The competition, widely dubbed the ‘brewing Oscars’, returned to Burton-upon-Trent last year, attracting over 800 entries. As a firmly established ‘must enter’ for many brewers around the world, we are determined to make 2013s event an even greater success.

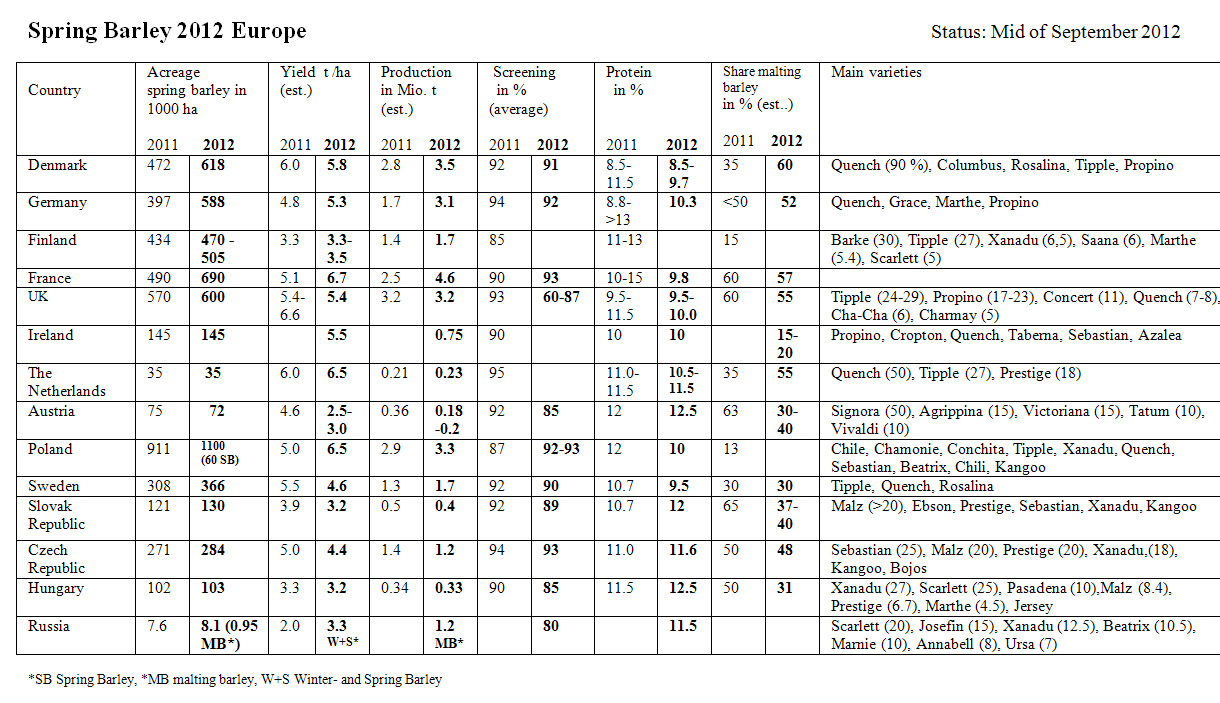

Unlike last year, the cultivation of spring barley in Europe has been expanded considerably in 2012. Besides in the most European countries good qualities were harvested. The supply with spring barley is much bigger than the demand of the processing plants.

AB-InBev intends to close its Kursk brewery, located about 500 km south of Moscow, in an effort to reduce costs, SUN InBev, the brewer’s Russian unit said in early August 2012.

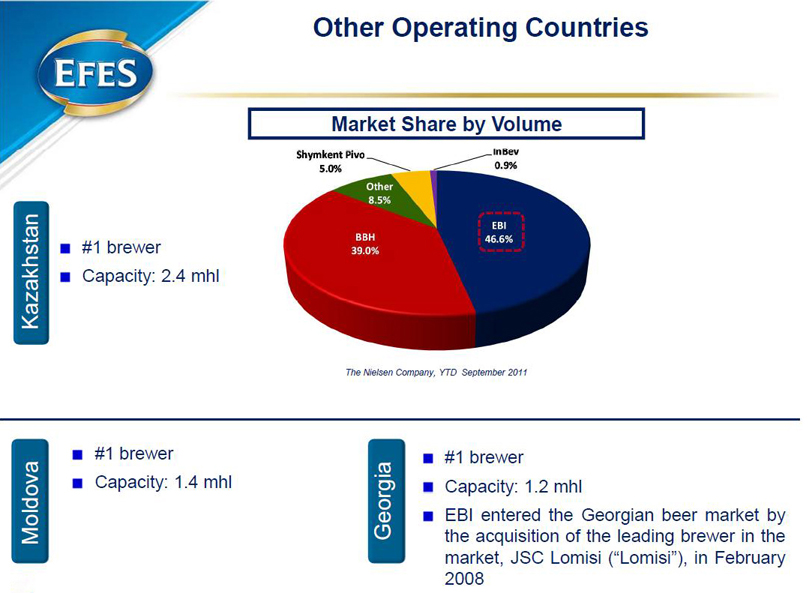

Why would anybody want to build a new brewery in Kazakhstan? It’s not a terribly fair question because the question is loaded. It implies that Kazakhstan, a huge country south of Russia, is a somewhat peculiar market. Well, it is. Larger than Western Europe, it’s home to only 15 million people. Think Berlin – Paris and hardly anybody in between. Not good for shunting beer around. If you pardon the comparison, Kazakhstan is a bit like an island market in terms of brewers’ profits. Alright if you’ve got a monopoly. So-so if it’s a duopoly. And truly, shockingly bad if there are several players in the same field. Already, beer consumption stands somewhere between 30 and 40 litres per capita. Sorry, market researchers are a bit vague here. Whatever the exact figure, it would still be ok for an emerging market. It would be even better, nay spectacularly high, for a predominantly Muslim one, which is what Kazakhstan is.

The UK loses its taste for InBev lager, British media concluded with some ill-concealed glee in early August 2012, after AB-InBev released second quarter results on 31 July 2012 which showed that it suffered a double-digit slide in UK lager volumes because of heavy promotions by rivals.

Like its rival AB-InBev, SABMiller’s western European sales volumes in the quarter ended June 2012 suffered from a combination of poor weather and weak economic conditions. However, on an organic basis (excluding the impact of acquisitions and disposals), lager volumes for the group were 5 percent ahead of the prior year for the quarter, the brewer reported on 26 July 2012.

The scale of the Corona empties scandal can be measured in its ever-widening ripples. After the German environmental pressure group Deutsche Umwelthilfe revealed in early July that brewer Radeberger had deceived consumers for years about what happened to the Corona bottles once they had been returned to Mexico as empties (where they were not refilled and shipped back to Germany as required by German law), the matter has now been taken up by the Association of Private Breweries.

That’s hopeless. That’s truly hopeless. Carlsberg Sweden will launch a new “craft-style lager” named Lawn Mower in Sweden this October. What on earth possessed them to call a craft beer Lawn Mower? Don’t they know that “lawn mower” is the term Americans use for those inoffensive bland light beers men quaff on a Saturday afternoon after having mown the lawn? Selling Lawn Mower in a can makes matters even worse. Cans are the packaging of choice for those who want to chug a beer in no time. It’s not the conventional container for a craft beer.

Where would we be without watchful non-governmental organisations? Having been accused by the environmental pressure group Deutsche Umwelthilfe of dodging on deposits (BRAUWELT International reported), German brewer Radeberger, which imports Corona, has acknowledged some “oversight”. On 10 July 2012 Radeberger promised that it would now put the Corona bottles into a proper recycling system, which, according to German law, means that the empties have to be returned to source where they are refilled and then shipped back to Germany. In the past, the empties were collected and shipped to Mexico to be “recycled” (whatever that means in Mexico), in exchange for which Grupo Modelo sent new bottles to Germany. This is in clear violation of German law.

Google, Amazon, Toyota and AB-Inbev are among the least "transparent" major corporations around the world, according to a new study. Transparency International (TI), the Germany-based not-for-profit group, rated how openly the 105 biggest global companies reported their anti-corruption schemes, country-by-country sales and organisational structures. AB-InBev ranked tenth – from the bottom.