The Americas

Happy with the outcome of their three-year probation period, Heineken USA and FEMSA Cerveza, Mexico’s number two brewer, agreed on a ten-year contract.

The Americas

The Latrobe brewery, which was closed down by InBev and then sold to City Brewing, has been given a new lease on life with a contract to brew the Samuel Adams beer.

Brewhouse

Consumers expect a very high and constant quality level from food products, cosmetics and drugs. The industries achieve this objective through the use of high-quality raw materials, modern process engineering, careful preparation and strict compliance with hygiene standards.

The Americas

What seems to work well in Italy and Russia is now being tried out in Panama. Under the eyes of rival SABMiller, Heineken has begun to brew and sell Budweiser under license from Anheuser-Busch.

The Americas

Constellation Brands, a leading international producer and marketer of beverage alcohol brands, has seen its shares drop sharply after it issued disappointing revenue and earnings projections.

The Americas

The Marlboro Men, also known as Altria, who still own about 29 percent in SABMiller, have spun off their 89 percent stake in Kraft Foods Inc. on 30 March 2007, divesting themselves completely of their interest in the largest North American Food company.

The Americas

Molson Coors Brewing said in March that cutting costs will save it about a quarter of a billion dollars over the next two years. The money will be spent on improving its brands.

The Americas

At the end of January 2007 Modelo and Switzerland’s Nestlé announced the completion of a joint-venture which allows them to manufacture, distribute and market bottled water brands in Mexico, which includes brands such as Santa Maria and Nestle Pureza Vital. Nestlé already has a bottled water business in Mexico. The new venture will also import and distribute Nestlé’s brands San Pellegrino, Perrier and Acqua Panna.

The Americas

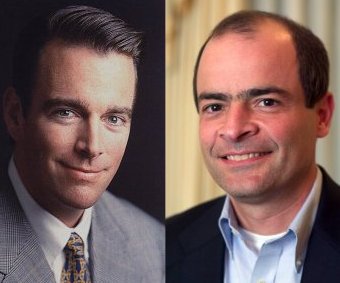

Kent, a long-time Coca-Cola veteran, who joined the company in 1978, most recently served as president of Coca-Cola International, a position he has held since January 2006.

The Americas

In mid-February there was a Brazilian press report saying that the two companies have held preliminary merger talks, quoting a source close to top Brazilian InBev investors. The Brazilian investors have also been behind the USD 11 billion merger between Brazilian brewer AmBev and Interbrew that created InBev in 2004.