Oh Lordy, how many changes in ownership can the brewer CUB take? Until 2011 CUB was part of Foster’s, which then sold it to SABMiller for AUD 12.3 billion (almost USD 12 billion in those days).

Hopped ciders are supposedly “tasty as hell”. In South Australia, the Hills Cider Company released its Hop Edition cider (8% ABV) in bottles, following a few small batch releases in keg. Made with fresh Adelaide Hills apples and – probably dry-hopped – with a blend of Cascade, Chinook, Summer, Citra and Galaxy hops, the “fusion displays upfront pineapple, citrus and tropical fruit aromatics, with subtle apricot, melon, pink grapefruit and citrus flavours,” Hills Cider’s Steve Dorman was quoted as saying. “The astringency of the hops balances the sweetness of the fresh apples, to create a fresh, crisp and fruit driven cider … with the ever growing popularity of hopped cider styles in USA and an increasingly educated craft beer and cider market here in Australia, we thought this would be a very exciting addition to the Australian craft cider category,” he said.

The death of William T (Bill) Cooper at the age of 82 on 11 November 2015 after a long illness is noted with sincere regret. Bill, the father of current Managing Director Dr Tim Cooper, joined the family-owned Coopers brewery in 1960 and was responsible for Marketing and Sales from 1965 to 1985, and, in addition, became Director and Secretary in 1969. He was appointed Managing Director in 1977, a position he held until retiring in January 2002, and remained a Director until 2009 when he was replaced by his daughter, Melanie, who became the first woman on Coopers’ board.

Brewforce is an Indian-based company which has been delivering process and engineering equipment and solutions to breweries and distilleries for 35 years now. Regarding know-how and equipment, they are supported by their German partner Brewforce Brautechnik GmbH.

The privately-owned Coopers Brewery from Adelaide defied falling Australian beer consumption, increased pressure on margins and higher malt prices to achieve record beer sales and revenues for its financial year 2014/15.

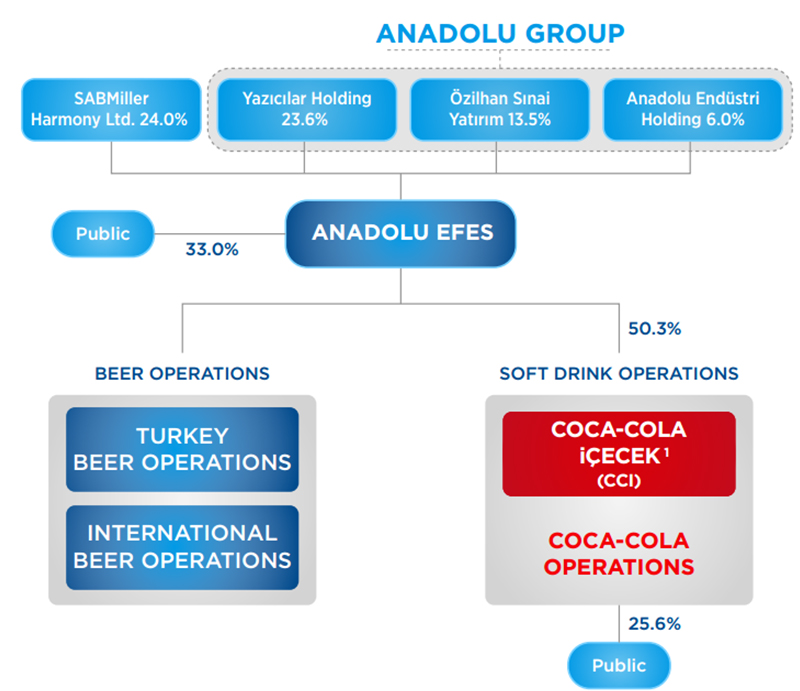

Revolving doors at Anadolu Efes: After a little more than a year at the helm, Damian Gammell resigned as President of Beverage Group and CEO of Anadolu Efes on 31 October 2015 to take up his new responsibility as Chief Operating Officer of Coca-Cola European Partners, the recently formed western European Coke bottler. Mr Gammell had only been working as Beverage Group President and CEO of Anadolu Efes since January 2014.

What’s going on at Diageo? After selling some beer assets to Heineken, Diageo continued in its attic clearance mode by offloading the majority of assets from Diageo Wine’s U.S. and UK operations to Australia’s largest winemaker Treasury Wine Estates (TWE) for USD 625 million.

To learn more about the latest technology innovations and processes in raw material handling and grinding, all major Japanese breweries and distilleries attended a seminar of Bühler in Osaka or Yokohama.

Funny that. Asahi seems to value craft beer in Australia but cannot develop the category at home, where craft beer accounted for less than 1 percent of sales in 2013. Not so in Australia, where craft beer is a growth category. No wonder, on 28 September 2015 the Japanese beer giant Asahi bought its second Australian boutique brewer in as many years, taking over the well-established Melbourne-based craft brewer Mountain Goat, founded in 1997.

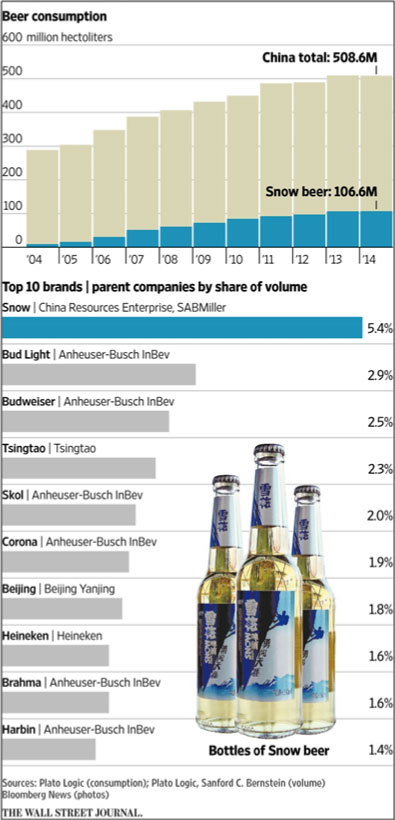

Most analysts seem to believe that once AB-InBev takes over SABMiller, it will have to sell SABMiller’s 49 percent stake in Chinese brewer CR Snow to appease China’s regulators. Combined, AB-InBev and CR Snow would hold a 38 percent market share. SABMiller, through CR Snow, holds a 23 percent share, while AB-InBev has a 15 percent share.