ms Katz’ gender discrimination suit against the brewer.

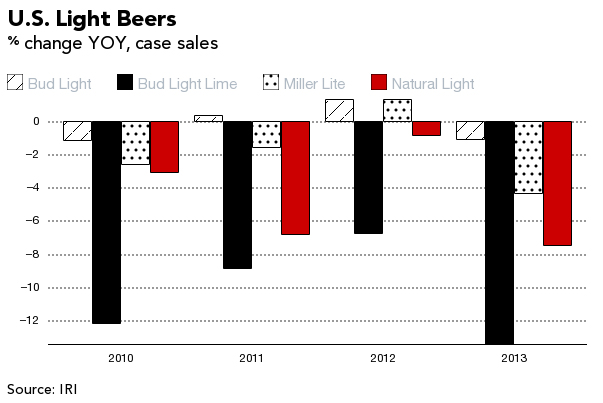

It’s a provocative thesis, but there’s a lot to be said for watching demographic shifts as businesses forge their long-term strategies. An article by MarketWatch.com on 23 June 2014 argued that younger Americans don’t like cars, cable TV, or soft drinks – which made Harry Schumacher, the editor of Beer Business Daily write on Twitter “Should we add light beer to this list?”

Light beers are as American as apple pie. After all, they were “invented” by American brewing companies in the 1970s. However, the category seems to be well past its prime. Volumes have been in decline although no one has a single and satisfactory explanation as to why this is so.

It’s no big secret, really, what goes into their beers. Still, the country’s two major brewers, AB-InBev and MillerCoors, on 13 June 2014 decided to respond to a food blogger’s online petition and update their websites to include a fuller list of the ingredients used in making their beers, U.S. media reported.

As was expected, a federal judge on 2 June 2014 dismissed lawsuits that claimed AB-InBev had watered down several of their beers. Many observers had commented that the issue was a non-starter right from the beginning – or why would AB-InBev do anything so daft as to break labelling laws?