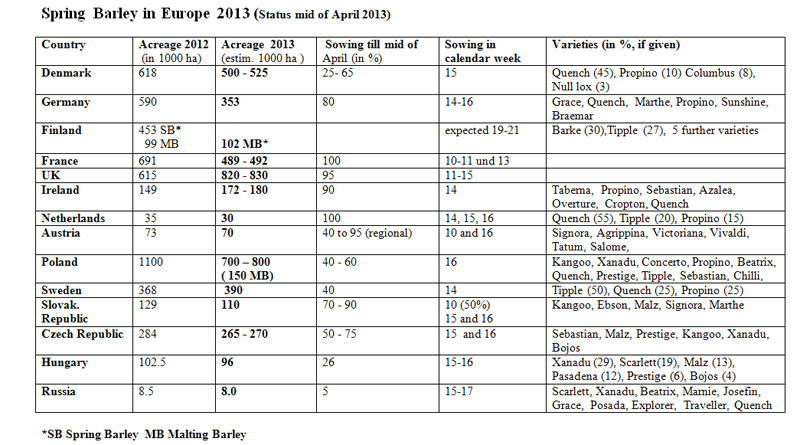

The cultivation of spring barley is turning out irregularly this year. In Germany, France and Denmark it is decreasing. Only Great Britain has enlarged its acreage. In almost every growing area it was sowed late. Losses of yield are expected.

Given that he stood at the helm of stock market-listed SABMiller, the brewer had to make a personal misfortune public knowledge for fear it might affect its share price negatively: its Chief Executive Graham Mackay has had surgery for a brain tumour. Therefore, he will be replaced by the group’s Chief Operating Officer Alan Clark with immediate effect.

In the carnival-mad city of Cologne revellers usually fall into a deep depression with the onset of Lent. Thanks to the on-going and highly publicised spat between the brothers Heinrich and Johannes Becker for control of the Gaffel brewery it’s now carnival all year round.

Global brewer SABMiller reported on 17 April 2013 that it saw a 7 percent rise in its full year organic revenue (until end March 2013), boosted by strong demand in Africa and a surprisingly resilient demand in Europe.

That’s what you get for being dependent upon Europe. Heineken, the world’s number three brewer, tempered its expectations for annual growth after reporting an unexpected decline in first-quarter sales on 24 April 2013.

Oops – what can it possible mean that Carlsberg’s head of the brewer’s Asia division decided to leave all of a sudden? The world’s number four brewer announced on 24 April 2013 that Roy Bagattini, 49, is leaving to take a job at fashion group Levi Strauss & Company as Executive Vice President and President of Commercial Operations, Asia Pacific, in June 2013.

So brewers have woken up and smelt the coffee? Several families with interests in – rival – breweries have clubbed together with Germany's Joh. A. Benckiser (JAB), the investment vehicle of the Reimann family, to make a bid for Dutch company DE Master Blenders, best known for its Douwe Egberts coffee brand.

That's it. Heineken hopes to exit Finland. According to media reports on 11 April 2013, Heineken has initiated sales procedures for its Finnish beer and beverage business Hartwall.

Why does the passing of Margaret Thatcher on 8 April 2013, aged 87, make me think of gin? Don't get me wrong. I did not plan to join the hundreds of opponents of Margaret Thatcher for a "mass party" in London’s Trafalgar Square to celebrate her death on 13 April with a G&T (Gin and Tonic). I don't think it tasteful or called for to rejoice in her death, irrespective of what you think of her politics or legacy.

Who on earth is Harbin? It was only a small news item on 9 April 2013 that Dutch brewer Heineken, via its Austrian unit Brau Union AG, bought a 3.21 percent stake in brewer Zywiec from the minority shareholder Harbin.