AB-InBev’s unit Labatt buys craft brewer Mill Street

So they are after craft brewers across the border too. The Toronto-based Mill Street Brewery, one of Canada’s largest craft brewers, was bought by AB-InBev’s local unit Labatt, media reported on 9 October 2015.

As in the U.S., the ensuing outcry was, in Canadian self-effacing terms, quite loud. Known for its organic beers, Mill Street is the second largest independent craft brewer in Ontario, brewing an estimated 100,000 hl beer.

Canada defines a craft brewer similarly to the U.S.: the three basic tenets are small (in Ontario, home to Mill Street, under 400,000 hl beer), traditional (no corn syrup or rice extract), and most importantly, independent. With the purchase by Labatt, Mill Street will no longer meet one or more of these criteria.

Although financial terms were not disclosed, under the agreement Mill Street will continue to operate as a stand-alone company as it looks for ways to expand production and capacity. Labatt said it plans to invest CAN 10 million into the company’s existing brewery operations.

Mill Street was started in 2002 with modest aspirations by its three founders, but its success pushed them to move the facilities to a larger space four years later.

Over the past few years, Mill Street has seen average sales growth of more than 15 percent annually, it was reported.

The popularity of craft beer has been on the rise across Canada for years. While overall beer consumption declined by 6 percent in 2014, craft beer servings grew by 7 percent, according to recent findings from data research company NPD Group. Craft beer is said to account for 6 percent of the Canadian beer market.

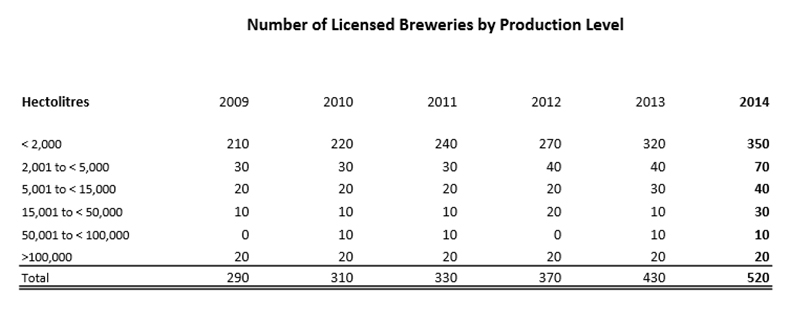

The number of licensed breweries in Canada has risen almost 70 percent over the past five years to 520 in 2014. In the Ontario province, which is Canada’s major beer market in terms of volumes, there were 140 breweries, with 60 more opening this year.

The Canadian beer market represented 22 million hl beer in 2014, of which 3.6 million hl were imports.

Labatt bought discount beermaker Lakeport Brewery in 2007 when "buck a beer" was all the rage. Three years later it shut down Lakeport’s brewery, after deciding it was cheaper to brew its beer at Labatt’s brewery in London, Ontario.

Media say that Labatt has also played in the craft brew market itself, under a relatively low profile, positioning AB-InBev’s Shock Top line of beers in the microbrew department at liquor stores.

Labatt, once an independent giant in Canada’s beer industry, was bought in 1995 by Belgium’s Interbrew, which has since turned itself into AB-InBev. It leads the Canadian beer market with a 42 percent share and operates 6 breweries across the country.

Canada: the number of breweries has almost doubled between 2009 and 2014

Keywords

Canada acquisitions international beverage market

Authors

Ina Verstl

Source

BRAUWELT International 2015