Heineken sells Hartwall business to Royal Unibrew

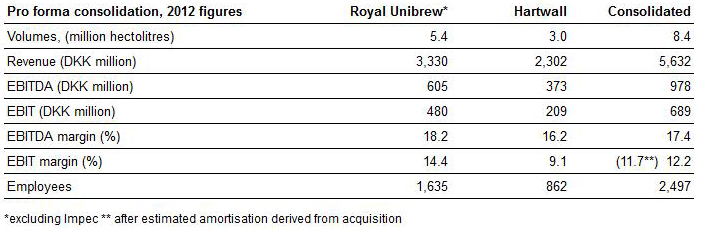

In February it was only a rumour put out by the UK’s Sunday Times that Heineken would dispose of its Finnish unit. But on 11 July 2013 it became a fact when Heineken announced that it has signed an agreement with Danish brewer Royal Unibrew for the sale of its Finnish business Hartwall.

A multi-beverage company with a broad product range, Hartwall is ranked second behind Carlsberg in Finland, says Royal Unibrew. Hartwall is the market leader in the categories of mineral water, cider and Ready To Drink (RTD) and number two in the categories of beer, soft drinks and energy drinks. Non-alcoholic beverages account for 43 percent of revenue, whereas beer, cider and RTDs make up 44 percent. The business unit Hartwa-Trade operates as an agency for a number of international wine and spirits brands and contributes 13 percent of Hartwall’s revenue.

Royal Unibrew did not pay as much for Hartwall as many thought it would fetch (EUR 590 million/USD 790 million). In actual fact, Royal Unibrew got Hartwall for EUR 470 million which includes interest, net debt and net debt equivalents assumed by Royal Unibrew.

To fund the acquisition, the stockmarket listed Royal Unibrew will issue shares to the Finnish investment company Hartwall Capital, which is the investment vehicle of the Hartwall family, the founder and owner of the Hartwall Brewery until the merger with Scottish & Newcastle in 2002. The family was a significant shareholder of Scottish & Newcastle until it was sold in 2008 to both Heineken and Carlsberg. Through taking a minority interest in Royal Unibrew, the Hartwall family seems to be making a safe investment decision, but they are also taking a bit of a gamble that Royal Unibrew can raise profit margins in Finland when Heineken could not.

Royal Unibrew has already said that it will temporarily discontinue dividend payouts until 2015 in order to reduce debt from the acquisition.

As part of the deal with Heineken, Royal Unibrew will get a 10-year licence to brew Heineken beer in Finland, Estonia, Latvia and Lithuania. Royal Unibrew already brews the Heineken brand in Denmark and distributes it in the Baltic countries.

For Royal Unibrew, acquiring Hartwall is certainly a boon. Only two years ago Royal Unibrew was rumoured to be a takeover target itself. It is strong in its domestic Danish market, with a brand portfolio headed by its flagship Faxe brand. But beyond Denmark, where it is a distant number two to Carlsberg, the group’s business is somewhat limited.

The M&A advisors Glenboden said that Royal Unibrew’s presence in Italy is only in the super-premium beer segment. In Germany it’s largely a border-trade operation. In eastern Europe it’s active in the small Latvian and Lithuanian markets, having sold its Polish business in 2010.