Which future for medium-size brewers?

While AB-InBev’s takeover of SABMiller is still underway, media pundits have started wondering what lies in store for the world’s medium-sized brewers like Heineken, Molson Coors and Carlsberg? Resorting to common sense quips, their strategic position boils down to: being in the middle either sucks or can be fun. At the moment, the first interpretation seems to prevail.

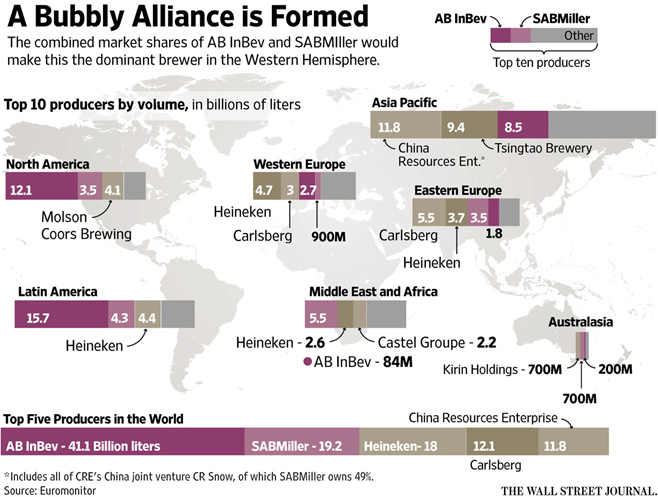

Several armchair pundits say that the merger of their two biggest competitors into what has been dubbed MegaBrew leaves medium-size brewers without a clear way forward, as they will find themselves squeezed between a global heavyweight that will produce almost a third of the world’s beer and a growing army of craft brewers.

Discussions about world beer domination heightened on 11 November 2015 when AB-InBev made a formal offer for SABMiller, valuing the brewer at GBP 71 billion (USD 107 billion). This combination would account for 29 percent of the world’s beer market, making it three times bigger than its nearest rival Heineken, with a mere 9 percent, according to market data firm Euromonitor.

For the medium-sized brewers, catching up to MegaBrew is out of the question. With SABMiller gone, takeover options are few and scarce in between because some of the likely targets are privately held and not interested in selling.

Fortunately for them, medium-sized brewers don’t run the danger of being taken over. Heineken has public shareholders, but the family owns 50.5 percent of the shares. Carlsberg is controlled by a foundation, which has 75 percent of the votes.

As far as the financial markets are concerned, investors in both Heineken and Carlsberg don’t seem too fazed by MegaBrew. Although Carlsberg’s share price has languished because of the brewer’s continuing woes in Russia, Heineken’s stock has risen from EUR 56 per share at the beginning of the year to over EUR 80 in early November, thus confirming Mrs Cavallio’s decision to rebuff SABMiller’s overtures in September 2014 because she wanted Heineken to remain independent and thought that even with a smaller organisation the future looked bright.

However, financial markets are beset by short-termism. How things will pan out for Heineken, Carlsberg and Molson Coors in the long run remains to be seen.

Anyway, all eyes are now on the U.S., where, to ease regulatory concerns, SABMiller has agreed to sell its 58 percent stake in the MillerCoors venture to fellow brewer Molson Coors for USD 12 billion. But will this be enough to ease anti-trust concerns?

Craft brewers are among those watching things closely. Media say that the Brewer’s Association, the trade body for America’s 4,000 craft brewers, urged the Department of Justice and Congress to closely examine the merger’s “potential effects on the U.S. marketplace and American consumers.”

Ironically, craft brewers should want the new combination to be as big as possible, some market observers argue. That’s because economies of scale discourage behemoths from doing niche and specialty beers, leaving those spaces open to craft brewers.

Keywords

USA acquisitions international beverage market mergers

Authors

Ina Verstl

Source

BRAUWELT International 2015