The days of seemingly endless growth in the central and eastern European beer markets are definitely over. Russia, Poland, the Ukraine are all in decline, albeit for different reasons. In Russia government interventions threw a spanner into brewers’ spokes, while in the Ukraine the sorry state of the economy helped dampen consumer spending. Poland, on the other hand, did not witness any of the above. It is the only country in the EU to have avoided a recession. Its economy is still growing, albeit at a slower rate – 2.1 percent in 2012 – than in previous years. But there is no doubt about it: Poland has become a highly mature beer market with per capita consumption standing at 94 litres in 2011.

It’s probably small consolation to Efes executive suite that its Ukrainian unit in 2012 managed to grow its beer sales volume by 14 percent over 2011, although beer production in this eastern European country as a whole declined 1.6 percent over 2011 to 30 million hl.

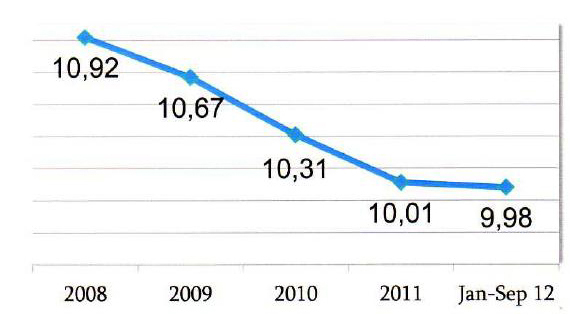

In 2012, German beer output is believed to have fallen 2 percent. That may not seem much given that sales spectacularly dropped 8 percent in April, 10 percent in September and 5 percent in December 2012 year-on-year. But if you bear in mind that beer consumption has declined for almost 20 years now at an annual rate of give or take 2 percent, then you will immediately understand how bad the situation really is.

Germany’s major brewer Radeberger suffered a defeat in court over its dodgy bottle deposit dealings with its Mexican import Corona Extra. On 19 December 2012 a Frankfurt court told Radeberger it had to pay the claimant, Deutsche Umwelthilfe (German Environmental Aid DUH), the cease-and-desist fee of EUR 243,43 (USD 323). As the fine is so small, Radeberger has no right to appeal against the ruling.

It’s probably more a case of piqued national pride than a real loss that has caused an outcry in Austrian media, following Heineken’s decision on 13 January 2013 to relocate its central and eastern european (CEE) headquarters from Vienna to Amsterdam.

It seems the UK taxpayer has taken yet another massive hit. On 4 January 2013 Admiral Taverns, one of the UK’s biggest pub groups, has been bought by U.S. based private equity group Cerberus in a fire sale. The Lloyds Banking Group, which had to be bailed out by the UK government to the tune of a 40 percent stake, reportedly received about GBP 50 million in cash for its pubs. Add to that the GBP 150 million that Cerberus took on in debt, the transaction is valued at GBP 200 million (USD 323 million) or a little over GBP 180,000 (USD 290,000) per pub.

Beer sales in Germany in November 2012 dropped 2.8 percent year-on-year and reached 7.26 million hl. In the January to November period, 89.4 million hl beer were sold. That’s a loss of one percent over the same period in 2011.

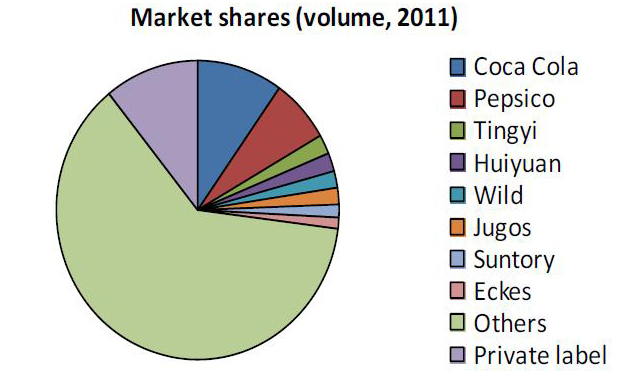

Given that Heineken is going to focus on its beer and cider brands, it was just a matter of time before it would sell its premium juice brand Pago. On 19 December 2012 the Heineken-owned Brau Union signed an agreement with Pago’s bigger German rival Eckes-Granini which will lead Pago to change hands during the first quarter of 2013.

SABMiller, Starbucks, Amazon and Google – the list of companies given a serve over their skillful ways of avoiding tax payments in the UK is getting longer.

You win some, you lose some. Diageo, the world’s number one drinks company, may have been successful at clinching a USD 2.1 billion deal for a majority stake in India’s largest spirits company, United Spirits, in November 2012, but ultimately failed to secure a takeover of Jose Cuervo, the world’s top-selling tequila brand, which is to stay with its Mexican owners, the Beckmann family.