Did his resignation pre-empt his being kicked out? In late February 2012 Rob Murray, 49, informed the board of brewer-cum-dairy company Lion that he would like to move on to a different phase of his life and give up his CEO role in 2013. His resignation came only weeks after Lion reported a disastrous beating of its profits for the year to 30 September 2011.

Hello? Didn’t they do due diligence before they bought Foster’s? So why complain now? At two recent investor conferences in the U.S. (February 2012) SABMiller’s head of investor relations, Gary Leibowitz, accused former Foster’s CEO John Pollaers and his team of failing to properly implement beer sales and marketing fundamentals and said it’s time to go back to basics.

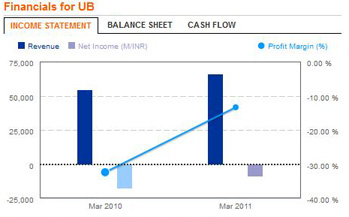

What a partner Heineken has picked in India. The larger-than-life entrepreneur Vijay Mallya is having troubles both at his Kingfisher Airlines and at his liquor company United Spirits. On 20 February 2012 The Times of India newspaper reported that the beleaguered Kingfisher Airlines’ operator Mallya plans not to shut down the private carrier which struggled to stay afloat after further large-scale flight disruptions and resignation of pilots.

Will Foster’s be trembling in their boots? Coca-Cola Amatil chief Terry Davis has warned former joint-venture partner SABMiller, the new owner of brewing major Foster’s, that he will be back in the Australian beer market in 2014. Speaking at the release of the Coca-Cola Amatil’s (CCA) annual results on 22 February 2012, Mr Davis said expansion into the alcoholic beverage sector remained a "core strategy for CCA".

When the supermarket chain Coles began selling two-litre bottles of house brand milk for AUD 2 (USD 2.12) in January last year, a discount of up to 33 percent that was instantly matched by larger rival Woolworths and German-owned discounter Aldi, Australia’s brewer-cum-dairy-company Lion knew they were in for a rough year.

It’s that time of the year for Coca-Cola and Pepsi: Infamous Indian summer is just around the corner and cola companies in this geographically wide market react to the weather, with temperatures reaching up to 42–45 degree Celsius during the four month (April – July) period. In an early move, before the onset of summer, Coca-Cola India has decided to reduce prices for its 200 ml returnable glass bottle. The price of Coke bottles will be cut by INR 2 to a uniform Rs 8 across the country. Competitor Pepsi may do the same as the 200 ml glass bottle segment is very price-sensitive as most of its sales come from rural areas and small towns. Glass bottles account for around 35 percent of sales, PET bottles account for 63 percent and cans for 2 percent of total cola sales in the country.

2011 was all about beer. Newspapers, magazines, blogs. Microbreweries got tons of great press. So BRAUWELT International went to the Middle East to find out what’s really going on.

Foster’s Australia (now acquired by SABMiller) can look forward for respite in a tax litigation, which has been going on India for a few years now. As our readers know, SABMiller had acquired Foster’s India from Foster’s Australia Ltd in 2006, for USD 120 million. The tangible and intangible assets of Foster’s India were taken over by SABMiller. The matter is sub-judice in a Pune court. Earlier, Foster’s Australia had approached the Authority of Advanced Ruling (AAR), a quasi-judicial body which ruled against the company and said the Australian beer company’s sale of brand and trademarks to SABMiller in India was taxable in the country.

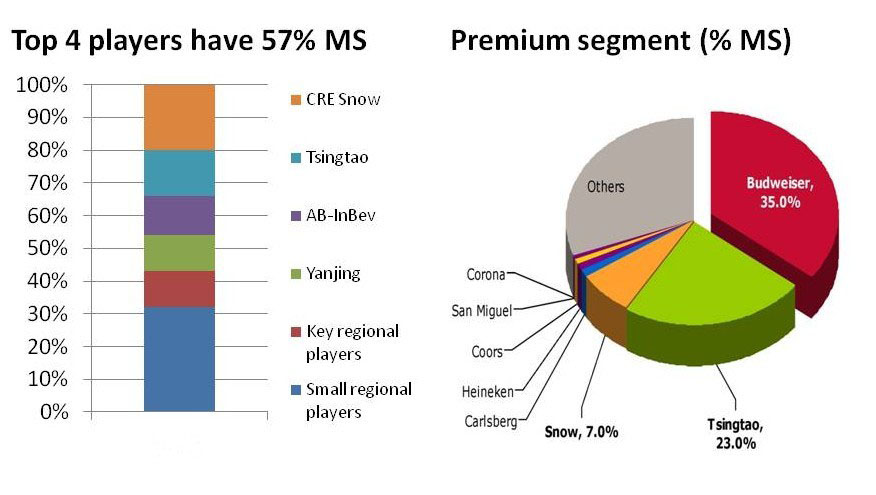

Given that AB-InBev’s Budweiser is already dominating the profitable premium beer segment, SABMiller’s decision to launch its Miller Genuine Draft brand (MGD) in the Zhejiang region smacks of a five-to-twelve-effort.

Total shipments of beer and beer-like drinks in Japan dropped 3.7 percent in 2011 from a year earlier to a record low of 442.39 million cases. Although declining beer consumption is nothing new to Japan, last year’s decline was partly due to the massive March earthquake and tsunami that disrupted supplies, industry data, which was released on 17 January 2012, showed.