Market

Huge potential | With a population of about 1.30 billion, 50 % of which are below 25 years and 65 % below 35, and an ongoing culture change, India has emerged as one of the most promising beer markets. Still, the Indian beer industry has not been able to reach its true potential yet. This article presents an overview of the Indian beer market and its major stakeholders.

Market

Dedicated to the world of craft beer | As we look forward to the Craft Brewers Conference in Denver, Colorado, next month, Bob Pease, President and CEO of the Brewers Association, Boulder, USA, outlines the rise of American craft beer and current developments both at home and abroad.

Market

Beer in Luxembourg | Perhaps the Grand Duchy is a case in point. You cannot be a multicultural society, neatly split into ‘somewheres’ and global ‘anywheres’, and still expect the two tribes to share a taste for local beers. Caught between rising beer imports and declining consumption Luxembourg’s brewers have suffered under consolidation and rationalisation until there were only three left. But there is a silver lining. Proliferating microbreweries may yet herald in a renaissance of domestic beer brands.

Market

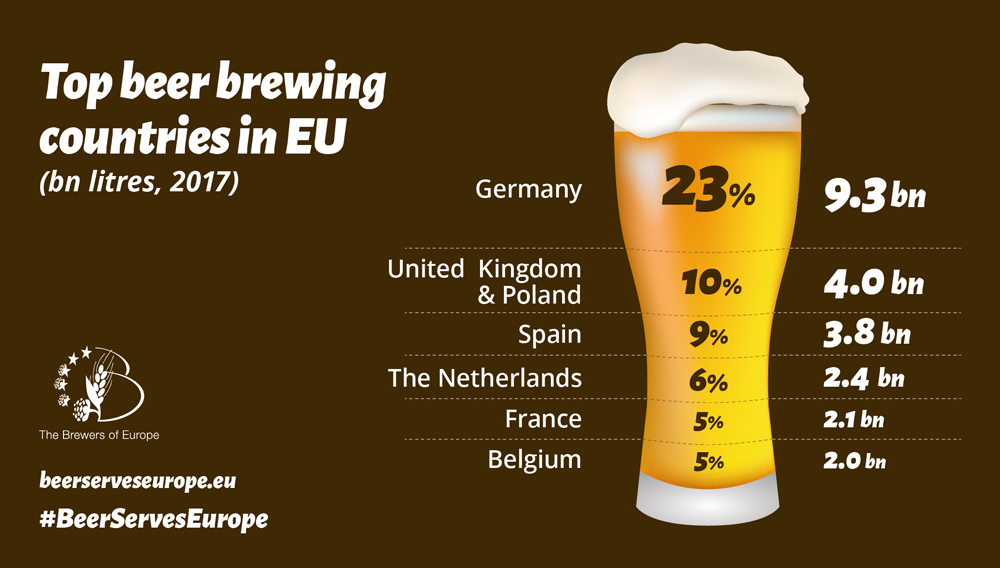

Europe’s beer production rose to an eight-year high in 2017 bolstered by record exports, a rise in micro-breweries and increased low-alcohol products.

Market

Localism and beer | Developing a beer culture is a slog. It takes decades rather than years. Switzerland is no exception here. On turning twenty, Basle’s microbrewery Unser Bier shows that a new beer culture can take hold, that it is made up mostly of people creating beers they earnestly care about, and consumers who may find the idea of craftsmanship important, but for whom flavour rules supreme.

Market

AB-InBev in Africa | Big news: AB-InBev declare themselves heir to SABMiller’s legacy as market maker and drop their own tactics as market taker. The question is: Can this metamorphosis boost investor confidence and revive AB-InBev’s share price?

Market

Small but powerful | With a population of 51.6 million in 2016 [1], South Korea is among the smaller countries in Asia, both in terms of population and geographical area. But it is one of the most vibrant beer markets in the continent. Dominated by two brewers for a long period, its beer market has become more interesting with the entry of a third brewer in 2014. Imports, which have started to play a significant role in the country’s overall beer market, have increased significantly in the last few years. BRAUWELT International presents an overview of the South Korean beer market and major stakeholders in this article.

Market

Travel report | In turning our attention to craft beer, it becomes obvious that the product has moved into the international arena, impacting on more and more countries as markets progressively develop. But what comes to mind are usually countries such as the USA, Belgium, Germany, Great Britain or Italy. And Vietnam? – The Southeast Asian country evokes images of exotic places, dreamlike beaches, coupled with a lot of history, culture and nature, rather than such of craft beer. On a journey with his family, BRAUWELT International author Dr. Markus Fohr discovered Vietnam as a craft beer country. In this very personal article he shares his impressions.

Market

US beer market | Is there no end to market fragmentation? Consumers are becoming more finicky. New products are creating their niches and category lines are blurring. Craft beers, the bright spot in the beer industry, keep on growing. So do wines, bourbons, tequilas, and cognacs, thanks to craft’s trailblazing. Without much effort they have adopted craft beer’s cachets of heritage, craftsmanship, regionality, a sense of premium and exclusivity. The consequence: macro beer brands continue to slip.

Previews

Global network | 2018 comes under the banner of drinktec worldwide. The network comprises several events all around the world. food & drink technology Africa (fdt) will get things started in September in Johannesburg. A short time later, in October, China Brew China Beverage (CBB) and drink technology India (dti) will be held almost simultaneously, in Shanghai and Mumbai respectively. As preparations are moving forward at full speed, Petra Westphal, Exhibition Group Director Messe München, speaks with BRAUWELT International Editor-in-Chief Dr. Lydia Junkersfeld about the features of the network and what visitors can expect at the three fairs.