Crash landing for Kingfisher Airlines and United Spirits?

What a partner Heineken has picked in India. The larger-than-life entrepreneur Vijay Mallya is having troubles both at his Kingfisher Airlines and at his liquor company United Spirits. On 20 February 2012 The Times of India newspaper reported that the beleaguered Kingfisher Airlines’ operator Mallya plans not to shut down the private carrier which struggled to stay afloat after further large-scale flight disruptions and resignation of pilots.

Kingfisher Airlines’ bank accounts were frozen by income tax officials due to non-payment of bills. The airline has repeatedly requested additional loans from its lenders but none of the pleas have yet been agreed to.

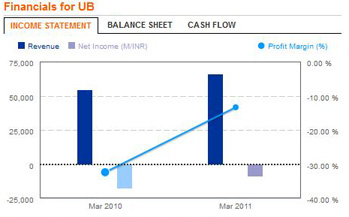

UB Group’s flagship spirits arm, United Spirits, is on wobbly financial ground too as interest costs mount and it faces low growth in markets such as Tamil Nadu and West Bengal due to regulatory issues, Indian media reported on 24 February.

An over-leveraged acquisition of Scottish liquor company Whyte & Mackay in 2007 for USD 1.2 billion (GBP 595 million) is taking a toll on the balance sheet of this market leader.

While volumes are good, with United Spirits controlling 55 percent of the spirits market in India, the cost at which this growth has come does not bear up well under close scrutiny, commentators say. Debt load is high and the interest outflow as a result of this has risen significantly.

Perhaps this is the time for Heineken to buy out Mr Mallya’s stake in United Breweries? Heineken indirectly acquired a 37.5 percent stake in UBL following its worldwide takeover of Scottish & Newcastle in 2008. United Breweries (Kingfisher brand) had a market share of over 50 percent early in 2011, while SABMiller’s had dropped to 23 percent from 35 percent in 2008, The Times of India reported.