That’s desperate. In mid-January 2013 Asahi Breweries said it is aiming to increase beer and beer-like drink sales in the Japanese market by 0.5 percent this year to the equivalent of 164 million cases (a case holds 20 bottles of 0.633 litres each). Asahi will aim for the increase by selling more inexpensive, so-called third-category beer (a non-malt, carbonated beverage with a beer-like flavour and alcohol strength of 5% to 6% ABV).

The craft brewer Boxing Cat from Shanghai, China has announced that the much anticipated Cat Scratched Celt beer is now pouring at its Sinan Mansions location. The Cat Scratched Celt is a collaboration creation between the Boxing Cat Brewery and The Celt Experience of Wales. Cat Scratched Celt represents the combined brewing philosophies of the Boxing Cat’s brewmaster Michael Jordan and The Celt Experience’s brewmaster Tom Newman.

This is political correctness gone too far. Although several U.S. states have pushed ahead with it, few would have imagined Australia to follow suite in banning “Ladies Nights” — a type of bar promotion that provides free or discounted drinks for female bar patrons — because it represents gender discrimination.

In 2012, we have seen a further increase in general awareness of the craft beer sector in this country. Some consolidation, accompanied, of course, by some “drop-outs”, has occurred but by and large the sector is thriving. There are now over 150 craft breweries in Australia.

How do you know you are getting on a bit? There are hundreds of tell-tale signs like when your back goes out but you stay at home; or when you realize that your joints are more accurate than the national weather service in predicting approaching showers. Another indication of rampant fuddy-duddyism is when you begin every other sentence with “Nowadays...”, and you actually hear yourself say “when I was younger…” as in “when I was younger I did not risk being walked into by some git on the pavement staring into his iPhone”, which makes you sound like your own high school teacher and you hate yourself for it (actually others tell me that I have taken up ranting like an old biddy too of late).

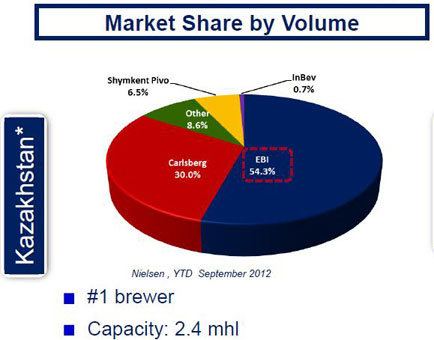

They probably call it an amicable separation. In late December 2012 Heineken and Efes terminated their partnerships in Kazakhstan and Serbia. The divorce did not come unexpectedly. Following the tie-up between Efes and SABMiller in 2011, it was just a matter of time before Heineken would walk away from this marriage of convenience with Turkey’s brewer Efes.

When the United States invaded Iraq, it hoped to turn the country into a booming economy fuelled by its oil reserves that are among the largest in the world. Alas, the fighting never stopped and the U.S. vision remained, well, a vision. A year ago, American troops left. But the nation’s leaders are still locked in a political crisis while insurgents launch attacks. Many wonder: where is Iraq headed?

The Carlsberg Group is reportedly looking for a buyer of its 100 percent subsidiary Carlsberg Uzbekistan. According to local rumour, Carlsberg is conducting negotiations and there are investors wishing to acquire its assets. This being Uzbekistan, the sale could drag on for a while to force Carlsberg to accept a lower price for its brewery with a capacity of one million hl beer.

Now that Heineken has its acquisition of Asia Pacific Breweries all sewn up, a bidding war for the rest of Fraser & Neave (F&N) is gathering pace. In November the Singaporean conglomerate received a rival offer from a group led by Overseas Union Enterprise Ltd (OUE), which offered USD 10.7 billion for F&N's property and beverages conglomerate.

Outgoing Lion CEO Rob Murray seems to be a sore loser. On 20 October 2012, in an interview with Australian media, he called the family behind the largest Australian-owned Coopers brewery “dysfunctional”, referring to Lion’s highly public but ultimately unsuccessful attempt in 2005 to take the smaller brewer over.