Vietnam | With a population of nearly 100 million people and beer accounting for 95 percent of alcohol consumption, the southeast Asian country has become an alluring market for brewers.

Germany | Beer production declined 2.7 percent during the first six months of 2019, compared with the same period in 2018. German brewers sold around 46 million hl beer in the first half – excluding non-alcoholic beers and malt beverages.

Firmly in domestic hands | Thailand, known for its tropical beaches, opulent royal places, ornate temples and ancient ruins has been one of the most vibrant beer industries in the Association of Southeast Asian Nations (ASEAN) region for long. Though the country’s beer industry (both production and consumption) has not been able to keep the momentum during the last few years, it remains one of the most important beer markets in the region. This article presents an overview of Thailand’s beer market and its major brewers.

Cannabis drinkables | Once an illicit drug, legal cannabis is now a fast-growing multi-billion dollar business. Despite the confusion and contentions, it is proving to be disruptive, impacting everything from beverages to home construction, while sparking a wave of innovation and entrepreneurship amidst increasing consumer demand.

Growth for small and independent craft brewers remained steady for the first half of 2019, according to new midyear metrics released by the Brewers Association (BA). Production volume for the craft segment increased 4 percent during the first half of 2019.

Commentary | The naming of craft beers is increasingly producing pretty strange outcomes. With zany names consumer transparency often falls by the wayside as beer properties are veiled. This prompted BRAUWELT International author Horst Dornbusch to discuss the phenomenon in a critical commentary.

Nigerian beer market | They had it so good. For decades, Nigeria’s cosy duopoly of Heineken and Diageo with their premium brands was run like a pharmacy. Brewers sold small volumes at high profits. However, the arrival of SABMiller and its value-for-money beer offerings, encouraged by the Nigerian currency’s decline, transformed the industry. As consumers traded down, the value segment ballooned and became the new mainstream. Overall price levels suffered and the beer profit pool shrank.

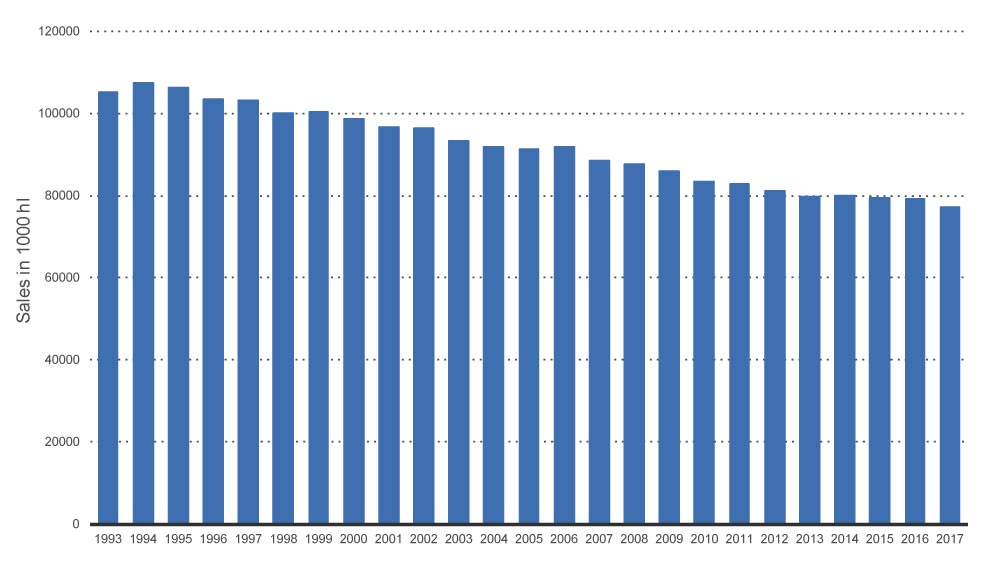

Foreign brewers in Germany | It’s a tough life for brewers in Germany. The market is in decline, beer prices are at rock bottom and profits under pressure. The only consolation old-established brewers can draw from such dire circumstances is that the foreign brewers AB-InBev and Carlsberg are suffering too. Little remains of their erstwhile plans to disrupt and consolidate the market. In fact, both seem to be beating a gradual retreat.

For the first quarter of 2019, AB-InBev reported a strong start to the new year. According to their management comments published in early May, revenue grew by 5.9 % driven by volume growth of 1.3 % (own beer +1.0 %, non-beer +4.9 %) and revenue per hl growth of 4.6 %. The top-line result was driven by healthy performances in several of the key markets, including Brazil, China, the US, Europe, Colombia and Nigeria, with especially strong volume growth from markets such as Brazil, Nigeria, Europe, Peru and Colombia.

Local beer brands | No Instagram, no Facebook, no advertising, no sports sponsoring, not even a moniker. How can a centuries’ old beer brand defy the textbook on marketing and still enjoy a cult following? The phenomenon is called Augustiner, Munich’s oldest brewery.