Cider outpaces beer category

In the on-premise sector, beer has had a challenging year. According to GuestMetrics, a company that tracks the hospitality industry, sales of beer in the first ten months of 2013 are down 3.7 percent, underperforming the wine and spirits categories.

However, cider has displayed exceptional strength, with volumes up 53 percent in the same period and 52 percent during the third quarter 2013. Not all of the 240 cider brands that compete in the on-premise have seen volumes go up. The Angry Orchard brand family (produced by Boston Beer) rules the roost, followed by Strongbow (Heineken) and Stella Artois Cidre (AB-InBev). Together, the three brands now account for 45 percent of total cider volumes in the on-premise channel (up from 17 percent in 2012)… and drove over 99 percent of the volume growth, according to GuestMetrics. Said differently, the remaining 230 or so cider brands have only increased volumes 0.3 percent compared to the prior year.

What may have helped Angry Orchard’s ascent in sales is a clever pricing policy. Angry Orchard’s average price in the on-premise is USD 4.99 per pint glass (16 oz), Stella Artois Cidre’s is USD 5.38. The “tail” of smaller craft cider brands sell for USD 5.48 per glass. Strongbow’s average price is USD 5.64 in the on-premise, a 13 percent premium above Angry Orchard.

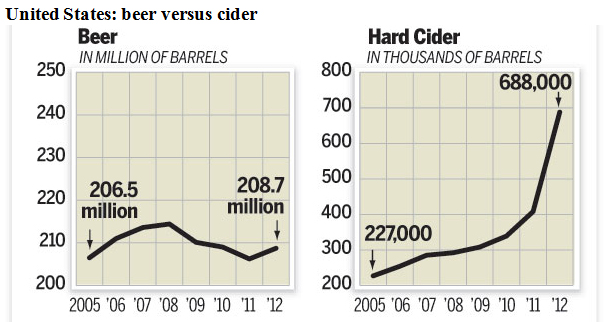

Cider, a niche product, accounts for less than 1 percent of the nearly USD 100 billion U.S. beer market (sales), but some analysts project that volumes could grow to about 3 percent of the beer market over the next few years.

Production of cider jumped nearly 70 percent in 2012 to 690,000 barrels (810,000 hl), from 408,000 barrels in 2011.

As concerns the whole cider category (on-premise plus off-premise), the top three cider brands accounted for 60 percent of volume sales in 2012. This is expected to decline in 2013, says market research company Canadean, because of the arrival of new brands.

Boston Beer’s cider brand Angry Orchard, which is the market leader with a 40 percent share, continues to attack the market aggressively, pushing its product onto shelves. Angry Orchard was launched in 2011. Canadean expects this growth to continue, as Angry Orchard may increase volumes by another 65 percent in 2013. This makes Angry Orchard the fastest growing brand in the market.

Vermont Hard Cider Co owns the leading brand family, Woodchuck. Woodchuck achieved sales of USD 38.6 million in sales in 2012. This was a 40 percent increase over 2011. It is expected to grow 5 percent in 2013. In late 2012, Ireland’s C&C Group acquired Vermont Hard Cider for USD 300 million.

Hornsby’s, also owned by C&C Group, is the number three brand in the market. Its line includes Hard Crisp Cider, Hard Strawberry Lime and Hard Amber Cider. Hornsby’s, which has been one of the top three brands for the past few years, experienced a 9 percent decline across its product range in 2012 compared to 2011, due to confusion over pack types (a switch to 330 ml bottles) and a previous lack of producer focus. The brand’s long-term decline is expected to be reversed in 2013 when the effects of the acquisition by C&C Group are more clearly seen.

Historically, six-packs have been the most popular multipack for ciders, but some producers are moving to four-packs as these provide distributors with a lower price point (per multipack) and higher profit margins.