Better late than never

Given that AB-InBev’s Budweiser is already dominating the profitable premium beer segment, SABMiller’s decision to launch its Miller Genuine Draft brand (MGD) in the Zhejiang region smacks of a five-to-twelve-effort.

SABMiller reported on 16 January 2011 that MGD will be imported – and not brewed under license in China.

That makes sense. Chinese consumers are a snotty lot. If they are expected to splash out, they expect to get the real thing. Also the decision to launch MGD in a well-off province like Zhejiang, which is one of the largest markets in coastal China and whose capital, Hangzhou, has one of the highest incomes of the provincial large cities, appears logical.

What has raised a few eyebrows among market observers is SABMiller’s super-cautious approach. They are only planning to "test the potential" for an international brand with a premium beer imported from the USA.

Could it be that SABMiller’s local joint venture partner in China Resources Snow Breweries (CR Snow), who holds a 51 percent stake, isn’t really keen on having MGD on the portfolio? SABMiller will certainly have bargained for a higher share of the eventual spoils.

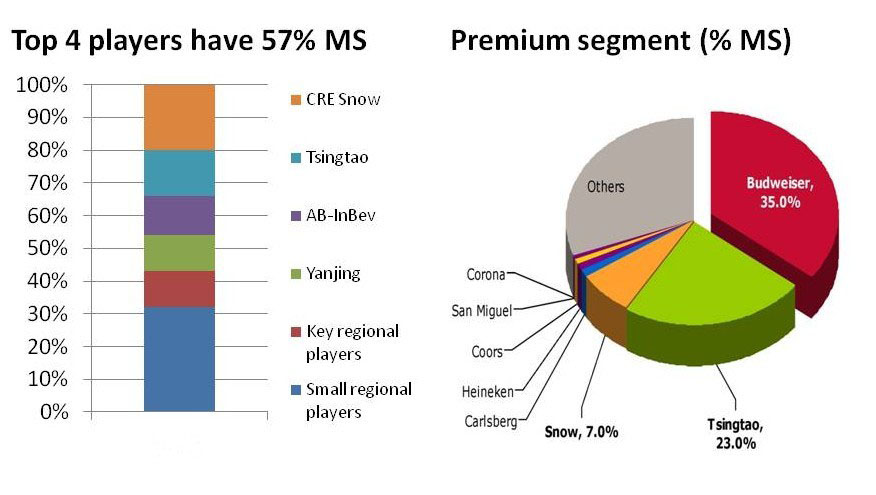

The joint venture has achieved significant growth for the local brand Snow, which is the largest beer brand in China. CR Snow had a 21 percent share of the Chinese beer market with sales of about 92 million hl beer in 2010, SABMiller said.

In 2010, the joint venture operated over 70 breweries in China. It is the largest beer company in China by sales volume.

But volumes aren’t everything in China. The major challenge in the country is not volumes but profitability. As SABMiller admitted a few years’ back, average profits on a per hl basis are only USD 2.

That’s probably one of the reasons why last year, Heineken and its partner Asia Pacific Breweries shifted their focus in China to international premium brands such as Heineken and Tiger, having sold their 21.4 percent stake in Kingway Brewery Holdings in March and their stakes in Jiangsu Dafuhao Breweries and Shanghai Asia Pacific Brewery to CR Snow in July.

As an APB executive said recently: "This segment is ten times more profitable than the beer market in general."

International premium beer is a small but increasingly attractive segment in China. It represented around 1.5 percent of the total beer market at the end of 2010 and was forecasted to reach 7.4 million hl by the end of 2011.