To stay or to leave: that’s the question for AB-InBev

Third quarter beer sales in Russia could prove a mixed bag for brewers. While Heineken on 24 October 2012 reported beer volume gains in its Central & Eastern European unit (that’s Bulgaria, the Czech Republic, Poland, Romania, Russia and Serbia!) by 3.6 percent on an organic basis, AB-InBev was forced to admit on 31 October 2012 that it saw its Russian beer volumes decline by 17 percent in the quarter.

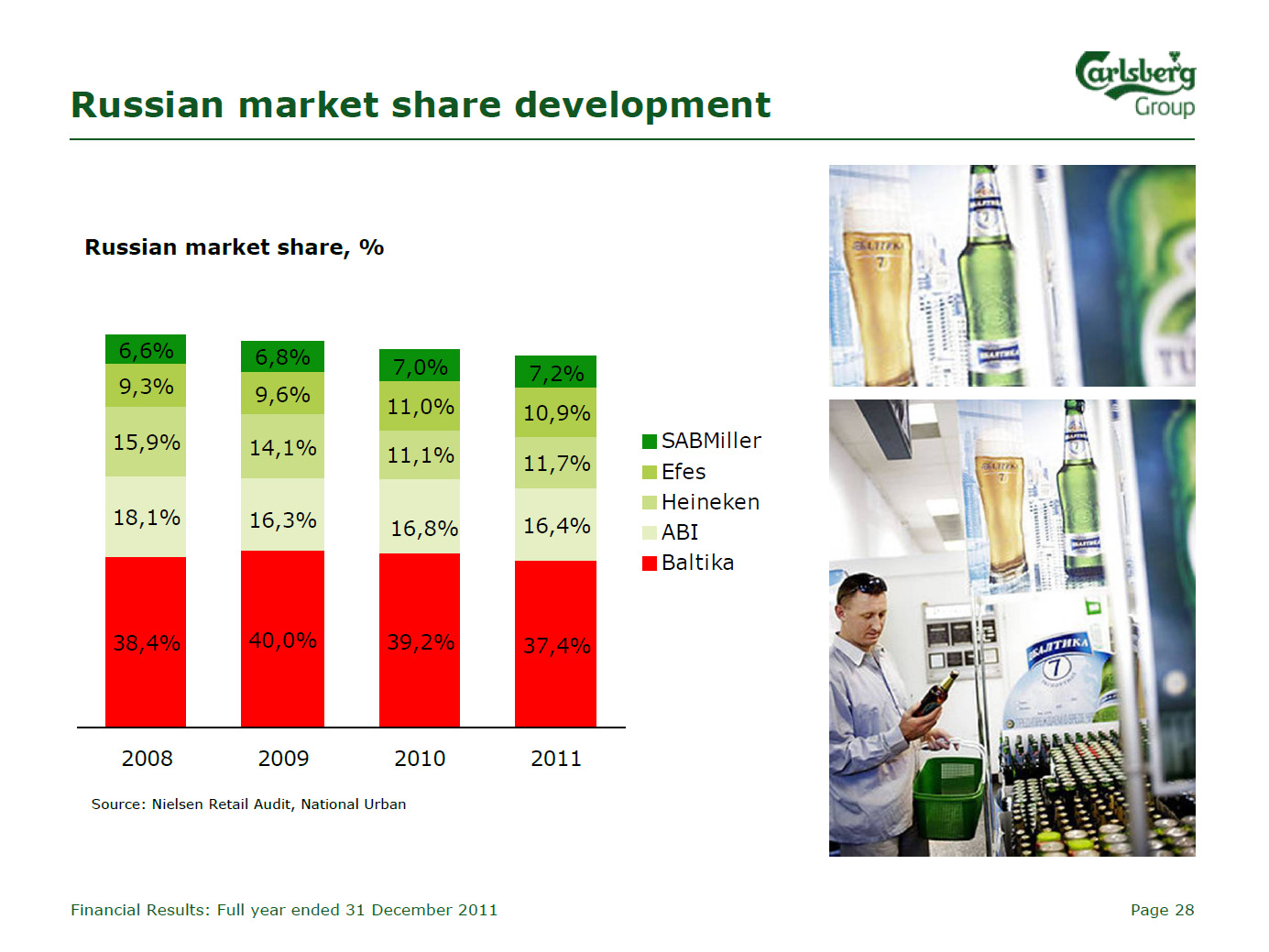

AB-InBev is the number three brewer in Russia with about 15 percent market share. Carlsberg is the biggest brewer with a share of about 37 percent, followed by the Efes/SABMiller tie-up with perhaps 16 percent. Heineken holds roughly 13 percent.

One way for AB-InBev to cut free from the declining Russian beer market is to sell out and pocket up to USD 4 billion. In a Brauwelt International report on the Russian beer market in June 2012 we thought that this was a likely move by AB-InBev.

Now an analyst has confirmed our musings. Nomura analyst Ian Shackleton said in an interview with just-drinks.com on 2 November 2012 that AB-InBev is “losing critical mass” in the country. Moreover, the Russian unit was only contributing 2 percent to the brewer’s total profits.

He predicted that a sale of the unit will be more likely in 12 to 18 months’ time to allow for some recovery in the Russian market and a higher profitability.

Alas, neither he nor Brauwelt International can make any prediction as to who might like to buy AB-InBev’s Russian assets. Mr Shackleton added that what could stand in the way of a sale is AB-InBev’s reluctance to sell to a rival such as Heineken, who may be keen to acquire AB-InBev's 15 percent market share, as it would catapult Heineken to number two spot.

The price tag Mr Shackleton attached to AB-InBev’s Russian and Ukrainian units is about USD 4 billion, based on a multiple of 2 x annual sales.

Other analysts immediately disagreed with Mr Shackleton. Bernstein Research analyst Trevor Stirling was quoted as contradicting Mr Shackleton, saying that a sale was “not on the cards”.

He thinks that Russia is too important a platform for the Budweiser brand for AB-InBev to give it up.

In Russia this year, Budweiser volumes grew about 40 percent in both third-quarter and year-to-date results.

As the saying goes: we shall see.

For whatever the Nielsen data is worth, being limited to urban centres as it is, it nevertheless shows that a tie up between AB-InBev and Heineken would make a lot of sense, as did the combination of SABMiller and Efes in 2011. Amongst other things, it would lead to further consolidation and healthier profits.