Burger King receives the famous AmBev-makeover

First the pain, then the gain, or so people have come to view the Brazilians’ famous business model. Isn’t it strange that it does not seem to work at the restaurant chain Burger King, which the three Brazilian co-owners of AB-InBev, through their investment vehicle 3G, bought in 2010 with promises to turn the business around? Behind 3G are Jorge Paulo Lemann, Marcel Telles, and Carlos Alberto "Beto" Sicupira, the trio that built their fortunes in AB-InBev.

In Germany, which is Burger King’s second most important market behind the U.S. with about 700 restaurants and 160 franchisees, the business seems to be in total disarray. Dozens of franchisees are suing for unfair termination of their licenses. Many more are bust and therefore don’t have the money to sue. In and around Berlin 15 restaurants are under receivership. If that’s not enough, employees are fighting in the courts for violation of labour laws, while punters complain about bad service and unappealing new menus.

The blow to Burger King’s image must be enormous, as its troubles are well-covered by the German media and the company’s management seems incapable of limiting the damage.

Is this what you call a successful business turnaround?

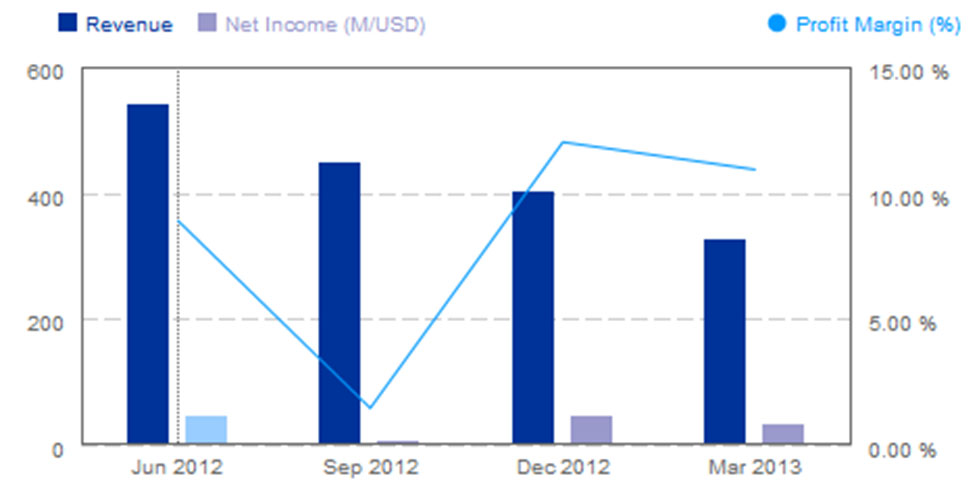

What is more, when 3G bought Burger King in 2010, it paid a premium for shares at USD 24 a piece. Three years later (July 2013), Burger King’s shares still only hover around the USD 20 mark. Quarterly revenues of Burger King Worldwide have been declining since June 2012, when its owners (3G has 71 percent) returned the company to the stock market.

Founded in 1954 in Miami, Burger King was a perennial number two to McDonald’s but recently fell to number three slot behind Wendy’s in the U.S., as measured by system-wide sales. The chain has shuffled through 13 chief executives over the past 25 years and has been passed between various owners, in and out of private hands, the Wall Street Journal wrote in 2012.

Burger King’s sales had been slumping prior to 3G’s buyout, particularly in the U.S., where the chain resorted to discounts that hurt profits and failed to rouse interest from customers. Relations with franchisees quickly deteriorated.

The situation over in Germany isn’t any different and got worse when Burger King announced in 2012 that it would sell all its managed outlets (the ones that are company-owned). Flogging off its own restaurants – all 1,300 of them – to franchisees was supposedly part of the new corporate strategy to improve the company’s bottom line. However, in Germany the disposal had a more desperate ring to it. Burger King Germany was anything but profitable. According to public records, Burger King GmbH in 2011 saw sales drop 3.1 percent and recorded a loss of about EUR 5.87 million. To avert insolvency, Burger King Worldwide had to transfer EUR 15 million to Germany.

In May 2013 Burger King sold its 91 managed restaurants in Germany to Yi-Ko, a venture by Ergün Yildiz and the Russian business man Alexander Kolobov, for a rumoured EUR 100 million. As part of deal, the two agreed to open more restaurants over the next five years and to modernise 57 of their current estate over the next 18 months at a cost of perhaps EUR 200,000 each, which puts another EUR 11 million on their initial investment.

Where the pair got the money from for this investment, remains the topic of much speculation. Fact is that Mr Yildiz was a Burger King franchisee with two restaurants in Germany, while Mr Kolobov has opened nearly 100 Burger King outlets in Russia over the past three years, it was reported.

In order to recoup some of their investment, Yi-Ko has announced that they need to cut costs. In defiance of German labour laws, they have shortened annual holiday allowances and reduced the hourly pay for new employees to EUR 6.50 from EUR 7.71. Employees responded by dragging them to court.

Meanwhile, at least three dozen franchisees are preparing a group action against Burger King over unfair termination of their licences. According to a report in the newspaper Financial Times Germany of November 2012, an employee of Burger King by the nickname "killer" has been going round to ensure that unpopular (read low-margin operators) franchisees give up so that their licences can be terminated. This is done mostly through restaurant inspections, which often reveal an alleged lack of hygiene, like chewing gum on the parking lot ground.

Many critics think that Burger King hopes to terminate its underperforming franchisees in order to reduce their number to perhaps 30 or 40 larger ones in Germany, while increasing the number of outlets over all.

Given the current climate of fear among Burger King’s German franchisees, this may prove a futile hope.

All of this makes insiders question 3G’s intentions. When the Brazilians applied the axe to their various brewing industry assets in Germany (Beck’s, Diebels, Gilde, Spaten and Löwenbräu), the bloody work was done quickly in order not to harm the long-term viability of their business. In the case of Burger King, however, the blood-letting seems to go on and on. Ultimately, this poses a puzzle: is 3G interested – really interested – in building the business or are they only after making a quick buck – much like Burger King’s previous private equity owners?