Asahi allegedly after StarBev

The rumour mill is spinning wildly. According to gossip mongers, the Japanese brewer Asahi is only days away from buying eastern European brewer StarBev in a deal likely to fetch up to USD 3 billion. If Asahi finally manages to clinch a deal, it will be a true indication of how desperate the Japanese alcohol producers are to grow overseas sales.

Private equity firm CVC Capital Partners, which owns StarBev, apparently wants to sell the business and Asahi is said to have put a big price on the table thus outdoing private equity co-bidders .

Needless to add that all parties declined to comment.

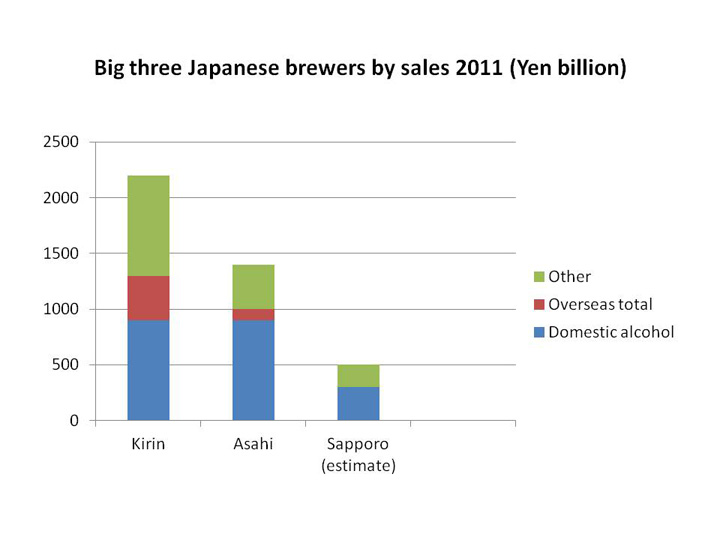

Driven by falling domestic sales, Japan’s leading drinks companies have embarked on an overseas spending spree. This is supported by low borrowing costs and a strong yen.

No doubt, the Japanese firms are willing to splash out big time. In August 2011, Asahi purchased New Zealand beverage company Independent Liquor from Pacific Equity Partners (PEP) and Unitas Capital for NZD 1.5 billion (USD 1.27 billion). The transaction valued the company at 13 times EBITDA, similar to valuations paid by Japanese companies in other deals.

Kirin’s AUD 3.3 billion buyout of Australian brewer Lion Nathan in 2009 came in at 12.5 times EBITDA, preceding its USD 970 million acquisition of Singapore-based Fraser & Neave a year later, also valued at 12.5 times EBITDA. That was topped by Kirin acquiring Brazil’s Schincariol in August 2011 at 15.7 times EBITDA. Meanwhile, rival Asahi in July of last year agreed to buy Permanis, Malaysia’s second-biggest soft drink maker, for USD 273 million, which equates to an EBITDA of 15.4 times.

For comparison, InBev paid an EBITDA multiple of 12.4 for Anheuser-Busch in 2008.

Speaking of which: AB-InBev, which has strong ties (brand-wise and other) with StarBev, shouldn’t be too worried about StarBev going to Asahi. Nowhere do the two compete against each other directly. In fact, the Japanese and the Brazilians got to know each other well when AB-InBev sold a 19.9 percent stake in Chinese brewer Tsingtao to Asahi in 2009, reducing its own stake to 7 percent.

What would Asahi get out of buying StarBev? We at BRAUWELT International would say: management expertise and a beer company that is probably as lean as a skinless chicken and therefore more profitable than any of Asahi’s other operations. Asahi reported an EBITDA margin of 11 percent for the financial year 2011. StarBev definitely must do better than that.

Can Asahi afford to fork out USD 3 billion for StarBev? They sure can although Asahi’s debt level in 2011 already stood at 2.35 times EBITDA.

We will keep you posted.