Light at the end of the Russian tunnel?

Brewers in Russia can expect another two years of disruption as the beer market adjusts to recent sales restrictions, Fitch Ratings agency reported in early February 2012. Wouldn’t Carlsberg know? The world’s number four brewer has long been looking for a way to reverse the steady decline in sales from its Russian market, which has been hit by a combination of spiralling taxes designed to curb alcoholism and intense competition.

In 2009 eastern Europe accounted for 57 percent or DKK 5.3 billion of Carlsberg’s profits (EBIT). In 2011, it accounted for merely 42 percent while profits from Russia stood at DKK 4.3 billion, Carlsberg said on 20 February 2012 when it released its 2011 full year results.

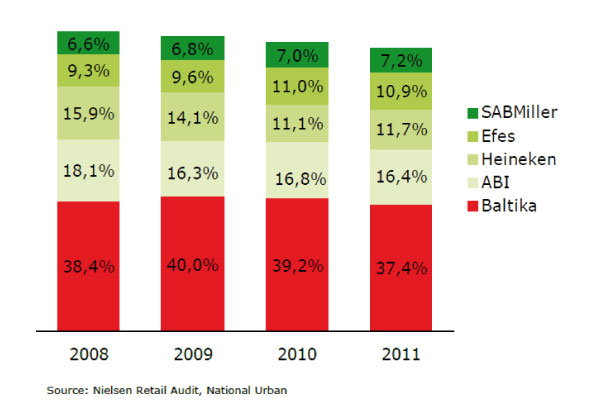

To make matters worse, Carlsberg’s market share in Russia in 2011 fell 1.8 percentage points to 37.4 percent, according to Nielsen data, while the total market contracted by about 3 percent. Carlsberg CEO Jørgen Buhl Rasmussen said that a “high level of promotional activities from competitors” had led to this loss of market share.

Nevertheless, the year ended on a high as suppliers and drinkers in Russia used the fourth quarter to stock up on beer ahead of a new year tax increase, although this is expected to weigh on January sales figures.

Carlsberg reported a full-year profit decline of 4.2 percent. Operating profit excluding some items fell to DKK 9.8 billion over the previous year, while net revenues rose to DKK 63.3 billion from DKK 60 billion in 2010.

The company warned that operating profit would be flat in 2012, hit by low single-digit declines in northern and western European markets and sluggish growth in Russia.

Investors are showing a lot of confidence in Carlsberg’s ability to turn things round in Russia, whose beer market conditions Fitch Ratings, also on 20 February 2012, described thus:

"After a decade of strong growth, per capita consumption of beer in Russia fell in 2011 to 65 litres per head from a peak of almost 80 litres in 2007 due to pressure on consumers’ spending power and the more than doubling of excise duties. Duty increases have forced brewers to raise retail prices by on average 30% over 2010 and 2011. In addition to these challenges, brewers have had to grapple with the sky-rocketing of input costs in Russia in 2011."

Looks like things could get a lot worse before they will get better.