The Americas

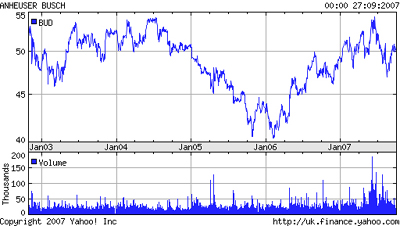

Whereas in times of economic weakness anxious investors usually tend to buy into safe havens, including brewery stocks, they have passed for now on ordering up the "King of Beers" -- leaving Anheuser-Busch’s shares flat.

The Americas

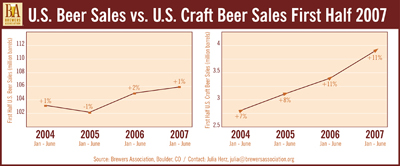

The Brewers Association, the trade association that tabulates industry data for craft brewers, reports craft beer sales and growth continue to break records.

The Americas

In August Anheuser-Busch, the number one brewer in the U.S., said that it reached an agreement to distribute and market the Borba drinkable skincare line domestically and in countries around the world.

The Americas

In May of 2007, Siebel Institute of Technology introduced the new 3-day Start Your Own Brewery course, and the response was amazing. They have had so many requests for another session of this groundbreaking course that they have added a second 2007 session.

The Americas

U.S. beer maker Coors Brewing Co, a unit of Molson Coors, has created a new subsidiary to develop high-end beers.

The Americas

On the occasion of presenting the brewer’s half-year results, Heineken’s CFO, Rene Hooft Graafland, reported that Heineken has exercised its option of maintaining a 17 percent stake in beverage company FEMSA Brazil.

The Americas

Latin America’s fast growing soft drinks company Ajegroup has introduced its Franca beer brand into the market with a 20 percent price discount.

The Americas

The Boston Beer Company signed an agreement with Diageo to acquire the Pennsylvania Brewery.

The Americas

The headquarters of all major breweries operating in South America are located at or near Sao Paolo. Naturally, locating the biggest event of the Latin American brewing sector at the city suggests itself. After having taken place in other cities, last at Rio de Janeiro, the choice of location appears to have drawn many visitors from the nearby breweries.

The Americas

The Siebel Institute of Technology is offering the Professional Beer Tasting & Styles Course (6 - 7 September 2007) to those involved in the production, distribution, sale and service of beer.