China Resources Beer at the crossroads

Never mind the low price, analysts on the whole welcomed the termination of the SABMiller and China Resources Beer joint venture, announced on 2 March 2016. China Resources Beer (CR Beer) agreed to buy SABMiller's 49 percent stake in the Beijing-based CR Snow brewing company for USD 1.6 billion. The sale clears the way for the completion of AB-InBev's takeover of SABMiller.

The deal not only removes a major regulatory obstacle to the takeover, it will also allow AB-InBev to focus its operations in China on its own brands like Budweiser.

The announcement was greeted by investors and sent up CR Beer's stock, raising expectations that the Chinese company won't have to borrow much to finance the deal. Originally, analysts had expected a price tag between USD 3 billion and USD 5 billion.

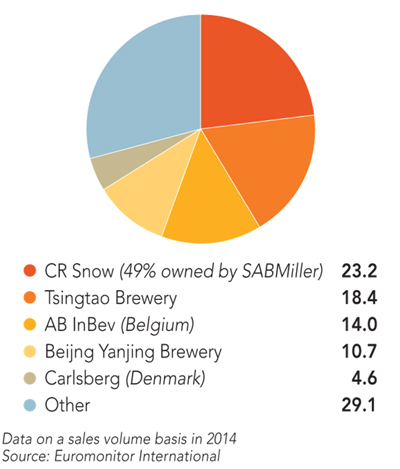

Observers concur that the main reason behind AB-InBev's decision to end the partnership was its desire to obtain Chinese regulatory approval for its acquisition of SABMiller. Together, AB-InBev and CR Beer would have controlled about 40 percent of the Chinese market, the world's largest.

AB-InBev may have also been motivated by how it sees the Chinese market evolving, which has started shrinking after peaking in 2013.

Media say that CR Snow saw its net profit for December 2014 drop by about 20 percent from the previous year and is believed to have continued struggling to lift its bottom line in 2015.

The brewing group does not sell any SABMiller brands and SABMiller’s stake in the joint venture would have been almost purely strategic. From what we at Brauwelt International have heard, SABMiller only started receiving dividends after 18 years in China, a market it entered in 1994.

As CR Snow's growth has started faltering, the investment has become less profitable.

AB-InBev's own beer brands, on the other hand, are doing reasonably well, especially the high-end Budweiser brand. According to estimates (for what they are worth), premium beers are expected to make up over a third of the USD 80 billion Chinese beer market by the end of the decade - compared to less than 10 percent in 2010.

CR Beer operates about 90 breweries around China, a legacy of its acquisition-focused expansion in the past decade. But these breweries, mostly aging facilities, are running at only around 50 percent of their capacity amid weak demand, it was reported. A major restructuring of its operations is required for the company to stay afloat. How it will achieve this without SABMiller’s technical expertise remains to be seen.

Consequently, there is speculation that SABMiller's departure could trigger a new round of takeovers as CR Beer may start looking for a new foreign partner.

Authors

Ina Verstl

Source

BRAUWELT International 2016