Good summer weather during the month of July 2013 has brightened up the mood amongst German brewers. Compared with the previous month, beer sales rose 11.9 percent.

Like Swiss microbrewers, the Scottish brewer and pub operator, BrewDog, has shown the finger to banks and turned to crowdfunding in an effort to raise money for its ambitious expansion schemes.

It must be the silly season. Or why has it not taken very long for the latest edition of the UK pub-goers’ Bible to become controversial?

Err – what was that? Carlsberg’s brewery workers went on strike in mid-August, not because they had fallen out with their bosses. No, they went on strike because a new employee had refused to join their union, 3F.

Here today, gone tomorrow. After merely 18 months on the job, Heineken’s Managing Director in Switzerland, Roger Basler, 48, has left the brewer to join the Swiss manufacturer of kitchen and bathroom appliances, Franke, in October 2013. Mr Basler’s departure was announced on 27 August 2013.

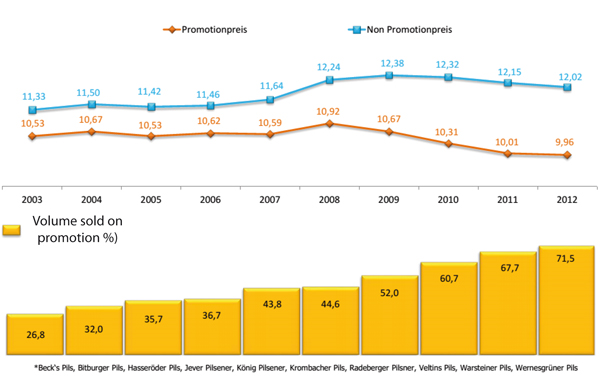

After the flour cartel, the coffee cartel, the chocolate cartel, the potato cartel and now the beer cartel, it’s kind of hard to dispel the impression that the German food industry is a hotbed for illegal activities and that it’s only thanks to the Cartel Office’s prying eyes and severe crackdowns that unsuspecting consumers aren’t screwed by big and cunning corporations.

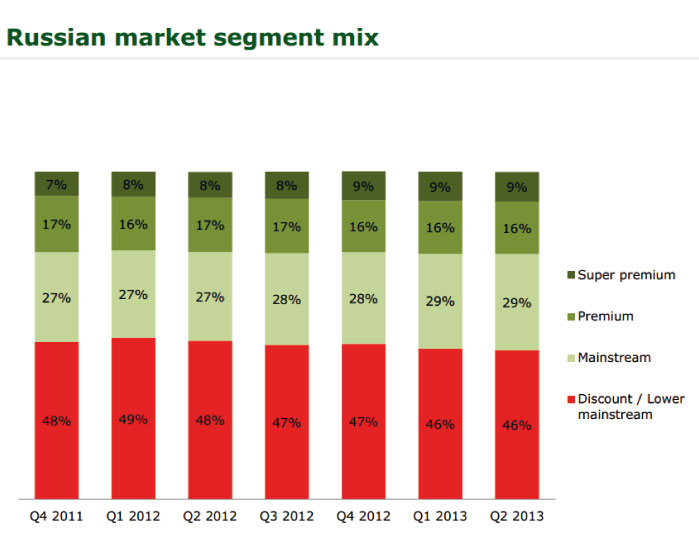

Retailers’ mind-sets never fail to baffle. Viz Russia. Why several of the country’s leading retail groups decided to sell their private label (PL) beers in these controversial big plastic bottles is beyond me. Why not offer PL beers at both ends of the price range as the British retailer Tesco does with its “Tesco Finest” and “Tesco Everyday Value” ranges?

Poor spring weather in Europe led to weak second-quarter revenue, Heineken said on 22 August 2013. The brewer predicted that earnings this year won’t grow as consumers curb spending.

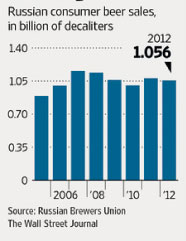

So is this the end of the BRIC era? That’s a question global brewers’ strategy departments will have to find an answer to. What is certain is: Brazil’s, Russia’s, India’s and China’s growth rates are slowing. This is not the beginning of a bust. But the "Great Deceleration", as The Economist quipped at the end of July 2013, will be having its effect on beer consumption.

How daft is this? Why would Germany's major brewers risk being fined for cartel shenanigans and price fixing while they put good money into retailers' grubby hands so that they can sell even more of their beers on super-saver offers? Why indeed?