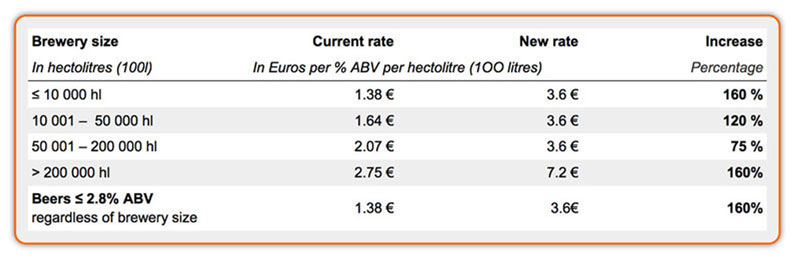

All protests were in vain: the French parliament on 3 December 2012 approved a bill to hike French beer tax by a massive 160 percent. Despite best efforts by the French Senate, twice sending the law back to the Parliament with a modest amendment to raise excise by only 120 percent – the law was finally passed without further modifications and will come into effect in January 2013.

That’s some optimistic extrapolation: if they drink lots of beer, they will eventually drink wine too. No doubt, Mexico, Brazil, Poland and Nigeria sport comparatively high beer consumption rates. But to what extent consumers in these markets can be swayed towards wine remains to be seen.

How they are doing it, no one really knows, but even in hard times British consumers keep on buying high end beers. SABMiller announced on 22 November 2012 that its UK subsidiary, Miller Brands UK, has delivered another strong period of lager volume growth during its first half year ending 30 September 2012.

Funny it should only occur to hacks now that SABMiller's shares have surged more than 20 percent to GBP 28.1 so far during 2012, making the share one of this year's best performers in the FTSE 100. True, beverage stocks have climbed about 26 percent between 1 January and 30 November 2012. But hey, a share price hike is a share price hike.

The Carlsberg Group, on 14 November 2012, signed an agreement to acquire a further 18.58 percent shareholding in Chongqing Jianiang Brewery, taking its total shareholding to 49.58 percent. The purchase price is approximately RMB 600 million (USD 96 million).

On 23 November The Brewers of Europe appointed the Spaniard Demetrio Carceller as its new President, succeeding the Portuguese Alberto da Ponte.

CAMRA, the Campaign for Real Ale, says that Britain’s pub closure rate has increased to 18 per week, with over 450 pubs across the country having been lost since March 2012. This is an increase from 12 per week for the September 2011 to March 2012 period.

The deal raised a few eyebrows. Yu Xiaoning of Vandergeeten & EG Distriselecta, the importer of AB-InBev beers into China, has bought a controlling stake in the small brewery Brasserie d’Ecaussinnes, the Belgian magazine Trends reported on 13 November 2012.

Brewers should not cheer the Senate’s rejection of a draft law to raise beer excise by a whopping 160 percent. In its vote last week, the French Senate proposed a 120 percent increase instead with a reduced rate for smaller brewers.

Hop, hop, more hops was certainly the much talked about topic at Brau Beviale in Nuremberg (13 to 15 November 2012), especially after the Bavarian Brewers Association in January this year issued a statement saying that dry hopping was not in contradiction with the German Reinheitsgebot. Phew. You can image how relieved German brewers were, now that this controversial issue has been settled, hopefully, once and for all.