AB-InBev increased profits and further cut debt

Why worry about economic troubles in the eurozone? In 2011 the Americas, that’s mainly the U.S., Canada and Brazil, contributed a staggering 94 percent to AB-InBev’s profits in 2011 (as measured in EBIT). The world’s largest brewer AB-InBev reported on 8 March 20111 that last year it benefited from higher demand and higher prices in Latin America. This way it more than compensated the decline in sales in the U.S. and sluggish volumes in western Europe. Sales rose almost five percent to USD 39 billion (EUR 29.6 billion). AB-InBev actually sold less beer last year than in 2010, but charged more for it and grew its premium brands. It also cut sales, distribution and administration costs.

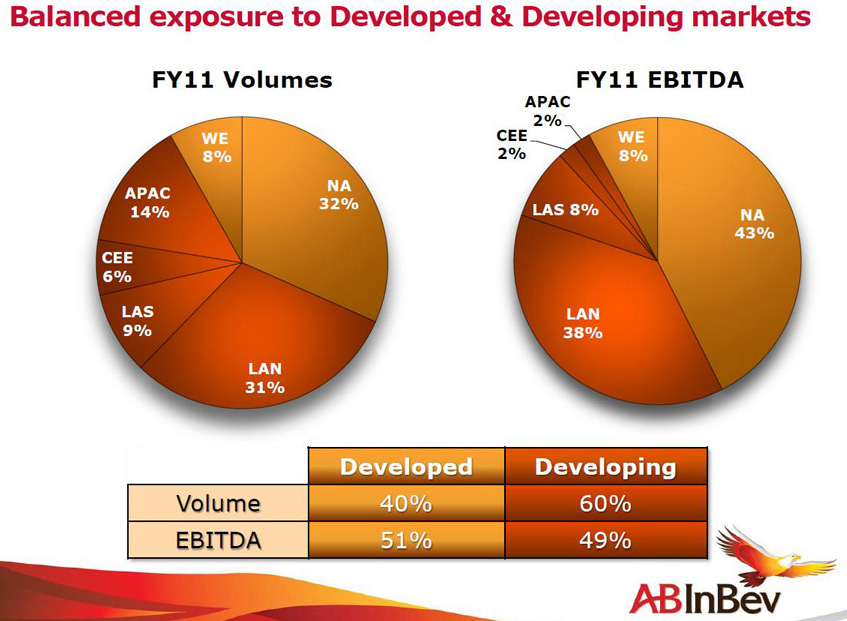

Adjusted for special items, EBITDA increased 7.7 percent to USD 15.4 billion, translating into an EBITDA margin of 39.3 percent, the brewer said.

Net profit was USD 5.86 billion, up 45 percent year-on-year. Shareholders will receive a 50 percent dividend increase to EUR 1.20 per share.

Contributing to the good results were the key brands, which increased their volumes 3.3 percent. In 2011, Budweiser grew volume by 3.1 percent globally to 37 million hl, with almost 44 percent of the brand’s sales now coming from outside the U.S., compared to only 28 percent just three years ago, AB-InBev said. Stella Artois volume rose 5.9 percent in the year, driven primarily by growth in the U.S., Brazil and Argentina.

The only region to register a decline in beer volumes was eastern Europe, where volume sales dropped 4 percent.

The brewer said volumes in the U.S. were encouraging in the first two months, helped by mild weather, early signs of a recovery in consumer confidence and better than expected results from its new lager, Bud Light Platinum.

It said it expected lower U.S. shipments in the second quarter, but more favourable levels in the rest of the year.

In Brazil, the 7.5 percent minimum wage increase should encourage higher beer consumption drinking in 2012, AB-InBev said. In 2011, volumes were flat due to price hikes.

As announced, AB-InBev managed to cut debt, which stood at 2.26 times EBITDA or USD 35 billion at the end of 2011 compared to USD 57 billion in 2008.

AB-InBev’s CEO Carlos Brito would not comment on any future acquisitions but said instead that in China they were currently engaged in six greenfield brewery projects.