| It must be high summer, when all rational discussion of important issues is cast aside for the perennial debate on “who is doing lunch or being lunch” which has driven mergers and acquisitions in the brewing industry around the world for the past 15 years. Following the break-up of Scottish & Newcastle and the takeover of Anheuser-Busch two years ago, several armchair pundits declared that the beer monopoly game was over. All said and done. Finished. No more. However, many tablecloth strategists would not accept this verdict. Indignantly, they pulled out their crystal balls, polished them off furiously and peered into them. Here is what they saw at the murky bottom.

You have to give it to him, in the fine art of psychological warfare AB-InBev’s CEO Carlos Brito is a pro. Last year, at an analyst meeting, his executives reportedly thought aloud that their U.S. unit Anheuser-Busch (A-B) could sell half of its volume directly to retailers. Hang on, how would that square with the Three Tier System? Wholesalers have been a crucial part of the beer-selling process in the U.S. since the end of Prohibition in 1933. After repeal, states generally required brewers to sell to distributors. Never mind if Mr Brito can really pull this one off. But the remark has had the desired effect: beer wholesalers have been up in arms, sensing their state-mandated monopoly is under attack. While Three Tier opponents are making antitrust challenges, calling the wholesaler tier a license to print money, wholesalers insist that they primarily serve the public good and have called upon legislators for greater protection. The protracted legal and political battles over beer distribution with their undercurrents of power, money and protectionism only underline that what started out as a social model has turned into such a successful business model that it is rousing the jealousy of the first and third tier.

It is not clear how the ban on selling alcohol below cost price could be enforced as retailers would be reluctant to reveal commercially sensitive details of deals with suppliers.

According to latest figures released by beer market specialists Plato Logic, the beer market in West Europe fell by 2.5 percent in 2009. Ian Pressnell, Director of Plato Logic, commented: “Nearly all markets were lower in what was clearly a difficult year, with volumes in the on-trade channel falling by around 6 percent.” Plato Logic also found that the premium beer market declined by more than 3 percent.

Isomaltulose (Palatinose™) is a sugar naturally occurring in honey and sugar cane molasses that has become growingly popular as functional carbohydrate for beverage products after its introduction in 2005. It exhibits a number of specific characteristics that make it very suitable for use in human nutrition thus offering great potential for innovative sport- and energy drink concepts as well as functional alcohol-free malt-based beverages with balanced and sustained energy-release profile. Extensive screening tests demonstrated that many common brewing yeasts are unable to ferment isomaltulose which resulted in a positive influence on the mouth-feel of alcohol-reduced and alcohol-free beers that typically lack body.

In 2008, more than 1.8 billion hl of beer were brewed worldwide, almost 30 million more than in 2007. China is the uncontested no. 1, with more than 410 million hl. Germany takes 5th place, after the USA, Russia and Brazil. This information is based on data from the Barth Hop Market Report 2008/2009, published by the Barth-Haas Group (table 1). The market share of the Top 40 countries was 92.5 percent in 2008 (2007: 85.6 percent). This article provides details on the world beer market.

“This is the end, beautiful friend, […] the end of everything that stands”, sang Jim Morrison. Perhaps this is not quite the end of everything that stands in the brewing industry, but the final act of the industry’s Great Game has begun. With AB-InBev controlling about a quarter of the world’s beer production, bookies will soon be taking bets on how many deals the Brazilian management will have to clinch before they can close the door behind themselves: Will it be one? Two? And what will the “bankers who sell beer” chiefly be remembered for? Their merciless cost-cutting drive? Or their counter-colonialist strive which has shown little regard for the complexities of mature markets and for brewers’ corporate cultures in Europe and North America?

Il Manuale del Birraio Pratico, 1st edition 2010,

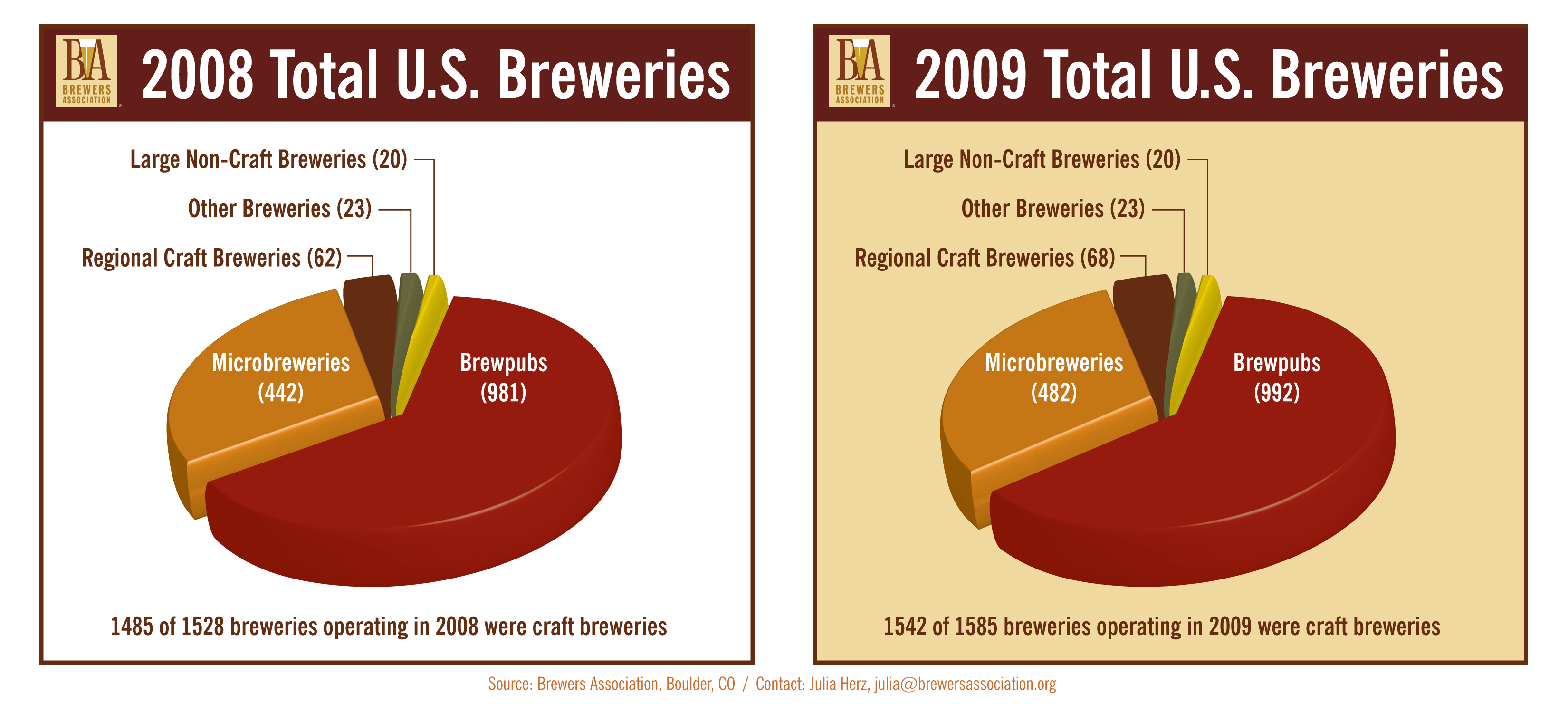

The Brewers Association, the trade association that tabulates production statistics for US breweries, released 2009 data on the U.S. craft brewing industry last month. In a year when other brewers saw a slowdown in sales, small and independent craft brewers saw sales increase 10.3 percent and volume increase 7.2 percent over 2008, representing a growth of 613,992 barrels equal to roughly 8.5 million cases.

European beer brands Heineken, Amstel and Stella Artois have all dropped down the list of the world’s most valuable beer brands at the expense of Budweiser, Corona and Foster’s, according to the annual BrandFinance® Global 500 survey of the world’s 500 most valuable brands published this week by Brand Finance plc, one of the world’s leading brand valuation consultancies.