So much for the Three Tier System allegedly protecting smaller brewers. Thanks to their financial muscle, the Big Brewers always seem to find ways and means to get around it.

Here’s the remarkable story of how JE Siebel, a feisty German immigrant and founder of one of the most renowned international brewing schools, finally received a marker on his grave, nearly 100 years after he died. The story is told by Keith Lemcke, Vice-President of the Siebel Institute, in his typical humorous fashion (iv).

As in “here today, gone tomorrow”, Heineken USA is ending its tequila-flavoured beer experiment. Desperados, a lager with tequila that launched in the U.S. only in 2014, will be discontinued, U.S. media reported on 18 November 2015. Heineken USA will focus instead on its four priority brands: Heineken/Heineken Light, Dos Equis, Strongbow and Tecate. Desperados is sold in 85 international markets and is especially popular in France.

Funny that. What started a decade ago as sort of a rebellion against “Big Beer” is itself becoming Big Business. Constellation Brands, the number three brewer in the U.S., said on 16 November 2015 that it will pay USD 1 billion for Californian craft brewer Ballast Point Brewing – a record sum for a U.S. craft brewer. San Diego-based Ballast Point, which was founded in 1996 by a small group of homebrewers, confirmed the sale one day after the conclusion of the San Diego Beer Week. Around the world the 10-figure sum commanded attention.

Oh dear, do they really call this innovation? The U.S. craft beer scene has been abuzz with talk about nitro beers for months, ever since Boston Beer, the number two craft brewer in the U.S., announced they would launch a series of nitro beers early next year, thus making several gassed-up commentators wonder if these beers will be the new IPA.

William (Bill) Siebel, philanthropist and former President of the Siebel Institute, died 8 November 2015, aged 69.

Virginia’s capital does not seem to have any vocal teetotalers because the city was allowed to raise “beer money” via the sale of bonds. Officials pledged USD 23 million towards the first phase of the brewery project, which would be repaid over the course of a 25-year lease between the Californian brewer Stone and the authority, which was signed in March this year.

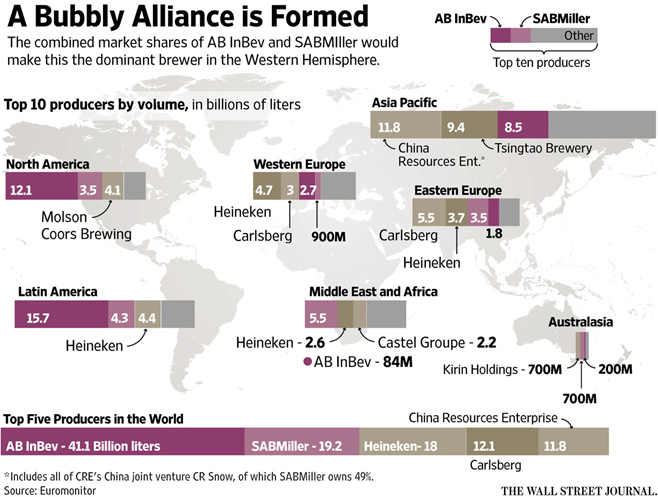

While AB-InBev’s takeover of SABMiller is still underway, media pundits have started wondering what lies in store for the world’s medium-sized brewers like Heineken, Molson Coors and Carlsberg? Resorting to common sense quips, their strategic position boils down to: being in the middle either sucks or can be fun. At the moment, the first interpretation seems to prevail.

Shareholders in Molson Coors certainly think so. The brewer’s stock has risen since news of a possible tie-up between AB-InBev and SABMiller broke in mid-September 2015.

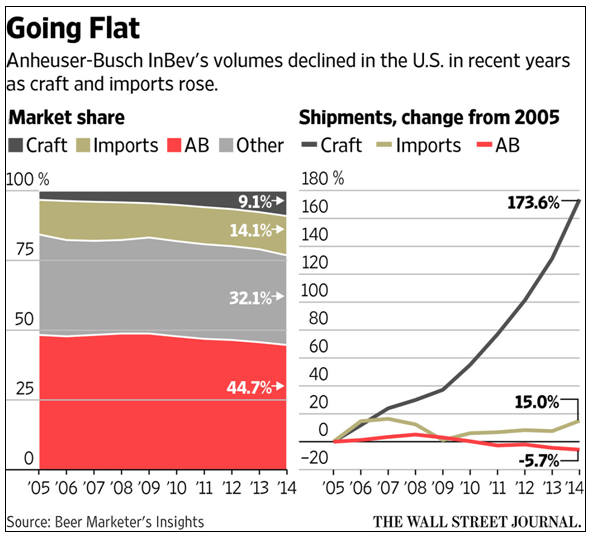

Regulators are having a busy time looking into allegations that brewer AB-InBev is limiting competition from craft brewers by buying distributors, media reported on 12 October 2015.