Too “crafty” for their own good? Australian brewers have been put on notice over misleading craft beer labels after SABMiller-owned CUB was fined for potentially fooling drinkers, Australian media reported on 29 April 2014.

After months of speculation, AB-InBev, the world's major brewer, confirmed on 24 April 2014 that it has fully acquired the Chinese beer company Siping Ginsber, but did not disclose financial terms of the purchase. The acquisition was approved in March by the Chinese Ministry of Commerce and Chinese media valued the deal at EUR 450 million (USD 622 million).

A full-page advertisement in an Adelaide daily newspaper on the eve of the State election on 15 March 2014 reminded readers that “Coopers began life 152 years ago as a really small business with a bathtub as a brewery” and urged readers “to support the team who pledged its support to small business.” The ad, which showed a gilded bathtub, was signed by Tim Cooper, the Managing Director and his cousin Glenn Cooper, the Chairman of Australia’s number three brewer.

Now comes the counter attack. The two private equity firms that are being sued for NZD 500 million (EUR 320 million) by Asahi over their sale of the beer-cum-alcopop company Independent Liquor have retaliated by filing a cross claim against two of Independent’s most senior Australasian executives, Australian media reported at the end of March 2014.

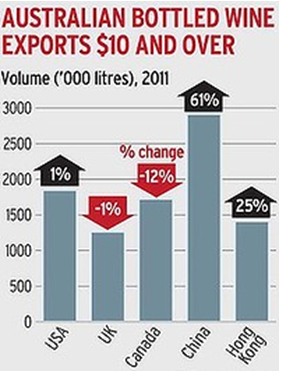

Following the catastrophic melamine-contamination scandal of 2008, the Chinese authorities and Chinese consumers have become understandably nervous about other possible contaminants in food and drink products. But why manganese in imported wines has now been singled out by the Chinese authorities as a “baddy” leaves a lot of room for wild speculation.

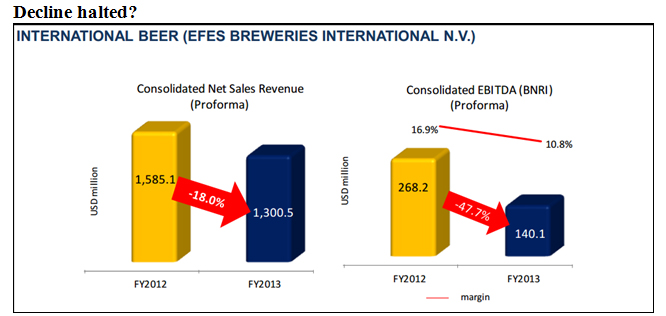

Thanks to the consolidation of its Coke unit Coca Cola İçecek (CCI) within the group, Turkish brewer and Coke bottler Anadolu Efes saw net profit surge to TRY 2.61 billion (USD 1.2 billion/EUR 846 million) in 2013 from 609.8 million in 2012.

The world’s largest listed wine company, Treasury Wine Estates (TWE), which is fighting challenges on several fronts, announced on 20 February 2014 that Michael Clarke, 49, will take over the helm on 31 March 2014.

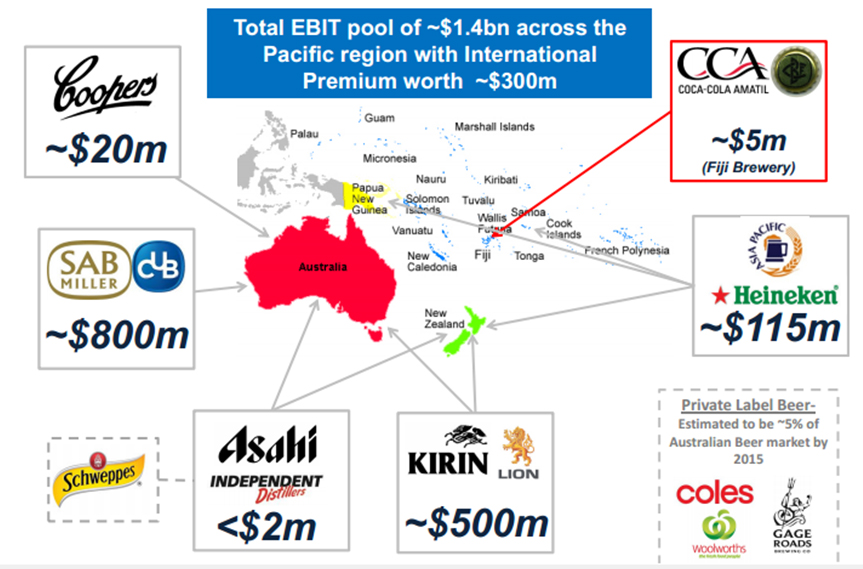

Competition watchdogs on the prowl. In January 2014, the Australian trust-busters launched an investigation into the supply of beer to Australia’s pub industry to find out if brewers are resorting to anti-competitive tactics that lock out rival beer brands.

It served its purpose while SABMiller was in a joint venture with Coca-Cola Amatil (CCA). Now that SABMiller own CUB, the former Australian unit of Foster’s, they decided to close the Bluetongue brewery down. Dozens of workers at this New South Wales brewery are set to lose their jobs, when the plant is shut down by the end of the year, media reported in January 2014.

Suntory Holdings Limited and Beam Inc., Deerfield, jointly announced that they have entered into a definitive agreement under which Suntory will acquire all outstanding shares of Beam for USD 83.50 per share in cash or total consideration of approximately USD 16 billion, including the assumption of Beam’s outstanding net debt. The consideration represents a 25 percent premium to Beam’s closing price of USD 66.97 on January 10, 2014. The transaction is expected to close in the second quarter of 2014, subject to Beam stockholders’ approval, regulatory approvals and other customary closing conditions.