Looks like Carlsberg could get lucky with Habeco. The northern Vietnamese brewer at the end of October 2016 started trading on the Unlisted Public Company Market. Both Sabeco and Habeco are expected to enter the stock market properly by 20 December. Their trading prices will be used for selling the state’s stakes in those firms.

Coopers Brewery, the largest independent brewer in Australia, is spending AUD 63 million on a new malting plant at its Adelaide site. The plant will be completed by the end of 2017, and heralds a return to malting for Coopers. It had sold its stake in Adelaide Malting Company in 2002 to help fund relocating its operations from Adelaide’s leafy eastern suburbs to a new brewery at Regency Park.

Although the dispute between the company and the Electrical Trades Union (ETU) drags on, CUB has dismissed a statement from the ETU, which claims that the brewer will now struggle to meet Christmas and summer stock demands.

So it’s beer again for Trevor O’Hoy, who resigned as CEO of Foster’s in 2008, after 33 years with CUB, thus taking responsibility for the brewer’s ill-fated foray into wine.

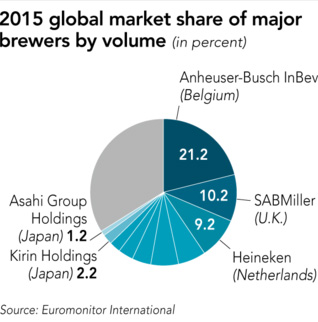

Following the loss of various AB-InBev brand licences, including Corona Extra in September 2016, Kirin’s Australian unit Lion will be dethroned as the major brewer in Australia. Kirin had a licensing agreement with AB-InBev under which it sold several popular brands. These rights reverted to Lion’s domestic rival CUB after the takeover of SABMiller by AB-InBev.

The practice of slipping bureaucrats a back hander is coming under increased scrutiny by US regulators. Not just in the US, but in foreign countries too. A minority-owned joint venture of AB-InBev used third-party sales promoters from 2009 to 2012 to make improper payments to officials in India to boost sales and production.

AB-InBev may walk into an interesting situation in Australia when they take over SABMiller. Since June 2016, a labour dispute at CUB’s Abbotsford brewery in Melbourne has simmered, leading several well-known local pubs to turn off their Carlton Draught and VB taps.

In this case it’s see and believe. Too often we were told that the Vietnamese government would sell its controlling stake in the country’s brewers Sabeco and Habeco and nothing came of it.

If you want a beach to yourself, go to Turkey. Where last year millions roasted like hot dogs, you will find empty deck chairs this year. Turkey’s spat with Russia is partly to blame for the drop in tourists.

Evil to him who evil thinks. Only three years ago Bihar’s government lured Carlsberg into the state and made it invest about USD 25 million in setting up a brewery. Then in 2015 the government introduced prohibition, which had been part of an election promise. What do you make of that?