Kirin and Asahi announced on 9 May 2012 that their January-March results were down on a year-on-year basis, it was reported. Kirin Holdings and Asahi Group posted smaller consolidated operating profits. In most years, brewers face higher expenses in the first quarter, pouring money into promoting new products for the high-consumption summer months. However, they reduced spending on advertising and promotions last year as part of a post-disaster moderation trend.

Although it had been rumoured for months, it was only announced in early May 2012 that as of 1 July 2012 Coopers Brewery and its distribution arm, Premium Beverages, will brew and distribute Carlsberg beer in Australia.

Traditional cider makers have been worried about rumours that, following the Federal Budget on 8 May 2012, their products will be taxed at a rate similar to that applied to RTDs – pre-mixed spirit and cider-based products.

Carlsberg is rolling out a rejuvenation programme of Tuborg, one of the top 10 international premium brands.

... and is already setting its sights on the future. In April 2012 Australia’s biggest independent brewer bought America’s largest home-brew brand, consolidating its position as leader of the global home-brew market.

Foster’s lost the low volume brands along with Corona Extra when owner Grupo Modelo cut ties with the SABMiller-owned company in March 2012.

Indian summer especially on the Gangatic plain (the area around river Yamuna, covering most of north India) can be harsh and cruel. Temperatures of up to 44 degree Celsius are considered as normal in the months of April, May and June. Incidentally, these three months (also 1st quarter of Indian financial year) are the best period for beer producers in India. Along with North India, most of the country is in the grip of a severe heat wave during this period. With the mercury level rising, the cash registers of beer producers tick non-stop as the sales of chilled beer goes up substantially during this period. This three months period is the busiest period for beer producers accounting for about one-third of the annual sales of beer in the country.

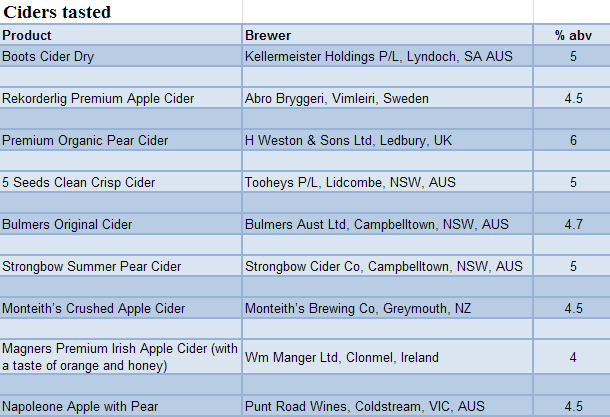

Australia seems to be in the middle of a cider boom. Walk into any big-name liquor store and you’ll find shelves, once packed with bag-in-the-box wines, groaning under the weight of apple and pear cider bottles. One liquor store your correspondent visited on a recent trip to Australia claimed to stock 70 different ciders from all over the globe. Dozens of shiny brands from Australia and New Zealand, from Ireland and Sweden, were jostling for the consumers’ attention, alongside funky French farmhouse cidre and cloudy British scrumpy from the West Country.

It’s like a mass mutiny. First Stella, then Asahi and Corona, now Carlsberg. One by one, Foster’s is being deserted by foreign brand owners. The latest ones to leave the Foster’s stable are Carlsberg and Kronenbourg, both owned by the Danish Carlsberg Group.

India’s largest brewer, United Breweries Limited is likely to undergo a major restructuring in shareholding pattern. According to grapevine Heineken is likely to emerge as majority shareholder in the company. Heineken had acquired a 37.38 percent stake in United Breweries Limited as a result of its takeover of Scottish and Newcastle in 2008. Since then, Heineken has had two non-executive representatives on the board and a chief executive officer in UBL. The Amsterdam based global beer major had indicated at that time that India is a market with significant upside.