The end is near

SABMiller’s AUD 11.5 billion bid for Foster’s looks set for success as key shareholders backed the sweetened deal on 21 September 2011 with only an outside chance of a rival offer.

Following a three-month pursuit that turned hostile, Foster’s CEO John Pollaers eventually could not but roll over when SABMiller raised their offer to AUD 5.10 a share, a 20 cent-a-share increase on its initial offer.

Factoring in a 30 cents-a-share capital return and a final dividend of 13.25 cents, the deal is now worth AUD 5.53 a share to stakeholders.

Shareholders received a firm offer on 28 September 2011. They still need to signal their approval. Foster’s say shareholders meetings will be held some time in December and relevant documentation will be distributed in November.

SABMiller hope to wrap it all up by the end of December but the Scheme Implementation Deed does not expire until 29 February 2012.

In the meantime the Australian competition watchdog ACCC has given its ok to the takeover. Now the deal is with the Foreign Investment Review Board.

The bid values Foster’s at 12.5 times estimated EBITDA, SABMiller Chief Financial Officer Jamie Wilson admitted. That ain’t cheap, given that Australia’s beer market has been flat for the past 25 years, and it’s certainly way above the average (11.5 times EBITDA) for comparable transactions in the brewing industry as Bloomberg pointed out.

Still, Australia is a very profitable beer market, whose total profits (17.5 million hl of beer production) bankers at JP Morgan reckon, outshine China’s by far (450 million hl). That made the market leader Foster’s, who generates barrels of cash, an attractive target.

Foster’s profit margin, or EBIT as a proportion of sales, was 36 percent last year, higher than the 30.8 percent at Anheuser-Busch InBev NV, the world’s biggest brewer, in the year ended December 2010, and the 23.5 percent at SABMiller in the year ended March 2011 (Bloomberg data).

SABMiller secured USD 12.5 billion of loans for the bid, its costliest to date.

As has become routine after takeovers, SABMiller said they will have to slash costs when they take control in December, which could mean job cuts at Foster’s. SABMiller reportedly expect to generate cost savings of between AUD 130 million and AUD 150 million. We wonder how many jobs could go? Our impression is that there is hardly anybody left at Foster’s headquarters since the de-merger of Foster’s wine division earlier this year.

Still, it is hoped that under the new owners, Foster’s staff will face a more predictable future and will enjoy a boost to their morale. It cannot have been conducive to employee confidence that turnover among Foster’s top beer executives has been high in recent years.

Whatever changes to Foster’s management and strategy SABMiller have in mind, they will need to act quickly to stem Foster’s decline in market share, which has fallen from 55 percent to less than 50 percent in the past six years. And they will need to find ways and means to stop the retailers from further engaging in price wars.

SABMiller CEO Graham Mackay has already indicated that "you’ve got to be competitive in the market, but we’re not going to discount our way to success."

We shall see.

In the immediate aftermath of Foster’s board welcoming SABMiller’s increased bid offer, the usual sourpuss with an axe to grind came out of hiding and commented that the reason Foster’s was taken over and could not stay independent is the inevitable result of a company that simply lost its way. First, they say there was the hubris of John Elliott who led Foster’s on its ill-fated international takeover course in the 1980s, then Ted Kunkel’s costly bet on wine, and finally Trevor O’Hoy’s controversial multi-beverage distribution model.

What these know-alls tend to forget (or ignore) is: Foster’s never had a real chance of staying independent forever. Foster’s has been a listed company and not privately-owned. Its ultimate fate depended on shareholders, not on the designs of a single owner. As BRAUWELT International argued last year (“Last drinks for Foster’s”, BWI 6 2010): “To us, Foster’s has always shown great staying power, resilience, derring-do. While brewers of similar size and scale were bought up in the great game called Mergers & Acquisitions, Foster’s proved very shrewd at staying one step ahead of its predators. As Allied Domecq, Scottish & Newcastle, Anheuser-Busch, to name but three, fell prey to takeovers, Foster’s managed to remain independent. We think that’s no small achievement for a stock-market listed, medium-sized company that has never enjoyed the benevolent backing of a major shareholder or a family.”

“Foster’s story shows what a cruel, unkind and dangerous playing field the financial markets are. Without memory or gratitude. Who cares or even remembers that a decade ago Foster’s was the markets’ darling? Feted, courted, written up. Once they stopped ‘delivering’, it was thumbs down. ‘Go split up and sell out’, that’s what they have been told. End of story. The dogs bark but the caravan moves on.”

One year on, we see no reason to amend our opinion. As a listed company your fate is: eat or get eaten. That’s how it is.

So farewell to Foster’s.

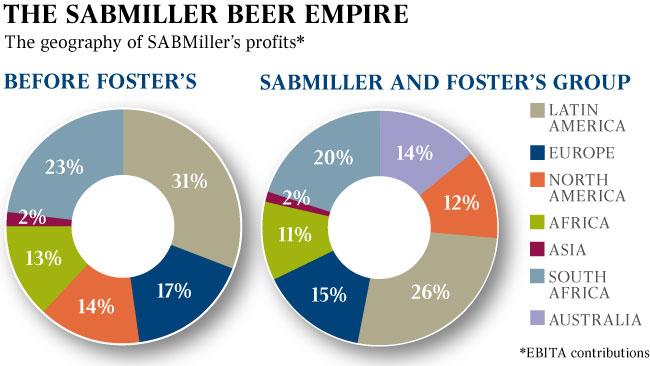

Analysts have already complained that with the Foster’s takeover SABMiller is reducing its exposure to high-growth emerging markets. That may be the case. But securing a safe profit stream from a lucrative market like Australia should not be frowned upon either especially in times of world-wide economic uncertainties.