SABMiller expects competition watchdog ruling this month

How SABMiller can be so sure that their complaint with Mexico’s competition watchdog will be successful this time, is beyond us. Through their – legal –exclusivity contracts with retailers, Grupo Modelo and Heineken have held the Mexican market in a tight grip, thus preventing SABMiller from gaining significant market share. After 20 years of trying, SABMiller has only managed to gain just 0.7 percent of market share.

Now SABMiller has joined with several microbreweries to challenge exclusivity contracts and a ruling is expected this month. "We’re feeling positive about [the market] opening up," said Karl Lippert, SABMiller’s Latin America regional chief, at an investors’ presentation on 25 March 2013.

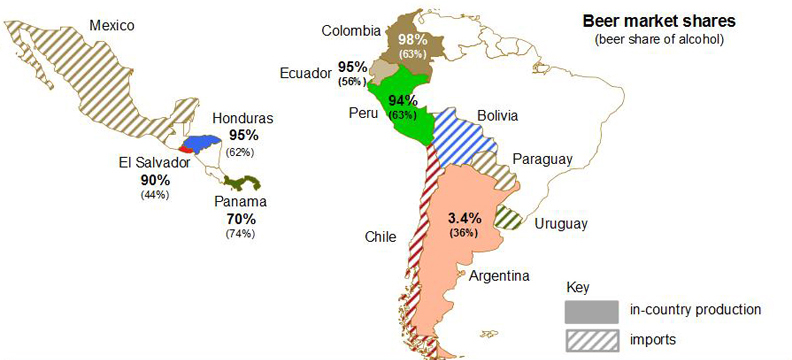

In Mexico, Heineken–owned FEMSA Cerveza controls about 38 percent of the beer market in volume terms, while Grupo Modelo has around 59 percent, leaving just 3 percent to other players. Both major brewers have used exclusive contracts with retailers to “compete” in Mexico’s roughly 70 million hl market.

SABMiller’s lawyers must be well known to the Mexican authorities by now. According to the 21st amendment law blog, in 2004 SABMiller filed a complaint with the Federal Competition Commission (“FCC”) in Mexico alleging unfair competition stemming from Modelo’s exclusive contracts. In 2006, Mexico’s antitrust agency initially found in favour of SABMiller; but, on appeal, Modelo was able to get the ruling reversed, allowing Modelo and others to continue entering into exclusive contracts.

In 2010, SABMiller filed a second complaint with the FCC claiming the country’s beer duopoly – Modelo and FEMSA – is unfairly restricting competition by offering payments, loans, and refrigerators to restaurants and retailers that agree not to serve other brands.

Exclusivity contracts are entrenched in Mexico because, without them, many small retailers would struggle to survive. Heineken and Modelo are said to often offer support for retailers and bar owners, such us refrigerators, tables, chairs and awnings, as part of commercial deals. In return, the retailers won’t sell anybody else’s beer.

So why are SABMiller convinced that this time the FCC will rule in their favour given that several previous investigations did not have much of an impact? Well, the political winds have changed.

The watchdog’s investigation comes only a few months after Mexico’s new pro–business government headed by centrist President Enrique Peña Nieto launched legislative proposals that might prise open long–protected sectors of the economy – from oil to cement and from bread to paint.

Let’s wait and see what comes of these proposals. After all, it will be remembered that President Felipe Calderon, too, in 2010 had promised to improve competition but nothing much came of that. As Reuters commented in 2010, “a relatively compact but powerful group of family–run companies in Mexico controls industries ranging from cell phone services to beer making. New companies find it tough to break into their turfs.”

Even if the FCC closes SABMiller’s current case for lack of evidence, SABMiller and the microbreweries have at least two opportunities to appeal. So there’s some hope still.