To avoid the demography-is-destiny-trap, Japanese firms are looking overseas for growth. But it’s a big leap to become a fully-fledged international player.

If you listen to wine companies explain why they aren’t doing well, they are never short of excuses. The weather, the supermarkets, the consumers. The latest excuse seems to be „international currency movements“. Heavens know how the wine industry could ever dream of going global.

Heineken has every reason to feel concerned about Fraser and Neave’s (F&N) future plans. At the end of September 2011, the Singaporean conglomerate, whose interests range from food and beverages to real estate, ended a 75 year partnership with The Coca-Cola Company. Or rather, it was Coke which did not want to renew their contract.

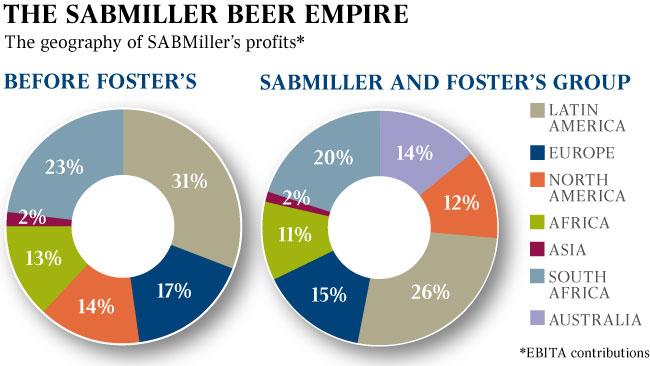

SABMiller’s AUD 11.5 billion bid for Foster’s looks set for success as key shareholders backed the sweetened deal on 21 September 2011 with only an outside chance of a rival offer.

What are the “don’t-tempt-us-with-booze” bosses at The Coca-Cola Company going to say to Mr Davis’ latest? The CEO of Coca-Cola Amatil (CCA), Terry Davis, is to turn the Australian company’s alcohol ambitions to spirits after losing its slice of the beer business to the new owner of Foster’s.

India is traditionally a strong beer market, but the consumption pattern in this exciting market has been showing signs of change lately. Strangely for a country with a billion plus people, one doesn’t get many beer varieties. Its either strong or mild, one gets to hear at most of the places. Although strong beers still have a strong four fifth of the market, the mild segment started calling attention to itself.

SABMiller may have become a bit of a laughing stock last week when on 8 September 2011 the Australian Takeovers Panel rejected its application to investigate Foster’s accounting policy, which SABMiller considered "misleading and deceptive".

The battle over Foster’s is turning nasty or ludicrous now that SABMiller has sent out its vanguard troups, made up of, you will never guess: its bean-counters! The USD 10 billion battle for control of Foster’s heated up once more when SABMiller on 2 September 2011 lobbed a grenade into Foster’s trenches, accusing its takeover target of making "misleading and deceptive" statements about its debt position and trading outlook when reporting its annual results.

Seems like they want to buy time. Or why should the Philippine government ask the World Trade Organisation (WTO) to revisit a ruling that declared a tax levied on spirits from the European Union and the United States in violation of the trade body’s rules? The Philippines government said in August that the ruling was not binding until the appeal was taken into consideration and processed by the WTO Appellate Body.

drinktec, the world´s leading trade fair for beverage and liquid food technology, is now a co-organiser of CBB, China Brew & China Beverage, International Brew & Beverage Processing Technology and Equipment Exhibition for China. The organisers of the two trade fairs signed a contract to this effect at the beginning of August 2011 in Beijing. The cooperation will be expressed for the first time at CBB 2012, and will cover the period up until 2024.