SABMiller‘s Chief Executive Graham Mackay must have done some heavy schmoozing to convince the Coors people to enter into a venture with the world’s number two brewer.

Beer is one of the favoured beverages in Mexico. The most popular brands are Corona and the Modelo products Negra Modelo and Modelo Especial, as well as the competitive products Dos Equis, Sol, Tecate and Superior. Now Grupo Modelo is starting a massive step forward with it’s new megaplant in Piedras Negras.

Molson Coors Brewing Co could post free cash flow of USD 550 million next year, plus or minus 10 percent, senior executives announced in September.

Siebel Institute offers the World Brewing Academy Concise Course in Brewing Technology (29 October – 9 November 2007).

AmBev Peru, the brewer of Brahma beer, forecasts that in 2007 more than 10 million hl of beer will be consumed in the Andean state, bringing average consumption up to 34 litres per person.

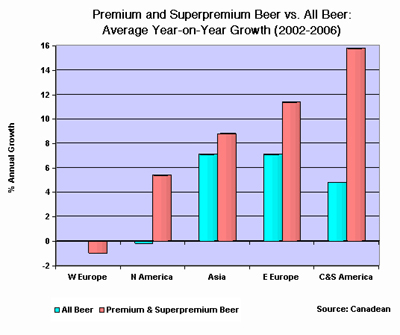

The dynamic growth of the premium and superpremium sectors has been one of the global Beer market’s key recent developments, reports Canadean.

After Andy Thomas, who has been with Heineken USA for 12 years, had been forced to take his hat, Heineken named Don Blaustein President and CEO of Heineken USA.

Starwood Hotels & Resorts Worldwide, parent of the St. Regis, Westin and Sheraton chains, has hired former Coors Brewing Company head Frits van Paasschen as Chief Executive, succeeding interim CEO Bruce Duncan.

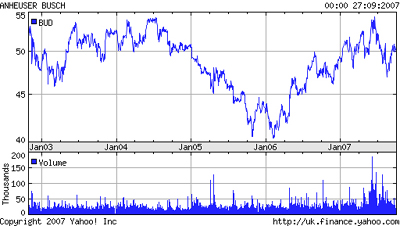

Whereas in times of economic weakness anxious investors usually tend to buy into safe havens, including brewery stocks, they have passed for now on ordering up the "King of Beers" -- leaving Anheuser-Busch’s shares flat.

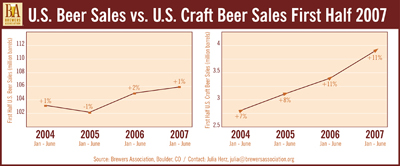

The Brewers Association, the trade association that tabulates industry data for craft brewers, reports craft beer sales and growth continue to break records.