Corona’s previous Mexican owners should be tugging their forelocks. Their previous partner and now owner of Corona in the U.S., the wine-to-beer company Constellation Brands, has shown that Corona does very well on draught.

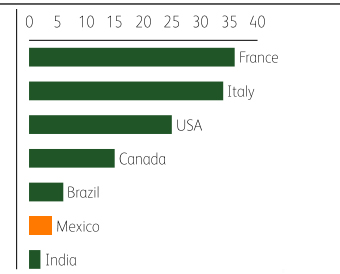

That’s courageous. Kirin plans to produce its Ichiban Shibori draft beer in Brazil as of March 2014, Japanese media report. The Japanese probably hope to benefit from increased demands for beer forecasted for the 2014 World Soccer Cup to be held in the country.

According to a new analysis by the Brewers Association (BA), small and independent American craft brewers contributed USD 33.9 billion to the U.S. economy in 2012 – this corresponds to a 17 percent growth of the craft brewing market.

So much for those lofty economic growth forecasts. Both Brazil and Mexico have had to revise their GDP growth rates down: Brazil is heading for growth of less than 3 percent this year, while Mexico is expected to expand by 1.2 percent. Beer markets have taken a hit. Consumption of beer in Brazil and Mexico is expected to decline in the low single digits this year.

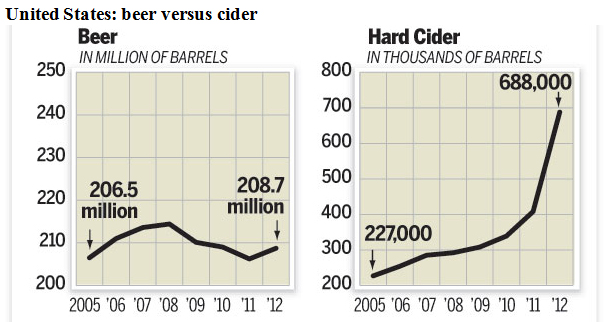

Except for Crown Imports, the top U.S. brewers saw beer sales flat or decline in the nine months to end of September 2013, Beerinsights reports. Meanwhile, lots of craft brewers continued to score double-digit growth.

In the on-premise sector, beer has had a challenging year. According to GuestMetrics, a company that tracks the hospitality industry, sales of beer in the first ten months of 2013 are down 3.7 percent, underperforming the wine and spirits categories.

India currently represents one of PepsiCo’s largest markets globally. In mid-November, PepsiCo announced plans for the company and its partners to invest 5.5 billion USD in India by 2020 to increase the capabilities in the areas of innovation, manufacturing, infrastructure and agriculture. In addition, the investment is expected to significantly increase production capacity to meet the growing demand for PepsiCo foods and beverages. The company and its partners plan to expand capacity in India to more than double current levels by 2020.

It would have been nice if regulators had turned the other way. But no, in early November 2013 AB-InBev announced they will sell their 30 percent stake in City Beverage Illinois, a beer distributor in the Chicago area, to the Hand Family Cos., to comply with new Illinois alcohol regulation.

Beer legally brewed with medical marijuana may be light years away, but it would give the American IPA a whole new meaning, wouldn’t it? Already there are a few producers of “soda pot” around. Yep, the soft drinks are made with the “sacred grass”, not hemp. The company Canna Cola, located in Las Vegas (where else?) is among them. So far, their marijuana soft drinks with zany labels like Orange Kush, Sour Diesel, Grape Ape, and Doc Weed, can only be bought in states where medicinal marijuana is legal and by patients who have a prescription from their doctors.

It could get interesting. In November, the “Belgizians”, as executives of Belgian-Brazilian brewer AB-InBev are nicknamed, will meet the Teamsters union to start contract talks. At issue is a new contract for workers at Anheuser-Busch's 12 U.S. breweries, including St. Louis, the U.S. headquarters for AB-InBev. The current contract expires 28 February 2014.