The Americas

At the end of January 2007 Modelo and Switzerland’s Nestlé announced the completion of a joint-venture which allows them to manufacture, distribute and market bottled water brands in Mexico, which includes brands such as Santa Maria and Nestle Pureza Vital. Nestlé already has a bottled water business in Mexico. The new venture will also import and distribute Nestlé’s brands San Pellegrino, Perrier and Acqua Panna.

The Americas

Kent, a long-time Coca-Cola veteran, who joined the company in 1978, most recently served as president of Coca-Cola International, a position he has held since January 2006.

The Americas

In mid-February there was a Brazilian press report saying that the two companies have held preliminary merger talks, quoting a source close to top Brazilian InBev investors. The Brazilian investors have also been behind the USD 11 billion merger between Brazilian brewer AmBev and Interbrew that created InBev in 2004.

The Americas

It may have been the climax of the American football season. The Indianapolis Colts beat the Chicago Bears 29-17 in a game played on 4 February 2007 during a driving rainstorm in Miami. But it was not the game that gripped the audience’s attention: it was the commercials, many of which were shown for the first time. With 93.2 million viewers, the Super Bowl is a hit with U.S. audiences, only to be topped by the Oscar ceremony which draws a larger, albeit world-wide, audience. That is why Anheuser-Busch showed nine commercials at this year’s Super Bowl, featuring humour, horses and Jay-Z, in what the company’s top ad executive called an essential part of its business strategy.

The Americas

In an announcement the organisers said that the Craft Brewers Conference (CBC) delivers four learning tracks of educational seminars and provides a platform for networking and discussions on current legislative issues.

The Americas

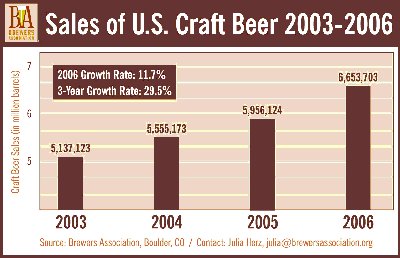

This comes on top of strong growth in each of the prior three years and illustrates the ongoing surge of consumer interest in craft beers. The Brewers Association estimates 2006 sales by craft brewers at over 6.6 million barrels (7.7 million hl) up from an adjusted total of just under 6.0 million barrels in 2005. The increase totals over 690 000 barrels or 9.5 million case-equivalents. For 2006 craft beer posted an estimated retail sales figure of USD 4.2 billion.

The Americas

Should the merger ever materialise it would cement relations between Anheuser-Busch and InBev, particularly in Canada and the United States. According to reports in the local media, the deal would likely hasten a growing trend in Canada’s beer business: more emphasis on foreign brands at the expense of Canadian and Blue, which are in decline.

The Americas

On 1 February 2007 InBev said that its Canada-based Labatt Breweries has entered into an agreement to acquire all outstanding shares of Lakeport Brewing Income Fund for CAD 201 million (USD 171 million).

The Americas

Anheuser-Busch’s sales in 2006 rose mainly because of mainstream brands such as Bud Light and the addition of smaller brands such as Rolling Rock and imports.

The Americas

Mexican brewer and bottler Coca-Cola Femsa said it plans to buy Latin American juice maker Jugos del Valle for USD 380 million in a joint venture with the Coca-Cola Company.