After Stockholm and Trondheim, Brooklyn Brewery will tap into South Korea’s booming craft beer market by building a brewery in Jeju, a tropical island off the country’s southern coast, which serves as a popular tourist destination.

It’s all very hush-hush. Asia Brewery, a subsidiary of Philippine conglomerate LT Group, said on 27 May 2016 that it had struck a deal with Heineken that will allow it to brew the popular Dutch beer brand later this year.

For the International Women’s Collaboration Brew Day (WCBD), which took place on 8 March 2016, the Adelaide based Wheaty Brewing Corp created a Bluestocking beer, which was to excel at having a really deep blue colour.

If AB-InBev can do it, so can Lion. Buying up craft brewers, that is. In early May 2016 Lion reported it was buying Byron Bay Brewing Company, a 5,000 hl craft brewer, after being approached by its owner Barry Schadel. This will expand the number of craft breweries in its portfolio to half a dozen.

On 5 May 2016 the Australian Competition and Consumer Commission (ACCC) advised that it will not oppose AB-InBev’s acquisition of SABMiller. Chairman Rod Sims said: “The ACCC has concluded that the proposed acquisition is not likely to substantially lessen competition in the Australian beer market…. While AB-InBev’s brands have been successful in Australia, particularly Corona, they have previously been distributed via either Lion or CUB. AB-InBev has only a limited direct company presence in Australia and does not brew beer here.”

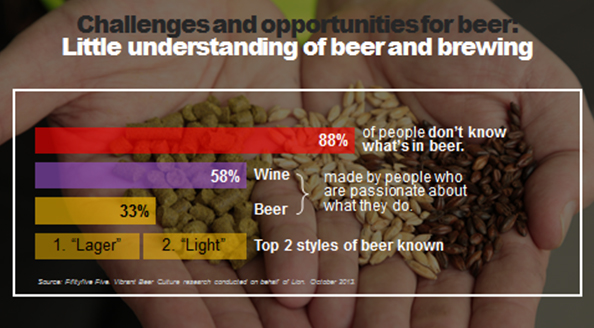

Can it really be true that most Australians only know two styles of beers: lager and light lagers? This is what Lion’s market research suggests. Unless, of course, researchers on behalf of Australia’s major brewer Lion took the easy way out and only polled teetotallers upon leaving church.

Are they beginning to see the beauty of a high profit stream? With Australia’s beer consumption in decline, it was understood late last year, after the takeover of SABMiller, that the new owner AB-InBev would embark on a dual track process to sell SABMiller’s USD 10 billion Australian beer unit CUB (formerly Foster’s), either through an IPO or a trade sale, with the Japanese company Asahi and private equity firms the most likely buyers.

Bad news travel fast and to unexpected places. Only three days after German media reported that a Munich environmental institute had detected traces of the weed killer glyphosate in 14 German beer brands, Korean retailers and restaurateurs on 29 February were biting their nails, wondering whether to place any more orders with the country’s importers of German beers.

Men, in case you did not know: International Women’s Collaboration Brew Day (WCBD) took place on 8 March 2016 and ladies from all over the world got together to create unique and challenging recipes.

What a juicy scandal. An Indian tribunal, heeding a call from a group of creditor banks, has blocked the USD 75 million settlement between Diageo and Vijay Mallya, 60, after he agreed to step down as chairman from the spirits giant's local unit United Spirits in February 2016.