It’s hard to imagine that the corporate fat cats, aka members of the global business elite, who read Bloomberg Businessweek, regularly go for a sour beer. I mean, can you envisage the Coke-swilling super-investor Warren Buffett ever allowing a Rodenbach Grand Cru to touch his lips?

The response came within days. In early May 2016 AB-InBev announced it is replacing the Budweiser logo with “America” on its 12-oz. cans and bottles this summer. The cans of patriotic beer will be available from 23 May through the November election and aim “to inspire drinkers to celebrate America and Budweiser’s shared values of freedom and authenticity,” the brewer said.

Constellation’s deep pockets. Not only did the beer-to-wine group Constellation splash out a record-breaking USD 1 billion for the San Diego-based craft brewer Ballast Point in November 2015, it has now agreed to invest nearly USD 50 million to establish an East Coast brewing operation in Roanoke, Virginia, a city of 100,000 people that is located 380 km southwest of Washington DC. This was announced on 24 May 2016.

Again, the World Beer Cup 2016 was a huge affair. 96 categories; 6,596 beer entries from 1,907 breweries; 253 judges from 31 countries. The results were posted on 6 May 2016. Since this year is the 500th anniversary of the German Reinheitsgebot, it was interesting to see who would come out top in a German category.

Funny that a socialist like Venezuela’s president Nicolas Maduro should think like a French queen. Reportedly, Marie Antoinette said when told that there was a bread shortage: “let them [the French] eat cake.” Well, we know how things worked out for her: she was beheaded in 1793.

Cervecería Centroamericana in Guatemala plans on modernizing its brewhouse this year, while at the same time extending the cellar area of the brewery. In addition, a second, very modern brewhouse is to start operating in 2017. With the corresponding cold block adaptation, this will increase the capacity of the brewery to 4.3 million hl per year. As was the case with the existing brewhouse and the current extension, the corresponding order was once again awarded to Ziemann Holvrieka GmbH in Ludwigsburg.

In theory this sounds like a good idea. Stone Brewing co-founders Greg Koch and Steve Wagner, on 2 May 2016, announced the formation of True Craft, a USD 100 million company aimed at investing in craft breweries. The new organisation will buy small stakes – no more than 25 percent – of interested craft breweries. That will allow the breweries to expand or fund other improvements without compromising their independence by borrowing from banks, dealing with venture capitalists or selling to the Big Brewers.

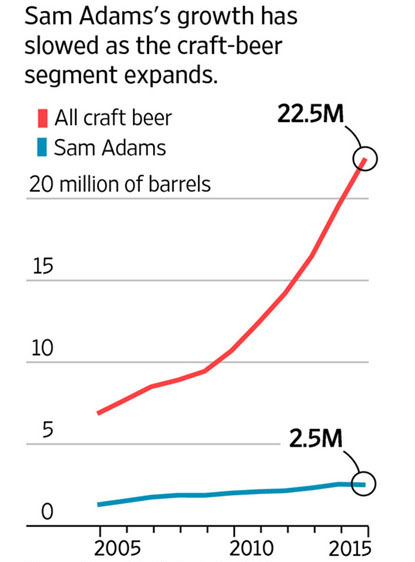

It’s a cruel world out there. Boston Beer, once the darling of the financial markets, is about to turn into its pariah. Why? Because its growth rates have disappointed. The volume shipped by Boston Beer, the maker of Sam Adams beer, last year rose just 3.6 percent after enjoying double digit increases for years.

Mr Brito, we hear you. The same day – 27 April 2016 – AB-InBev’s CEO Brito told shareholders that his future acquisitions are more likely to be in beer rather than in other beverages, a panel of Wall Street analysts at the Beverage Forum in Chicago said that AB-InBev could either do several smaller beer acquisitions or take on a heavyweight like PepsiCo or Coca-Cola.

Continuing its strategy of snapping up leading craft brewers in individual states, AB-InBev on 12 April 2016 said it agreed to acquire Devils Backbone in Virginia. Financial terms of the deal, expected to close in the second quarter, were not disclosed.