The deal is done, and the reviews are coming in on AB-InBev’s takeover of the Dominican Republic’s national brewer CND. Market observers agree on two things: the deal is clever but it comes with a high price tag.

The New York Times newspaper has been on the warpath against AB-InBev ever since February 2012 when the Oglala Sioux filed a USD 500 million federal lawsuit against several large brewers, including Anheuser-Busch (A-B) and Miller Brewing, local beer distributors, and the four Whiteclay beer shops, which sold the equivalent of 4.3 million cans of beer last year. The suit accuses the alcohol businesses of encouraging the illegal possession, transport and consumption of alcohol on the Indian reservation, where alcohol is banned.

Contrary to many pundits, Germain Hansmaennel and I have always maintained that AB-InBev will struggle to buy SABMiller. In our humble opinion AB-InBev would be better off acquiring PepsiCo’s beverage business or more U.S. distributors. To our delight this was confirmed by Harry Schuhmacher, one of the most astute U.S. beverage market observers. Here’s what he wrote on 27 April 2012:

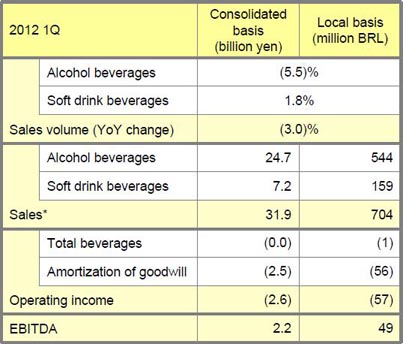

Thanks to AmBev's deeper pockets, the Brazilian unit of AB-InBev managed to pull ahead of Heineken in the race for Cerveceria Nacional Dominicana (CND). On 16 April 2012 the deal was announced after weeks of the rumour mill spinning wildly out of control.

Neither AB-InBev nor Heineken has confirmed it, but a persistent rumour in the Caribbean has it that the two brewers are in a USD 1.5 billion race to buy the Dominican Republic’s biggest brewer Cerveceria Nacional Dominicana (CND).

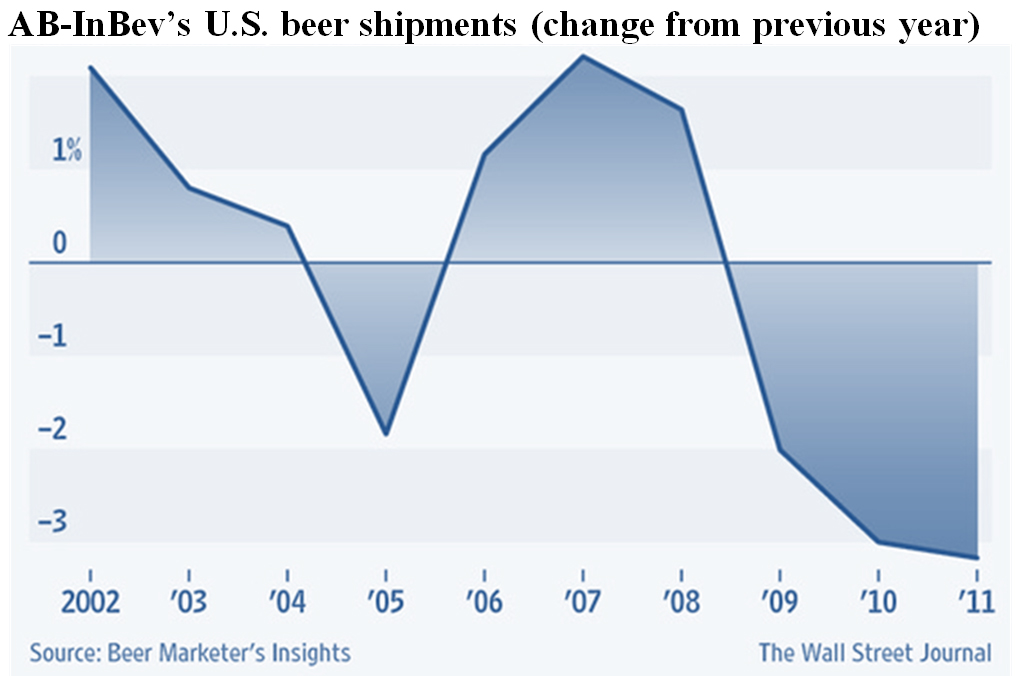

After three years of straight volume declines, AB-InBev thinks it’s got a plan. As the President of North American operations, the Brazilian-born Luiz Edmond, told the Wall Street Journal on 29 March 2012, the brewer will produce more beers this year, while leaning on its distributors not to carry the competition’s beers.

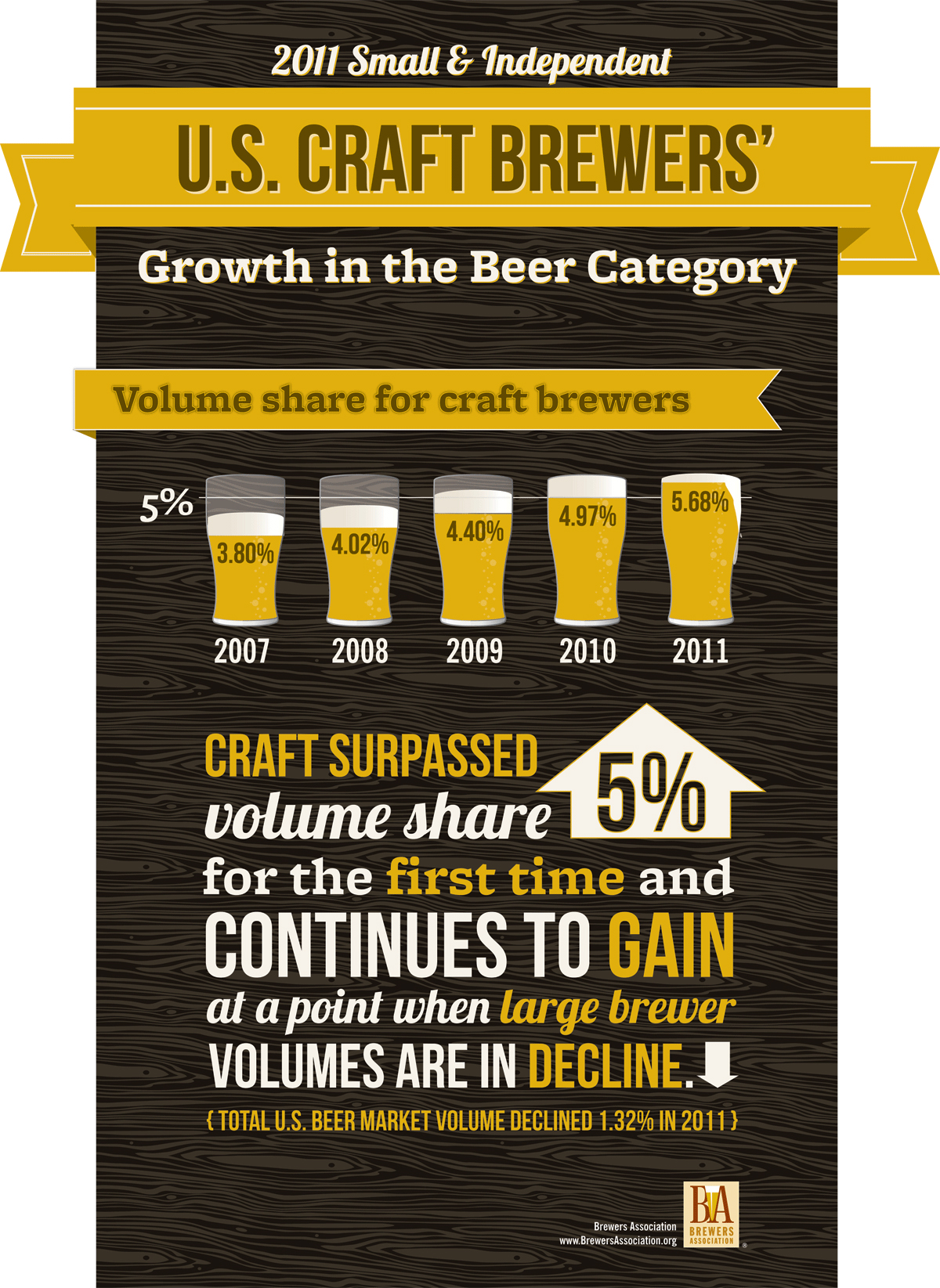

U.S. Craft brewers saw volume (by craft brewers represent total taxable production) rise 13 percent, with a 15 percent increase in retail sales from 2010 to 2011, representing a total barrel increase of 1.3 million.

Not a good year but it probably could have been worse. MillerCoors said on 16 February 2012 that net sales dipped 0.3 percent to USD 7.55 billion for the 12 months to the end of December 2011. Net profits fell 5.5 percent to USD 1.01 billion over 2010, even though the number two brewer in the U.S. delivered the final tranche of USD 765 million in synergies related to its formation as a joint-venture between SABMiller and Molson Coors.

The Beer Institute on 13 February 2012 released new data that show retail beer sales rose more than 2 percent in 2011, highlighting beer’s continued strength within the alcohol beverage sector. While U.S. beer production, according to the Beer Institute, was down 2 percent, sales revenue, in both the on-premise and off-premise sector, was USD 98 billion last year.

The search is over: Sierra Nevada Brewing Company from California announced that it has chosen a site in the state of North Carolina for the future home of a 360,000 hl East Coast brewery. Lured to North Carolina by a USD 3.5 million tax break, Sierra Nevada will spend USD 100 million on a new production facility, as well as a proposed restaurant and gift shop.