Polish beer market declines slightly

The days of seemingly endless growth in the central and eastern European beer markets are definitely over. Russia, Poland, the Ukraine are all in decline, albeit for different reasons. In Russia government interventions threw a spanner into brewers’ spokes, while in the Ukraine the sorry state of the economy helped dampen consumer spending. Poland, on the other hand, did not witness any of the above. It is the only country in the EU to have avoided a recession. Its economy is still growing, albeit at a slower rate – 2.1 percent in 2012 – than in previous years. But there is no doubt about it: Poland has become a highly mature beer market with per capita consumption standing at 94 litres in 2011.

So it should not come as too much of a surprise that in 2012 the market dropped 0.5 percent to 37.8 million hl. As SABMiller’s Polish unit Kompania Piwowarska (KP) reported on 22 January 2013, the Polish beer industry closed the calendar year 2012 with weak sales in the second half year after a strong growth in the first half of the year. The growth of the Polish beer market lasted only until July 2012, says KP, driven by favourable weather, the Euro 2012 football championship and brewers’ efforts to innovate. However, during the last four months of 2012 sales began to decline, compared with the previous year on the heels of falling consumer confidence.

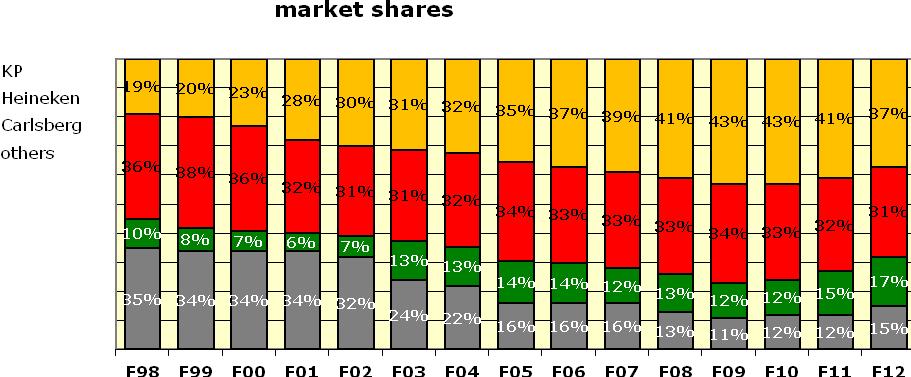

KP said it lost volume, too. Still, it maintained that its sales outperformed the industry’s average resulting in KP defending a 38 percent market share.

According to KP, 2012 was marked by widespread innovation in the beer sector. KP claims to have been particularly active with as many as 11 innovative products launched within the last year or so. Its premium brand Lech was supported by the launch of Lech Shandy (which is a mix of beer and lemonade). This brought to the market a whole new beer category with very promising sales results.

Market observers see it as a sign of market maturity that in Poland the beer category as a whole lost some value, owing to the rising popularity of cheaper brands. KP admitted that many consumers today select their beer predominantly on price. “In fact, among all distribution channels, discount stores posted the most significant sales increases”, KP reported.

Add to that a growing cost pressure and KP thinks it likely that brewers in Poland will soon be forced to raise their beer prices.

Whether consumers will be prepared to accept the beer price hikes and not switch to the country’s favourite tipple, vodka, remains to be seen.