Heineken and Carlsberg fight it out in Vietnam

Vietnam | With a population of nearly 100 million people and beer accounting for 95 percent of alcohol consumption, the southeast Asian country has become an alluring market for brewers.

Media report that Heineken’s sales have jumped by double-digit percentages in the past four years, making Vietnam a major source of group profits after Mexico. Analysts estimate that Vietnam contributed slightly more than 10 percent to the EUR 3.87 billion (USD 4.3 billion) Heineken made in operating profit before one-off items in 2018.

Growth has mainly been driven by Tiger beer, a popular Asian lager brand, which was acquired by Heineken in 2012 when it took full ownership of Asia Pacific Breweries.

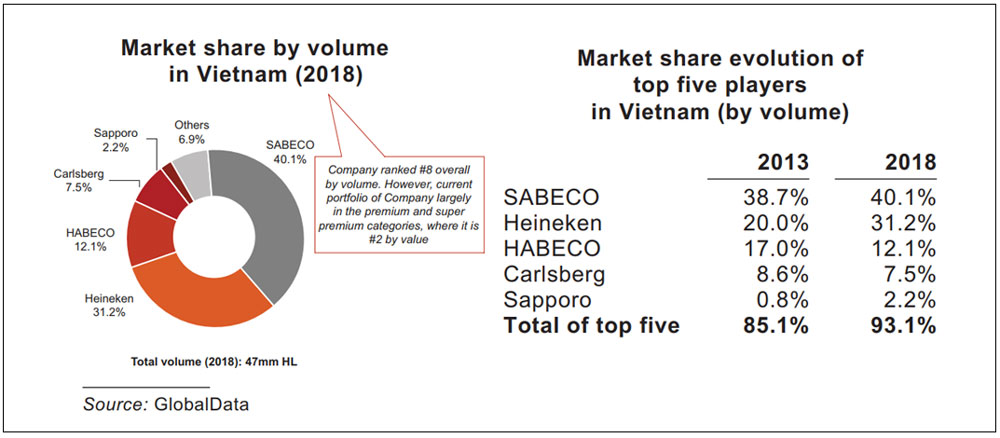

Heineken’s overall market share has since risen to 31 percent from 20 percent in 2013, according to data analytics firm GlobalData.

As the market is expected to premiumise, the Dutch brewer has launched the super-premium priced Heineken Silver in March this year. It is the first country-specific variant of its eponymous lager since the introduction of Heineken Light in the US in 2006.

Observers say that Heineken Silver is less bitter and has 4 percent ABV compared with 5 percent ABV for Heineken. Heineken Silver is around 5 percent more expensive than the standard version. Both are sold at a premium of 40 percent or more over mainstream beers.

Vietnam’s brewer Habeco, ranked third, has not been able to benefit from rising beer consumption. In fact, it has encountered strong competition from other firms, such as Sabeco (which is majority-owned by ThaiBev) and Heineken. Habeco’s volume sales in the north and central regions fell 3 percent in 2018, it was reported.

The brewer, in which Carlsberg holds a 17.34 percent stake, has already warned shareholders in April this year that its post-tax profit will drop 36 percent to approximately USD 13.3 million in 2019, the lowest in ten years. In 2018, Habeco recorded approximately USD 21 million in total post-tax profit, down 26 percent over 2017.

In 2019, Habeco’s total production is projected to decline to 4.4 million hl, the majority of which is beer.

Authors

Ina Verstl

Source

BRAUWELT International 2019