Eckes-Granini Group buys Heineken’s fruit juice company Pago for an estimated EUR 75 million

Given that Heineken is going to focus on its beer and cider brands, it was just a matter of time before it would sell its premium juice brand Pago. On 19 December 2012 the Heineken-owned Brau Union signed an agreement with Pago’s bigger German rival Eckes-Granini which will lead Pago to change hands during the first quarter of 2013.

Although the transaction price was not disclosed, market observers estimate that Eckes-Granini paid between EUR 75 million and EUR 100 million for Pago, whose turnover was EUR 92 million (USD 120 million) in 2011.

The transaction makes perfect sense for Eckes-Granini. The Austrian-based Pago is a producer of premium fruit juices. Pago has prominent market positions in Austria, Italy, France and Spain, and a wider geographic presence in over 35 markets. It also does well in the on-trade – something Eckes-Granini has failed to achieve on a large scale yet.

According to Austrian media, Brau Union chief Markus Liebl called the decision to sell Pago “purely strategic”. It will allow Brau Union to focus on the beer market, where it allegedly managed to gain market share in 2012.

Eckes-Granini, which operates 15 subsidiaries and sells juices in more than 70 countries, is best known for its granini juice brand. The group had a turnover of EUR 888 million and an EBIT of EUR 52.4 million in 2011.

Its major shareholder is the very secretive Harald Eckes-Chantré, 73, with a 47 percent stake. Mr Eckes-Chantré is also Germany’s major sparkling wine producer. The Rotkäppchen-Mumm champagne house, which he founded in 1991 when he took over the former eastern German company Rotkäppchen (trans. Red Riding Hood), today controls about 48 percent of Germany’s sparkling wines sales. Together with his two daughters he owns a 56 percent stake in Rotkäppchen-Mumm.

Dutch Rabobank says that Eckes-Granini, whose brands include “hohes C”, “granini” and “Joker”, is the market leader in the western European off-trade juice segment in volume terms, accounting for 6.0 percent, followed by PepsiCo with 5.7 percent and Coca-Cola (MinuteMaid) with 4.4 percent.

All three companies are producers of premium juices and account for larger shares in value terms, especially PepsiCo with the Tropicana brand. In value terms (as measured in retail selling price), PepsiCo is market leader with 7.8 percent, followed by Eckes-Granini (6.9 percent) and Coca-Cola (5.4 percent).

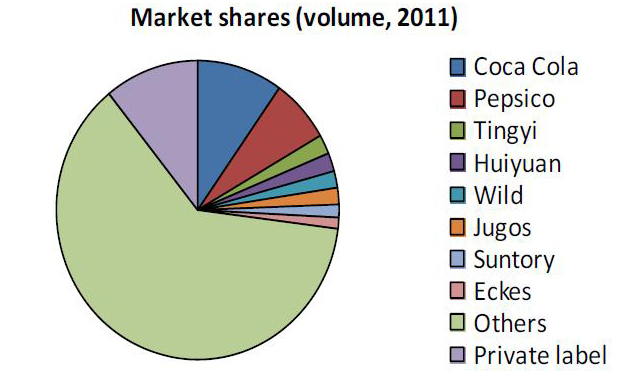

This shows that the consolidation of Europe’s market for fruit juices has quite some way to go. As Rabobank commented, global juice companies represent only 18 percent to 24 percent of sales volume (depending on your definition of Eckes-Granini) in western Europe.

In beer, the globals (that is AB-InBev, SABMiller, Heineken, Carlsberg, plus Molson Coors and Diageo) account for 42 percent. The big difference between beer and juice is private label: it accounts for 37 percent in juice and 5 percent in beer in western Europe. Moreover, most private label producers of juices are local operators.