Europe/Russia

The British Beer & Pub Association (BBPA) reported on 26 July 2013 that pub beer sales were down by 5.8 percent in the second quarter of 2013. Volumes in supermarkets fell 3.6 percent, the lowest second quarter fall since 2005. Overall beer volumes across both channels dropped 4.8 percent.

Europe/Russia

A sure way to find out that you are getting on in age is perusing the annual Barth Report for Germany’s ranking in global beer output. In 2000 Germany ranked third behind the U.S. and China. By 2012 it had dropped to fifth rank among the 40 largest beer producing countries, behind China, the U.S., Brazil and Russia, with a beer output of nearly 95 million hl.

Europe/Russia

First the pain, then the gain, or so people have come to view the Brazilians’ famous business model. Isn’t it strange that it does not seem to work at the restaurant chain Burger King, which the three Brazilian co-owners of AB-InBev, through their investment vehicle 3G, bought in 2010 with promises to turn the business around? Behind 3G are Jorge Paulo Lemann, Marcel Telles, and Carlos Alberto "Beto" Sicupira, the trio that built their fortunes in AB-InBev.

Europe/Russia

The 5th largest brewer in Europe by volume Efes expresses serious concerns over the plans by the Ukrainian MPs to sharply increase beer excise, in the middle of financial year and without any prior notice.

Europe/Russia

AB-InBev is cooperating with Germany’s anti-monopoly agency to help in its investigation of a dozen major brewers for prize fixing. A spokesperson for AB-InBev Germany, the brewer of Beck’s beer, told media on 6 July that AB-InBev used the leniency provision and turned itself prime witness. Prime witnesses in cartel probes usually receive a pardon or lesser fines.

Europe/Russia

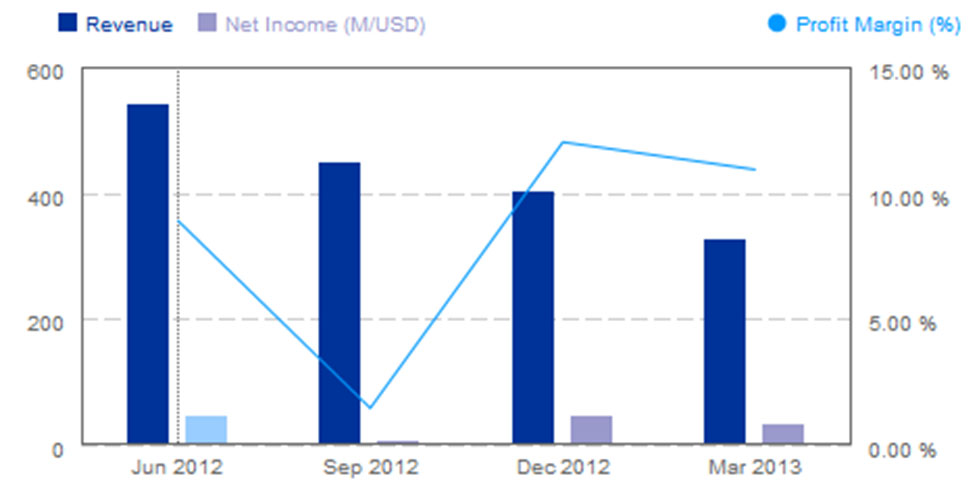

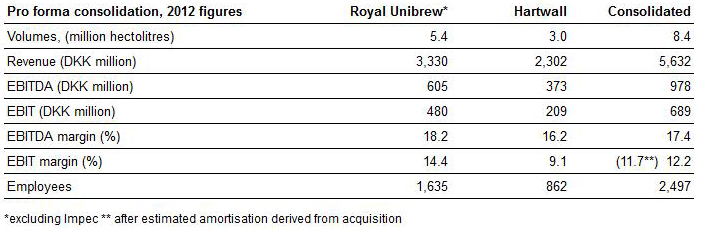

In February it was only a rumour put out by the UK’s Sunday Times that Heineken would dispose of its Finnish unit. But on 11 July 2013 it became a fact when Heineken announced that it has signed an agreement with Danish brewer Royal Unibrew for the sale of its Finnish business Hartwall.

Europe/Russia

For over a decade, demographers have said that that the 21st century will be ruled by the “New Old”, formerly known as the Baby Boomers – those born in the 1950s and 1960 – who as a cohort are significant on account of their size alone. In many countries, like in the U.S. and Europe, they represent the largest generational segment.

Europe/Russia

That’s settled, then. AB-InBev was granted trademark rights throughout the European Union for the word “Bud” on 14 June 2013. The trademark registration follows AB-InBev’s victory earlier this year in its long-running trademark clash over the Bud name with Czech brewer Budejovicky Budvar.

Europe/Russia

The idea isn’t new, but it certainly warrants repeating. In 1998 the songwriter/comic Tony Hawks travelled around Ireland for a month in the company of a fridge and turned his adventures into a bestselling book. In May this year Canadian brewer Molson told its advertising agency Rethink to set up red fridges at various locations around Europe as part of its reactivated campaign “I. Am. Canadian”, which was binned a decade ago.

Europe/Russia

What’s happened to Belgian media? Have they grown tired of complaining against price hikes on beer? Or are they saving the news of an 8 percent tax hike on beer, effective 1 August 2013, for the silly season next month, when brewers will have little choice but to pass the tax increase on to consumers?