Could it be that real sugar is best after all? PepsiCo on 28 April 2015 announced that it will remove the artificial sweetener aspartame from Diet Pepsi in the U.S., amid consumer concerns that it contributes to the growth of tumours.

Is this the new succession plan for U.S. craft brewers? Louisiana’s Abita Brewing Co. is becoming a founding brewery partner of Enjoy Beer, an enterprise created to provide resources on a national scale to a select group of top independent craft brewers across the country, U.S. media reported on 7 April 2015.

Who is the biggest U.S. craft brewer? Well, Boston Beer ain’t any longer. Although the maker of Samuel Adams beers actually increased volumes by 20 percent in 2014, it lost the top spot in the Brewers Association’s ranking to Yuengling, thanks to a change in the trade group’s definition of what can be considered a craft brewery.

Beer is Canada’s favourite alcoholic drink, and the brewing sector is one of the country’s oldest industries, with 85 percent of production owned by Canadian brewers. The sector’s vitality is of crucial importance, as it drives a whole industry – from the barley field to the pint, which is reflected in an exponential boom in craft breweries.

U.S. craft brewers are not only taking market share away from AB-InBev and MillerCoors, they are also starting to impact brewers in other countries. Export volume was up 35.7 percent in 2014 for a total of USD 99.7 million, according to the Brewers Association (BA). Total export shipments were 383,422 barrels (450,000 hl) in 2014 – which is less than 2 percent of the total amount of craft beer brewed in the United States.

Do potential candidates think the job a one-way ticket, or does the candidate who suits all still need to be born? Fact of the matter is that MillerCoors, the U.S. venture between SABMiller and Molson Coors, hasn't named a new CEO.

Is Megabrew, the potential tie-up between AB-InBev and SABMiller, permanently off or just temporarily? Crystal ball gazers wondered after it was announced on 25 March 2015 that the Brazilian owners of 3G (who also have a 20 percent in AB-InBev) are buying a majority stake in Kraft Foods, together with investor Warren Buffet.

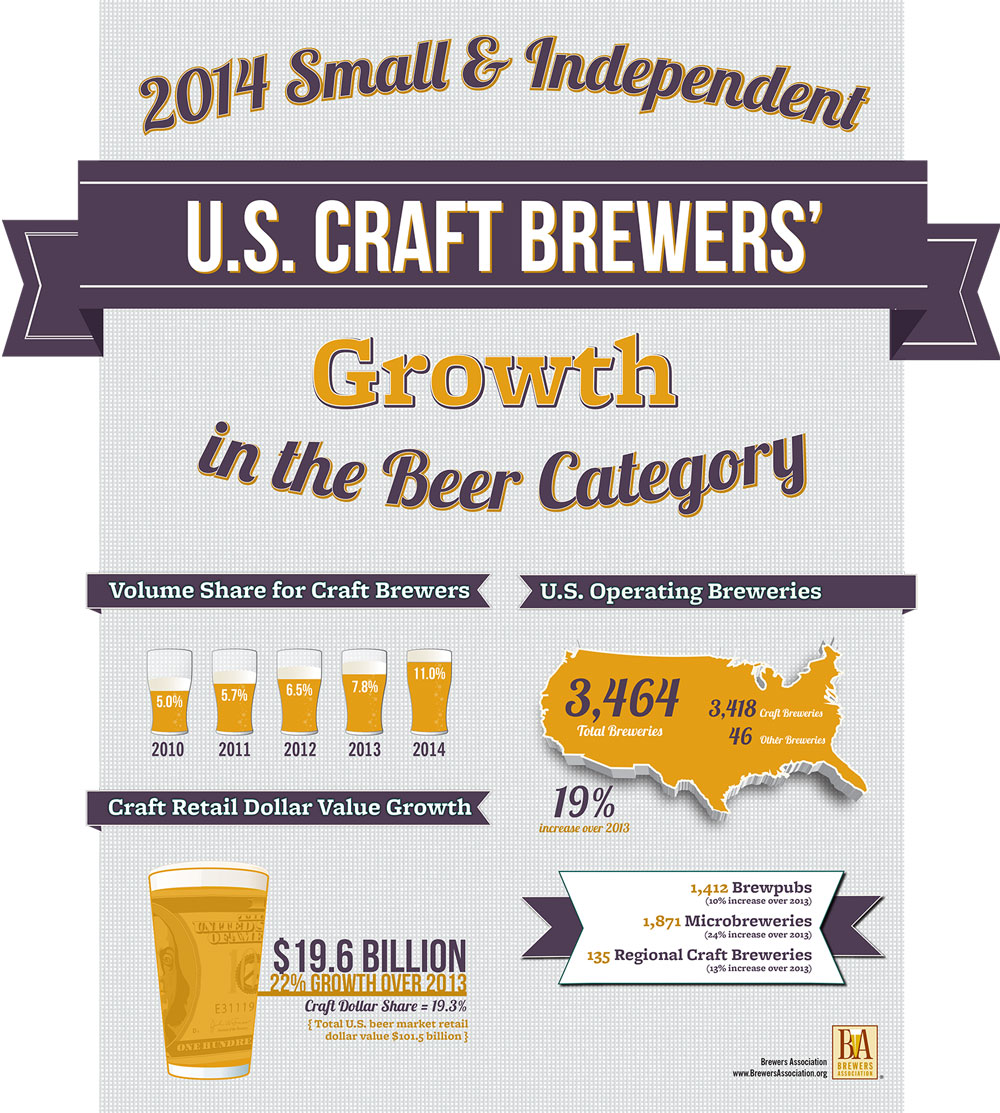

That calls for a celebratory beer: For the first time ever, in 2014, American craft brewers reached double digit (11 percent, no less) volume share of the U.S. beer market, the Brewers Association reported on 16 March 2015.

Isn’t that strange? U.S. craft brewer Full Sail is sold to private equity and no outcry ensues? Is it because the buyer was not AB-InBev?

Heineken plans to invest about USD 470 million in its seventh plant in Mexico, a facility in the northern border state of Chihuahua.